Bull of the Day: Honda Motor Company (HMC)

Honda Motor Co. HMC is a leading manufacturer of automobiles and motorcycles, recognized internationally for its wide variety of products that range from small general-purpose engines to specialty sports cars.

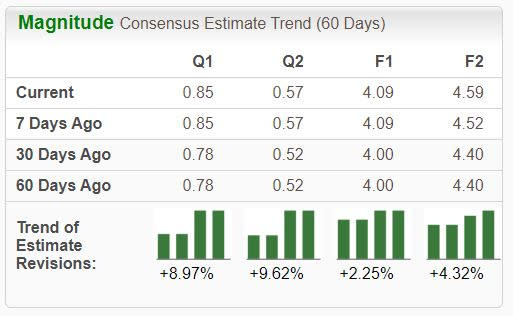

The stock is currently a Zacks Rank #1 (Strong Buy), with analysts raising their outlooks across all timeframes.

Image Source: Zacks Investment Research

In addition, the company is part of the Zacks Automotive – Foreign industry, currently ranked in the top 25% of all Zacks industries. Aside from the improved earnings outlook and favorable industry standing, let’s take a closer look at a few other aspects of the company.

Honda Motor

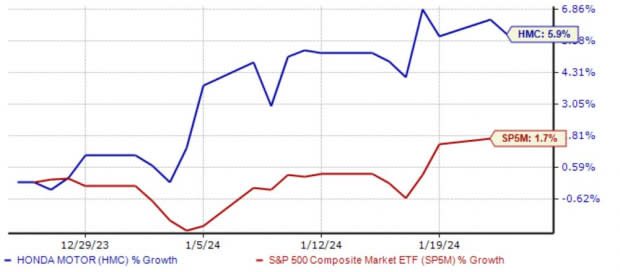

Honda Motor shares have shown solid relative strength over the last month, tacking on nearly 6% and outperforming the S&P 500 handily. Shares are looking to break out of a multi-year consolidation period, with positive earnings estimate revisions helping drive the move.

Image Source: Zacks Investment Research

Investors also stand to reap a steady income from HMC shares, currently yielding a solid 2.8% annually paired with a sustainable payout ratio sitting at 21% of the company’s earnings. The payout has also grown nicely, with HMC sporting a 3.3% five-year annualized dividend growth rate.

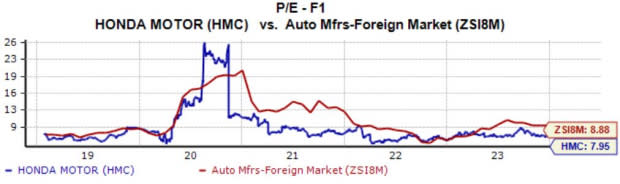

Shares aren’t expensive given the company’s forecasted growth, with earnings forecasted to recover 35% in its current fiscal year on nearly 15% higher sales. Shares presently trade at a 7.9X forward earnings multiple, comparing favorably to the respective Zacks industry average of 8.9X.

The stock carries a Style Score of ‘A’ for Value.

Image Source: Zacks Investment Research

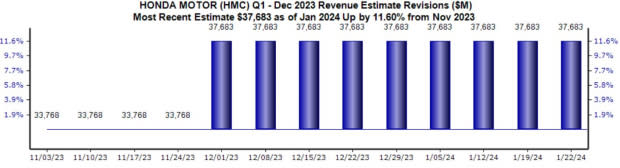

Keep an eye out for the company’s next quarterly release scheduled for February 9th, as the Zacks Consensus EPS Estimate of $0.85 has been revised more than 20% higher since last November. Analysts have also been bullish regarding the top line, with the $37.7 billion quarterly revenue estimate 11% higher over the same timeframe.

Earnings are forecasted to decline 16% from the year-ago period, with revenue suggested to climb nearly 20% year-over-year.

Image Source: Zacks Investment Research

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

Honda Motor Company HMC would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance