Bull of the Day: Super Micro Computer (SMCI)

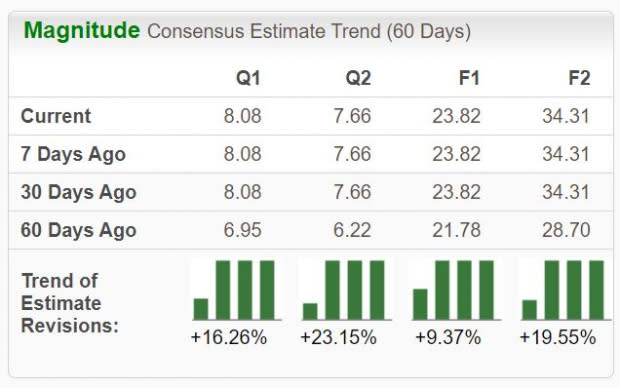

Super Micro Computer SMCI is the premier provider of advanced Server Building Block Solutions for 5G/Edge, Data Center, Cloud, Enterprise, Big Data, HPC, and Embedded markets worldwide. The company’s earnings outlook remains bullish across the board, pushing it into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

In addition to favorable earnings estimate revisions, the stock resides in the Zacks Computer – Storage Devices industry, currently ranked in the top 18% of all Zacks industries. Let’s take a closer look at how the company currently stacks up.

Super Micro Computer Posts Robust Quarterly Results

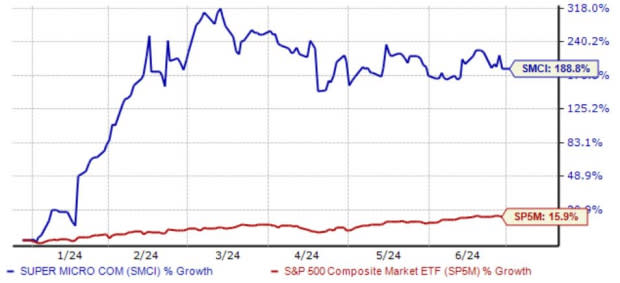

Super Micro shares have been in a league of their own in 2024, gaining nearly 190% and crushing the S&P 500’s also impressive 16% gain. Share performance has been aided by robust quarterly results, with the company posting 360% year-over-year EPS growth on 200% higher sales in its latest print.

Image Source: Zacks Investment Research

SMCI’s top line has shown a notable acceleration over the last few periods, as we can see illustrated below. Sales growth is forecasted to remain robust, with the $14.9 billion Zacks Consensus Sales estimate for its current fiscal year suggesting a 110% climb year-over-year.

Image Source: Zacks Investment Research

Charles Liang, CEO of Supermicro, was positive on the latest set of results, stating, “Strong demand for AI rack scale PnP solutions, along with our team’s ability to develop innovative DLC designs, enabled us to expand our market leadership in AI infrastructure. As new solutions ramp, including fully production ready DLC, we expect to continue gaining market share. As such, we are raising our fiscal year 2024 revenue outlook from $14.3 to $14.7 billion to a new range of $14.7 to $15.1 billion.”

Revenue expectations moved accordingly following the release, up a staggering 94% overall over the last year.

Image Source: Zacks Investment Research

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

Super Micro Computer SMCI would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance