Brokers' Digest: Singtel, Boustead Singapore, UMS Holdings, Wilmar International, MPACT

See what the analysts have to say this week.

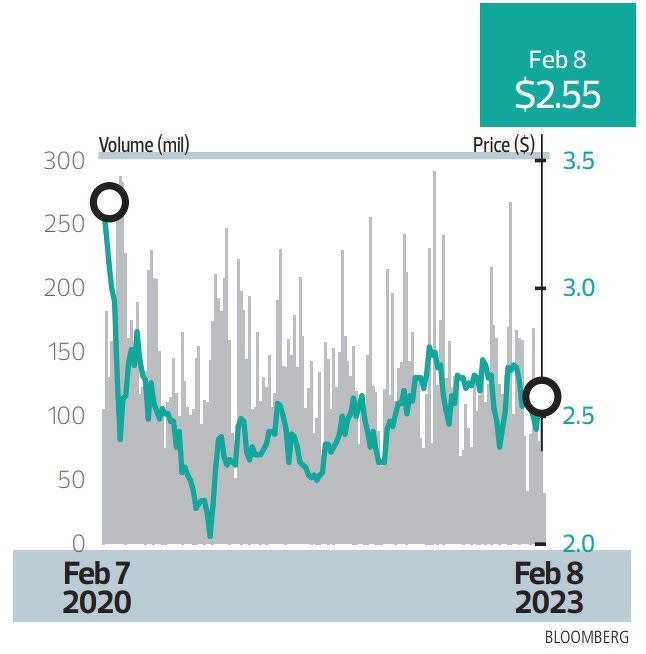

Singapore Telecommunications Z74

Price target:

DBS Group Research ‘buy’ $3.18

Singtel’s ROIC could improve in the next two years

Sachin Mittal of DBS Group Research has raised his target price for Singapore Telecommunications (Singtel) to $3.18 from $3.15 on projections that the telco will be able to improve its return on invested capital (ROIC) in the coming two years.

“Singtel’s share price has demonstrated a positive correlation of 89% with its ROIC, implying when the ROIC performs better, the share price inches up,” writes Mittal in his Feb 9 note. ROIC is measured using a company’s profitability as the percentage of total capital employed, a combination of book value and net debt.

In May 2020, Singtel’s share price dropped by 26% to $2.50, and then the telco’s ROIC dropped from 8% to 5% because of weakened core business and lower contributions from the regional associates.

At this level, Singtel’s ROIC was below its weighted average cost of capital at 6.5%. “The WACC of a company often acts as a breaking point for the ROIC, resulting in a significant movement of the stock price,” observes Mittal.

Mittal projects Singtel’s ROIC to increase by 190 basis points over the next two years, led by a sharp recovery in its associate in India, Bharti.

Other factors contributing to the lift include further divestment of non-core assets and the recovery in mobile roaming revenue across the region.

In addition, Singtel might enjoy potential catalysts in the form of special dividends to be dished out over the coming two years. This will be on top of the expected 14.5 cents in regular dividends, which implies a yield of 5.7%.

In an earlier note on Feb 7, DBS lauds Singtel’s regional data centre ambitions, with a total of 170MW in data centre capacity come 2025. For 1HFY2023 ended September 2022, Singtel generated operating earnings of $86 million from its Singapore data centre business. Applying a 20 times EV/Ebitda multiple makes the current data centre business worth $3.2 billion. If a strategic investor takes a one-third stake, that is $1 billion in cash that could be unlocked, notes DBS. — The Edge Singapore

Boustead Singapore F9D

Price target:

CGS-CIMB Research ‘add’ $1.35

Boustead Projects privatisation offer accretive for FY2024

CGS-CIMB Research analyst Ong Khang Chuen has kept his “add” call and target price of $1.35 for Boustead Singapore after the group announced its intention to make a voluntary unconditional general offer for the remaining 25% stake in its subsidiary, Boustead Projects.

Following the offer, Boustead Singapore will privatise Boustead Projects and delist it from the Singapore Exchange. Boustead Singapore’s cash offer of 90 cents per share implies a valuation of $281.9 million for Boustead Projects.

In Ong’s estimates, the transaction will result in an EPS accretion of 11.5% for Boustead Singapore’s FY2024 ending March 2024 results, should it go through successfully. The analyst adds that he is “positive” about the transaction.

“Boustead Singapore has a strong net cash position with minimal capital expenditure (capex) needs — we think this can be tapped into by Boustead Projects, which recently entered into various investments and partnerships (Bideford Road mixed-development, Vietnam industrial real-estate fund and so on) to chart its next leg of growth,” he writes.

“We also think the current offer price favours Boustead Singapore, as it represents [a] 50% discount to our target RNAV of $1.79 for Boustead Projects,” adds Ong. His “add” call comes as he sees Boustead Singapore’s 1HFY2023 results being a “fundamental inflexion point” for the group, with earnings recovery expected in the 2HFY2023, on the back of the group’s strong order backlog.

Ong’s target price is based on a 20% discount to its sum-of-the-parts (SOTP)-based valuation. He adds that further order wins and the successful execution of Boustead Projects’ privatisation offer, are potential rerating catalysts. However, weaker markets on cost escalation could pose downside risks. — Felicia Tan

UMS Holdings 558

Price target:

Maybank Securities ‘hold’ $1.33

Downgrade on unavoidable slowdown, negative outlook

Maybank Securities analyst Jarick Seet has downgraded UMS Holdings to “hold” from “buy” previously as he expects an “unavoidable” slowdown for UMS. The slowdown is based on Seet’s channel checks and the negative outlook released by several key semiconductor players like LAM Research, Samsung and Intel. The analyst has also lowered his target price to $1.33 from $1.47.

In his report dated Feb 6, Seet believes there may be a slowdown or a delay of orders from UMS’s key customers leading to a weaker 4QFY2022 ended Dec 31, 2022, and 1HFY2023. The analyst expects UMS to report revenue of $90 million and patmi of $20 million during its results for the 4QFY2022, which are due to be released on Feb 27. Seet’s figures come after lowering his forecasts for FY2022.

“We also expect 1HFY2023 to be weaker due to the broader sector slowdown and impact of the weakening US dollar (USD) on UMS’s receivables,” Seet writes. “However, the ramp-up of its new factory and new customer will be instrumental for its financial performance, and we see strong potential for a 2HFY2023 recovery.”

For FY2023, Seet expects an “attractive” dividend yield of 4.6% from UMS for FY2022 and FY2023. “UMS has generally awarded its shareholders attractively in terms of dividends, and we expect its dividend to increase as its performance continues to improve. We think it makes sense to hold the stock during this expected short downturn,” he writes.

Despite the weaker short-term forecast, the analyst remains optimistic about UMS’s prospects, saying that its longer-term outlook “remains intact”. This is especially with the gain of a new large customer, which should provide growth over the next few years,” Seet adds. — Felicia Tan

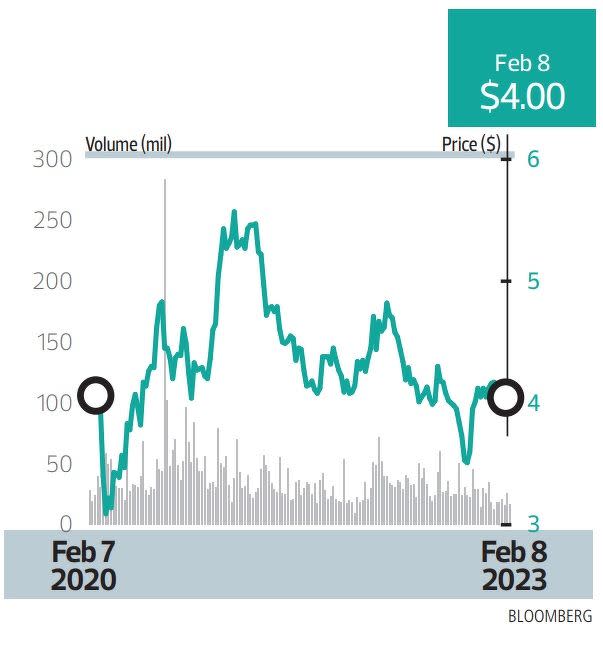

Wilmar International F34

Price target:

DBS Group Research ‘buy’ $6.67

No significant impact from Adani joint venture

William Simadiputra of DBS Group Research has kept his “buy” call on Wilmar International, as he believes the recent short-selling attack suffered by Adani Wilmar Limited (AWL) — the India-listed firm in a joint venture with Wilmar — will see no impact on the latter, a Singapore-listed palm oil giant.

In his Feb 3 note, Simadiputra writes that prior gains booked by Wilmar in 1QFY2022 ended March 2022 arose from revaluation and dilution of its interest post-AWL listing, not marked to post-listing AWL’s share price appreciation.

In 1QFY2022, following the IPO of AWL, Wilmar booked a gain of US$180 million ($238 million) from the revaluation of the stake, which was also diluted from 50% to 44%. “The gain was not a result of a mark-to-market gain arising from AWL positive share price performance post listing,” writes Simadiputra. He estimates that the value of AWL’s stake is carried on Wilmar’s books at US$440 million as of December 2022 and that the share of earnings booked was US$25 million for 1HFY2022.

“The size of AWL’s exposure on Wilmar’s balance sheet and income statement is relatively small to its earnings, estimated at US$2.3 billion for FY2022. Wilmar accounts for its investment in AWL through equity accounting method, and hence share price fluctuation in the latter will not be reflected on Wilmar’s income statement,” adds Simadiputra.

Citing New York-based short seller Hindenburg Research, the analyst notes that AWL has a relatively strong balance sheet relative to other AWL’s listed companies, with netdebt-to-ebitda of 1.9 times, which is lower than the industry average of 2.9x, as well as a healthy current ratio of 1.2 times.

The recent correction suffered by AWL was most likely driven by the previous rich valuation of more than 60 times earnings and not merely from the Hindenburg report, says the DBS analyst.

Meanwhile, AWL is seen to have a strong consumer products business and portfolio to sustain its operation in the future, further making the possibility of write-down in values low. The analyst’s $6.67 target price, derived using a sum-of-the-parts valuation methodology, implies a FY2023 P/E of 16.5 times.

In contrast, Wilmar trades at just 10 times its earnings. “Wilmar is mispriced as just another palm oil company,” says Simadiputra, adding that he believes that Wilmar should trade at a higher P/E multiple as the company enlarges its footprint in the consumer-branded products segment.

He adds that Wilmar will maintain its earnings performance amid commodity price volatility as its products have resilient demand. “Wilmar’s investments in midstream and downstream segments will create a strong platform that would enable the company to adapt to external challenges and deliver consistent margins and returns to investors.” — The Edge Singapore

Mapletree Pan Asia Commercial Trust N2IU

Price targets:

CGS-CIMB Research ‘add’ $2.08

OCBC Investment Research ‘hold’ $1.81

Citi Investment Research ‘buy’ $1.90

MPACT’s ‘uneven recovery path’

Analysts from CGS-CIMB Research and OCBC Investment Research have maintained their “add” and “hold” ratings for Mapletree Pan Asia Commercial Trust (MPACT) with increased target prices of $2.08 and $1.81 from $1.98 and $1.72 previously. Concurrently, Branden Lee of Citi Investment Research has maintained his “buy” rating and target price of $1.90.

In their Feb 2 report, CGS-CIMB’s Lock Mun Yee and Natalie Ong say that MPACT faces an uneven recovery path, with good leasing traction for its Singapore, Japan and South Korea assets, while those in Greater China continue to lag.

For the 3QFY2023 ended December 2022, portfolio occupancy dipped q-o-q from 96.9% to 95.5% due to occupancy losses at Mapletree Business City (MBC) and in its China portfolio. MPACT has reported positive reversions for leases signed ytd for FY2023 at VivoCity, Mapletree Business City and properties in Japan and South Korea.

Tenant sales at Vivo City for the quarter came in at 110% of 3QFY2020’s levels despite shopper traffic still forming only 79% of pre-Covid-19 levels, while 3QFY2023 tenant sales at Festival Walk in Hong Kong fell 2.3% y-o-y, likely impacted by outbound travel, coming in at 74% of pre-Covid-19 levels. While occupancy at Festival Walk was stable q-o-q at 99.8%, they say reversions for leases signed during the year were lower on average (12.7%). MPACT’s renewed five-year lease at Beijing’s Gateway Plaza with BMW during the quarter — the second-largest tenant in MPACT’s portfolio, accounting for 3.9% of gross rental income (GRI) — could also be a drag.

MPACT’s 3QFY2023 revenue and net property income (NPI) grew 84% and 77% y-o-y to $239.8 million and $179.4 million, respectively, boosted by full-quarter contribution from properties acquired through the merger and higher earnings from VivoCity. For the period, the REIT’s dividend per unit (DPU) of 2.42 cents came in flat y-o-y, eroded by higher interest costs. For the 9MFY2023, MPACT’s total DPU of 7.36 cents stands 8.1% higher y-o-y and is in line at 73.7% of Lock and Ong’s FY2023 estimates.

MPACT has also seen slight increases in aggregate leverage, cost of debt and interest rate hedges in the last quarter. The REIT’s aggregate leverage ratio increased from 40.1% to 40.2% during 3QFY2023, while 78.3% of its debt has been hedged versus 72.5% in the preceding quarter. Its weighted average all-in cost of debt also rose 13 basis points (bps) to 2.57%. MPACT estimates that every 50 bps increase in benchmark rates will impact its DPU by 0.14 Singapore cents, or around 1.4% of its FY2023 DPU forecast.

Meanwhile, Citi’s Lee sees a “muted share price impact”. Key downside risks include the continued negative rental reversion at its largest asset Festival Walk, foreign exchange risks as 44% of its earnings are derived from Hong Kong, China, Japan and South Korea, and a sharper-than-expected increase in interest rates, which could impact DPU and cap rates. Upsides include a quicker-than-expected improvement in retail outlook post resumption in international travel in Hong Kong, China or Singapore, the recovery of anchor and mini-anchor spaces for new asset enhancement initiatives (AEIs) and the potential acquisition of or joint redevelopment of sponsor’s assets. — Bryan Wu

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Moody's assigns Baa1 foreign currency issuer rating to MPACT

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance