Bull of the Day: Barrick Gold (GOLD)

Zacks Rank #1 (Strong Buy) stock Barrick Gold (GOLD) isa Canadian gold mining company. Barrick is among the top gold producers globally, and the company has mining projects and exploration locations across five continents. GOLD management is focused on maximizing the benefits of rising metal prices by meeting operations and financial targets. As you might expect, the stock is highly correlated to its underlying commodity, gold. As such, I will first cover the bullish thesis behind gold.

Gold Bull Thesis

Inflation Hedge

Investors see gold as a hedge against inflation. The U.S. faces a mindboggling deficit of $34 trillion and is proliferating each day. As the 2024 election approaches, investors must accept the fact that Biden and Trump, the two overwhelming frontrunners, are not known for their fiscal conservatism. Furthermore, even if spending tapers, the Federal Reserve is expected to cut interest rates by year-end, and the budget deficit will remain at nosebleed levels. Interest payments are swelling, ranking fourth in spending (only behind Social Security, Medicare, & Defense). In other words, don’t expect a budget surplus any time soon – the last surplus for the federal government was in 2001!

U.S. Sanctions & BRICS Demand

BRICS is an acronym for an association of five major emerging national economies- which stands for Brazil, Russia, India, China, and South Africa (Egypt, Ethiopia, Iran, & the UAE have been added to the original BRICS recently) – known for their significant influence on regional and global affairs. BRICS was formed to promote cooperation and collaboration among its member countries, which are major emerging economies, to address common challenges, foster economic development, and enhance their collective influence on the global stage. By working together, BRICS seeks to strengthen their positions in international institutions, promote inclusive development, and contribute to global economic governance reforms.

How does the BRICS impact the price of gold? The U.S. has levied severe sanctions on BRICS members such as Russia and newcomer Iran. With Russia locked in a multi-year conflict with Ukraine (with no end in sight) and Iranian leadership funding proxy wars on U.S. troops globally, the two countries are essentially barred from using the U.S. dollar and are forced to seek alternatives. To “de-dollarize” and provide an alternative to the U.S. dollar (which is no longer backed by gold), the BRICS countries have been dramatically increasing their purchases of gold on the international market – a trend that should last for years to come and put a floor under gold and gold proxies like the Van Eck Gold Miners ETF (GDX).

Costco Sparks Retail Gold Demand

Costco Wholesale (COST) is one of the top discount retailers in the United States and worldwide. What makes Costco so unique? The company offers dirt cheap prices to those consumers who are willing to purchase a Costco membership and buy in bulk. By moving a lot of products, COST can keep prices low on everything from gasoline to televisions to furniture. Though COST is a discount retailer, it offers high-end products to its loyal customer base, such as expensive and difficult-to-source cognac, for example.

In the second half of 2023, Costco began to offer gold bullion bars at competitive price levels. The addition of gold bars to Costco Wholesale locations has been breathtaking. Because of its solid reputation and competitive pricing, COST reportedly rakes in ~$200 million a month in revenue from gold bullion alone. With such success, it is not out of the question that other retailers follow suit and the consumer gold market snowballs, driving gold prices higher.

Barrick Bull Thesis

M&A Sparks Growth

Barrick has been leveraging mergers and acquisitions to become an industry leading gold company. The company now owns five of the industry’s top ten tier one gold assets. Furthermore, GOLD has the lowest total cash cost position among senior gold peers mixed with high-quality gold reserves. Barrick also has an extensive regional presence across many of the world’s most prolific gold districts.

Robust EPS Estimates and the Tendency to Beat the Street

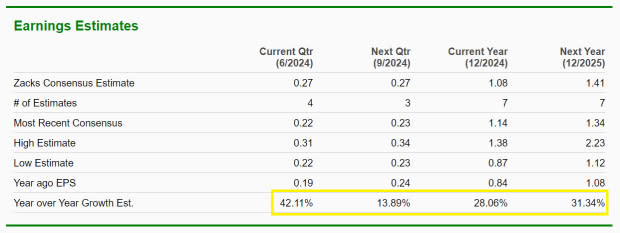

Zacks Consensus Estimates suggest that Barrick will grow EPS at a healthy double-digit rate over the next two years.

Image Source: Zacks Investment Research

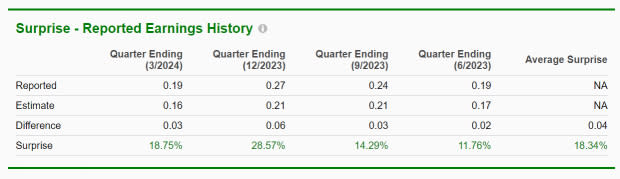

Meanwhile, the company has delivered positive EPS surprises for four straight quarters, with an average surprise of 18%.

Image Source: Zacks Investment Research

Bullish Technical Set-Up

GOLD is forming a bullish monthly pennant. Investors should look for the stock to clear last month’s doji (indecision) candle.

Image Source: TradingView

Bottom Line

Through its aggressive M&A strategy, Barrick Gold is well-positioned to take advantage of soaring gold demand and government spending.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

VanEck Gold Miners ETF (GDX): ETF Research Reports

Yahoo Finance

Yahoo Finance