Bull of the Day: CrowdStrike Holdings (CRWD)

Company Overview

Founded in 2011, Sunnyvale, CA-based Zacks Rank #1 (Strong Buy) stock CrowdStrike (CRWD) is a leader in next-generation endpoint protection, threat intelligence and cyberattack services. The company was formed when co-founders George Kurtz and Dmitri Alperovitch were inspired by the shortcomings in the previous-generation security software technologies. The company gains a leg up on the competition through its use of crowdsourced data from its customer base applied to modern technologies, including AI, cloud computing, and graph databases to detect threat and stop breaches.

CrowdStrike specializes in endpoint protection and threat intelligence. Endpoints include devices such as laptops desktop computers, smartphones, tablets, servers and other internet of things (IoT) devices. Endpoint protection aims to safeguard these devices from a wide range of threats including malware, ransomware, viruses, spyware, phishing attacks and other advanced cyber threats. Threat intelligence focuses on understanding the broader cybersecurity landscape including the motivations and capabilities of different threat actors as well as tactical threat intelligence which involves more specific and detailed information about current threats.

A Growth Story

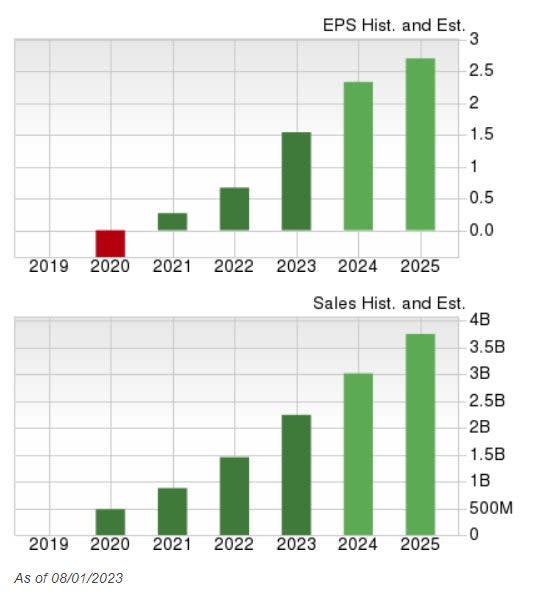

It’s difficult to find a company with higher and more consistent growth than CrowdStrike. Last quarter, earnings grew 84% year-over-year on revenue growth of 42%. Since going public in 2019, the company has grown annual revenue and earnings annually.

Image Source: Zacks Investment Research

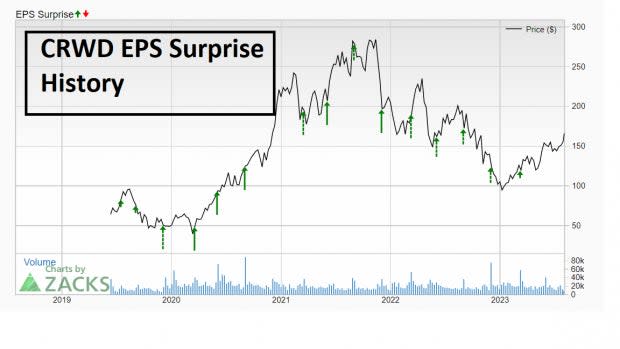

Not only has CRWD grown earnings each year, the company has beat analyst expectations for every quarter as a public company thus far.

Image Source: Zacks Investment Research

Future Outlook

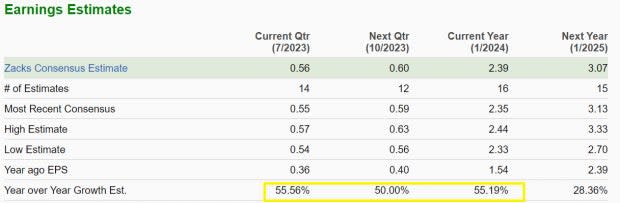

In recent quarters earnings growth has increased even more, spurred on by rising demand for security and networking products amid the growing hybrid working trend. Overall growth in cybersecurity demand is another significant catalyst. As hackers get more sophisticated, demand should rise. Pet Statista, the worldwide cybersecurity market is projected to reach $173.50 billion in 2023 and $262.40 billion by 2027. Analysts expect a similar, yet more robust trajectory for CRWD. Over the next 3 quarters, analysts expect CRWD to grow earnings at a healthy 50% clip.

Image Source: Zacks Investment Research

Consistency

CrowdStrike is able to be consistent for three reasons: it has a subscription-based model (recurring sales), makes strategic acquisitions, and is using the latest in technology (AI) to stay ahead of the competition.

Technical View

CRWD’s 50-day moving average crossed above its 200-day moving average recently, to trigger a bullish golden cross (signals a major trend change).

Image Source: TradingView

Takeaway

CrowdStrike is a leader in the cybersecurity industry because of its focus on new technology to thwart threats, strategic acquisitions, and subscription-based offering. Growing demand for cybersecurity solutions should only increase demand for CRWD’s suite of products moving forward.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CrowdStrike (CRWD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance