What Businesses Need To Know About Invoices And Payments Affected By The 2023 GST Changes

With effect from 1 January 2023, the GST rate will increase from 7% to 8%. As this is already mid-December, GST-registered businesses have less than a month before the new change kicks in. Here’s what businesses need to be aware of as we transit from 7% to 8% GST rate.

Read Also: When Must A Company Register For GST, And How You Can Register?

Price Displays Must Be Inclusive of 8% With Effect From 1 January 2023

Businesses must show prices inclusive of GST on all price displays to the public. Hotels and food & beverage establishments that impose a service charge on their goods and services are exempted but they must still display a prominent statement informing customers that the prices displayed are subject to GST and service charge.

If the business is unable to switch price displays overnight, you may display two prices:

One applicable before 1 January 2023 showing prices inclusive of GST at 7% and

One applicable from 1 January 2023 showing prices inclusive of GST at 8%

If the business does not increase prices, there is no need to revise price displays. However, according to IRAS’ eTax Guide, you must account for GST based on the prevailing tax fraction (8/108) of the price for sales made on or after 1 January 2023.

Read Also: Daiso To Start Charging GST From 1 May 2022: But Will They Be Displaying Prices In A Legal Way?

Transitional Rules And Time Of Supply Rules Apply

According to IRAS, transactions (including reverse charge supplies and imported services under the Overseas Vendor Registration (OVR)) that span a GST rate change may apply transitional rules.

A transaction can be considered under transitional rules if one or more of the following events straddles the date of rate change – 1 January 2023:

Issuance of invoice

Receipt of payment (or the making of payment in respect of a reverse charge supply)

The delivery of goods or performance of services (a.k.a. Basic Tax Point)

For GST purposes, the time of supply rules determines when the liability to account for output tax arises. For most transactions, the time of supply will be the earlier of when an invoice is issued or when a payment is received.

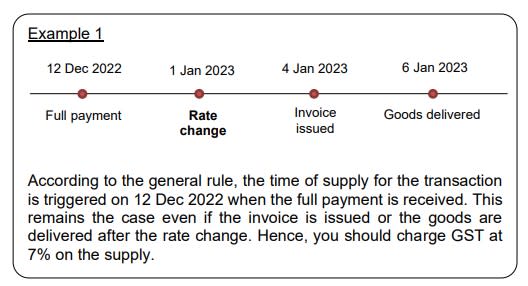

If Full Payment Is Received Before 1 January 2023

If full payment is received before 1 January 2023, the goods or service provided (a.k.a. the supply) is subject to 7% GST. This applies even if the invoice is issued, and the goods are delivered after the rate change.

Read Also: 6 Expenses That Businesses Could Save In 2022 Before Next Year’s GST Increase

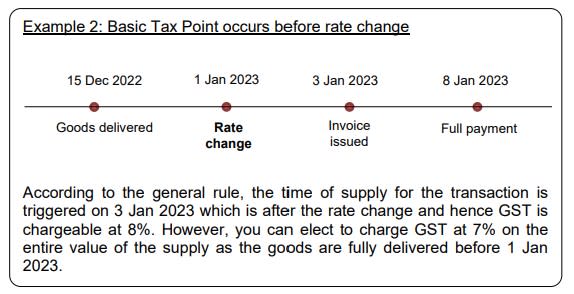

If Full Payment Is Received On/ After 1 January 2023

If full payment is received after the rate change, the supply will be subject to GST at 8%. In this case, both payment and supply are made after the rate change so no transitional rules can apply.

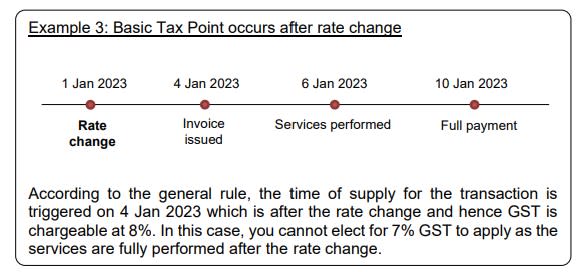

If The Supply Is Delivered Before 1 January 2023

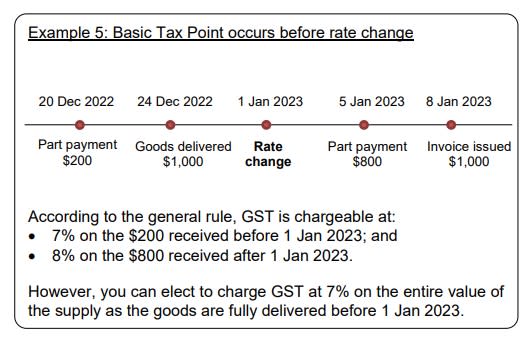

Transitional rules may apply if goods are delivered before the rate change. A GST-registered supplier can elect to charge GST at 7% on the value of goods delivered or services performed before 1 January 2023.

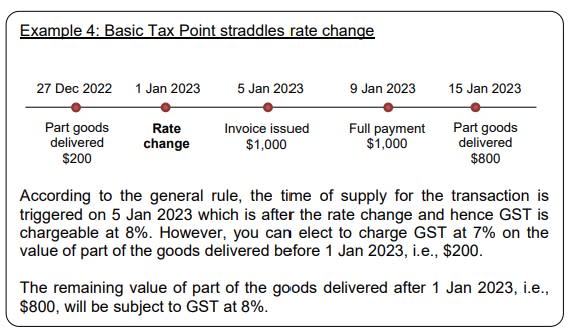

If Payment Is Partially Made Or Partial Supply Delivered Before 1 January 2023

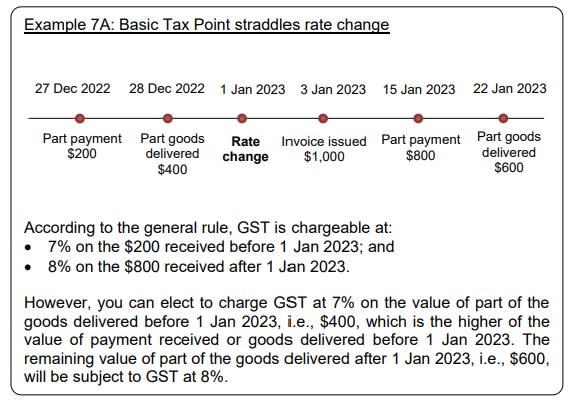

For cases where goods are partially delivered before the rate change, the value of goods delivered before 1 January 2023 can be chargeable at 7% GST. However, the remaining value of the goods delivered after 1 January 2023 is subject to 8% GST.

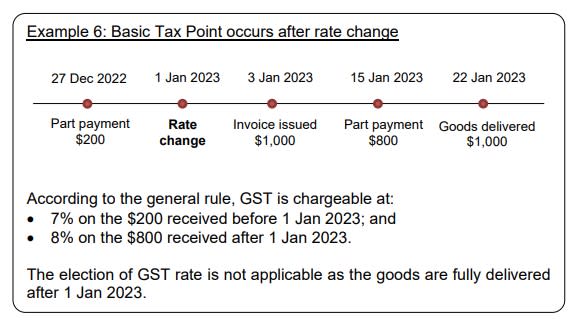

For cases where partial payment is made before the rate change, 7% GST is chargeable on the portion of payment received before 1 January 2023 and 8% GST is chargeable on the remaining payment.

However, in the cases where the goods are fully delivered before the rate change, the supplier can elect to charge GST at 7% for the full value of the supply as the goods are fully delivered before 1 January 2023

When payments and goods delivery straddle the GST rate change, 7% GST is chargeable on the payment received before 1 January 2023 and 8% GST is chargeable on the payment received after 1 January 2023.

However, if the goods or part of the goods is delivered before the GST rate change, the supplier can elect to charge 7% GST on the value of the portion of goods delivered before 1 January 2023. The remaining value of the goods delivered after 1 January 2023, is chargeable at 8% GST.

Tax Invoices With GST At 8% May Only Before Issued On/ After The Rate Change Day

Businesses may already be issuing tax invoices for orders where the payment and delivery of goods will be made after the rate change on 1 January 2023. In these cases, you are not allowed to issue a tax invoice with 8% GST. Instead, tax invoices issued before 1 January 2023, must reflect 7% GST.

If payment is not received before 1 January 2023, you must issue a credit note to cancel the original invoice and issue a new tax invoice reflecting the 8% GST.

For Tax Invoices That Straddle The Rate Change

If your business issues advance tax invoices (e.g. issue a tax invoice on 1 October 2022 for services spanning 1 October 2022 to 31 March 2023), the advance invoice should reflect GST at 7%.

If full payment is not made before 1 January 2023, you will need to issue a credit note for the lower of remaining payment or the remaining value of service to be performed on/ after 1 January 2023. A new tax invoice will need to be issued for the amount credited to charge GST at 8%.

Alternatively, you may issue a credit note to cancel the original invoice and reissue new tax invoice(s) for the value of the supply subject to 7% GST and value of supply subject to 8%. You can reflect the new and old GST rates in the same tax invoice issued on/ after 1 January 2023.

Even if you choose to absorb the additional GST for your GST-registered customer, you will need to issue a credit note and new tax invoice reflecting the 8% GST.

Concessions For GIRO Deductions And Cheques

As an administrative concession, businesses can treat all payments received through recurring GIRO arrangement for deductions within the month of January 2023 as payments received before 1 January 2023 and charge GST at 7% provided all the following conditions are met:

the GIRO deductions are successfully effected by the end of January 2023

the GIRO deductions relate to bills or invoices that have been issued before 1 January 2023

the bills or invoices have been issued according to the normal billing cycle of the business.

For cheque payments, cheques that are banked in by 4 January 2023 will be treated as payments received before 1 January 2023, if the cheques are successfully cleared. If the cheque is not banked in within the concessionary period, the business will have to issue a credit note to cancel the entire invoice and issue a new tax invoice, charging 8% GST.

Read Also: Getting Your Business Ready for GST Rate Change? Read This

Businesses may refer to IRAS’ e-Tax Guide on 2023 GST Rate Change and Frequently Asked Questions for Businesses – GST rate change 2023 for further details on GST rate change.

The post What Businesses Need To Know About Invoices And Payments Affected By The 2023 GST Changes appeared first on DollarsAndSense Business.

Yahoo Finance

Yahoo Finance