Bull of the Day: The Boston Beer Company (SAM)

The Boston Beer Company (SAM) looks back to being on the path of lucrative profitability and rewarding gains for investors landing its stock a Zacks Rank #1 (Strong Buy) and the Bull of the Day.

As one of the nation's premier brewing companies, Boston Beer’s market dominance through famous branded beers like Samuel Adams Lager is compelling with the company having a lengthy international presence as well. Investments into malt beverages through its branded BoDeans’s Twisted Tea are expected to support the iconic brewer which also produces alcoholic ciders.

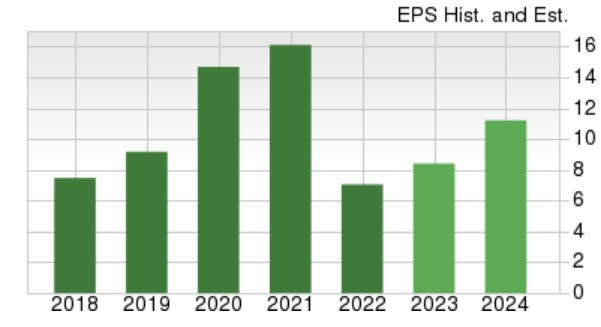

Fiscal 2024 EPS Rebound

Boston Beer will be reporting its Q4 results in late February and is expected to round out fiscal 2023 with earnings up a modest 4% to $7.33 a share. However, it is the anticipation of EPS soaring another 53% this year to $11.21 per share that should start to excite investors.

Image Source: Zacks Investment Research

More importantly, FY24 earnings estimates have continued to trend higher over the last quarter and are slightly up over the last 60 days. Notably, The Boston Beer Company has an “A” Zacks Style Scores grade for Growth in addition to its strong buy rating.

Image Source: Zacks Investment Research

Points of a More Reasonable Valuation

Magnifying Boston Beer’s stronger earnings outlook is that SAM shares trade at their most reasonable valuation in over a decade in terms of price to earnings. Currently at a 32X forward earnings multiple this is far more attractive than decade highs of 114.6X and a slight discount to the median of 35X.

Image Source: Zacks Investment Research

Furthermore, Boston Beer’s price-to-sales ratio is now near the optimum level of less than 2X compared to extreme decade highs of 7.9X and beneath the median of 2.8X.

Image Source: Zacks Investment Research

Bottom Line

Starting to eliminate some of the premium fears that may have curved investors in the past it's noteworthy that Boston Beer’s stock has an overall “A” VGM Zacks Style Scores Grade for the combination of Value, Growth, and Momentum. Now looks like a good time to buy as the alcoholic beverage conglomerate has the potential to be a very sound investment given its fiscal 2024 outlook.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance