Bucher Industries And Two More Leading Dividend Stocks

The Swiss market experienced a downturn on Wednesday, influenced by declining investor sentiment and global economic uncertainties, including anticipation of U.S. economic data and fluctuating Federal Reserve interest rates. The benchmark SMI index reflected these concerns, closing lower after an initial rise earlier in the day. In such a market environment, dividend stocks like Bucher Industries often attract attention for their potential to offer investors steady income streams amidst volatility.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Vontobel Holding (SWX:VONN) | 5.55% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.20% | ★★★★★★ |

Compagnie Financière Tradition (SWX:CFT) | 4.30% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.45% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.38% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.36% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 3.85% | ★★★★★☆ |

EFG International (SWX:EFGN) | 4.26% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 5.11% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.77% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

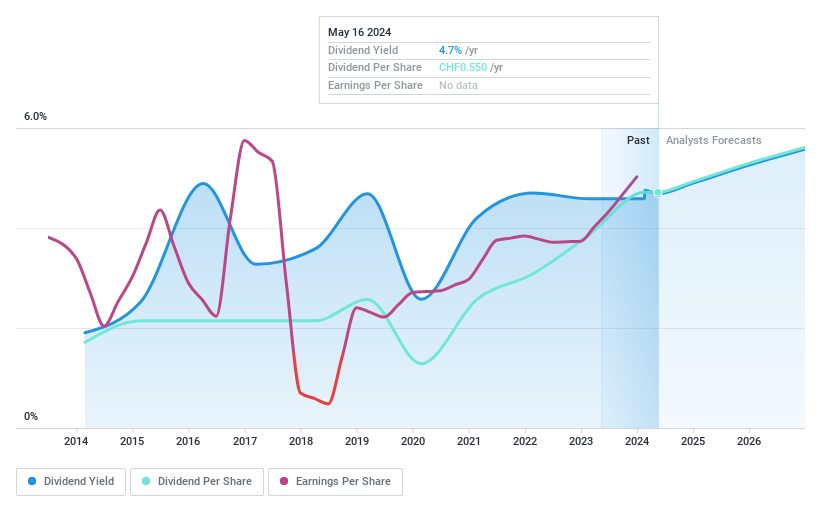

Bucher Industries

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bucher Industries AG specializes in manufacturing and selling machinery, systems, and hydraulic components for food production, harvesting, packaging, and maintaining clean and safe roads and public spaces globally, with a market capitalization of CHF 3.63 billion.

Operations: Bucher Industries AG's revenue is primarily generated through five segments: Kuhn Group (CHF 1.42 billion), Bucher Specials (CHF 398 million), Bucher Municipal (CHF 572.50 million), Bucher Hydraulics (CHF 743.60 million), and Bucher Emhart Glass (CHF 523.60 million).

Dividend Yield: 3.8%

Bucher Industries offers a dividend yield of 3.81%, below the top quartile in the Swiss market at 4.23%. Despite a stable dividend history over the last decade, its high cash payout ratio of 127.1% raises concerns about sustainability, as dividends are not well covered by free cash flow. Earnings have grown annually by 14% over the past five years, but are projected to decline by an average of 5.2% annually over the next three years. The stock trades at a discount of 24.4% below estimated fair value, suggesting potential undervaluation relative to peers.

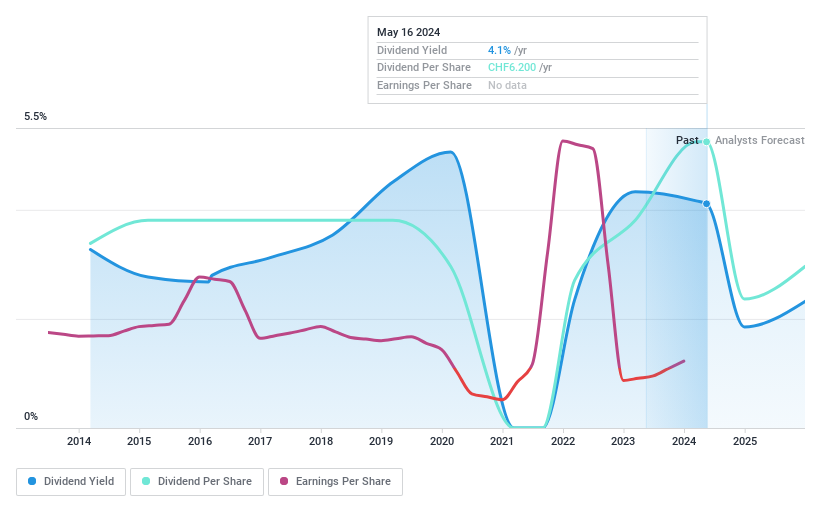

EFG International

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EFG International AG operates in private banking, wealth management, and asset management, with a market capitalization of approximately CHF 3.90 billion.

Operations: EFG International AG generates revenue through various regional segments, with CHF 450.20 million from Switzerland & Italy, CHF 249.70 million from Continental Europe & Middle East, CHF 177.40 million from the United Kingdom, CHF 165.30 million from Asia Pacific, CHF 133.20 million from the Americas, and smaller amounts from other business activities including Global Markets & Treasury and Investment and Wealth Solutions totaling CHF 205.40 million.

Dividend Yield: 4.3%

EFG International, trading at CHF 33.9% below estimated fair value, offers a dividend yield of 4.26%, placing it in the top 25% of Swiss dividend payers. Despite this, its dividend history is marked by volatility over the last decade with an unstable track record and inconsistent growth. Earnings have increased by 56.6% over the past year and are expected to grow by 5.43% annually. Dividends are currently well-covered by earnings with a payout ratio of 58.5%, projected to remain sustainable at a 53.2% payout ratio in three years despite concerns about its high level of bad loans at 2.5%. On April 30, EFG International extended its buyback plan to July end, reflecting potential confidence in financial stability or an attempt to support stock price.

TX Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TX Group AG operates a network of platforms and participations in Switzerland, offering information, orientation, entertainment, and support services with a market capitalization of approximately CHF 1.75 billion.

Operations: TX Group AG's revenue is generated through various segments, including Tamedia (CHF 446.40 million), Goldbach (CHF 274.70 million), 20 Minutes (CHF 118.40 million), TX Markets (CHF 133.80 million), and Groups & Ventures (CHF 159.40 million).

Dividend Yield: 3.7%

TX Group, while trading at 72.4% below its estimated fair value, presents a modest dividend yield of 3.75%, which is lower than the top Swiss dividend payers. The company's dividends are supported by both earnings and cash flows with payout ratios of 86.9% and 42.1%, respectively, indicating a sustainable payment despite its historical volatility in dividend distribution over the past decade. Recently turning profitable, TX Group forecasts an earnings growth of 28.14% per year, enhancing its potential for maintaining dividends.

Click to explore a detailed breakdown of our findings in TX Group's dividend report.

Upon reviewing our latest valuation report, TX Group's share price might be too optimistic.

Taking Advantage

Embark on your investment journey to our 27 Top Dividend Stocks selection here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BUCN SWX:EFGN and SWX:TXGN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance