Broadcom Inc (AVGO) Reports Strong Q1 Fiscal 2024 Results with Significant Revenue and Free ...

Revenue: $11.96 billion, a 34% increase from the prior year period.

Free Cash Flow: $4.69 billion, representing 39% of revenue.

GAAP Net Income: $1.33 billion, with a GAAP diluted EPS of $2.84.

Non-GAAP Net Income: $5.25 billion, with a Non-GAAP diluted EPS of $10.99.

Adjusted EBITDA: $7.16 billion, or 60% of revenue.

Quarterly Dividend: $5.25 per share.

Share Repurchases: 7.7 million shares eliminated for $8.29 billion.

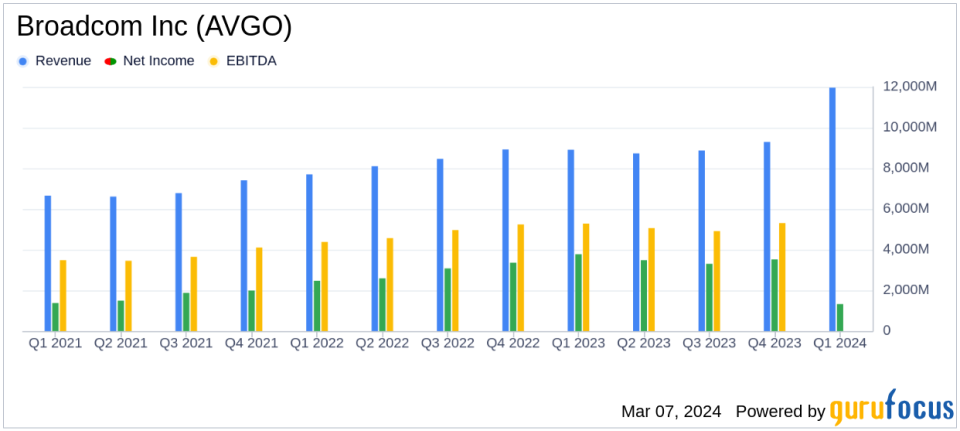

Broadcom Inc (NASDAQ:AVGO) released its 8-K filing on March 7, 2024, announcing its financial results for the first quarter of fiscal year 2024, which ended on February 4, 2024. The company, a global technology leader in semiconductor and infrastructure software solutions, has reported a significant increase in revenue and free cash flow, largely attributed to its recent acquisition of VMware and strong demand for its networking products.

Broadcom is the sixth-largest semiconductor company globally, with a diverse portfolio that spans across wireless, networking, broadband, storage, and industrial markets. It is also a major player in the software industry, providing solutions in virtualization, infrastructure, and security to large enterprises, financial institutions, and governments. The company's growth strategy has been marked by consolidation, with key acquisitions such as legacy Broadcom, Avago Technologies, Brocade, CA Technologies, and Symantec.

Financial Performance and Challenges

Broadcom Inc (NASDAQ:AVGO) has experienced a robust increase in revenue, up 34% from the previous year, reaching $11.96 billion. This growth is particularly significant as it includes contributions from VMware, which has accelerated revenue in the infrastructure software segment. The semiconductor solutions segment also saw a 4% increase, demonstrating strong demand for Broadcom's networking products and custom AI accelerators.

Despite the positive revenue growth, the company's GAAP net income saw a decrease to $1.33 billion from $3.77 billion in the prior year period. This decline is primarily due to higher operating expenses, including costs associated with the VMware acquisition. However, the non-GAAP net income, which adjusts for these acquisition-related costs and other non-recurring items, increased by $771 million to $5.25 billion.

Free cash flow was another highlight, with the company generating $4.69 billion, up from $3.93 billion in the prior year period. This represents a substantial 39% of revenue, underscoring Broadcom's ability to convert earnings into cash effectively. The company also demonstrated its commitment to returning value to shareholders by repurchasing $8.29 billion worth of shares and declaring a quarterly dividend of $5.25 per share.

Key Financial Metrics

Important financial metrics from Broadcom Inc (NASDAQ:AVGO)'s earnings report include:

Financial Metric | Q1 Fiscal 2024 | Q1 Fiscal 2023 | Change |

|---|---|---|---|

Net Revenue | $11,961 million | $8,915 million | +34% |

GAAP Net Income | $1,325 million | $3,774 million | -$2,449 million |

Non-GAAP Net Income | $5,254 million | $4,483 million | +$771 million |

Adjusted EBITDA | $7,156 million | $5,678 million | +$1,478 million |

Free Cash Flow | $4,693 million | $3,933 million | +$760 million |

These metrics are critical as they reflect the company's profitability, efficiency, and ability to generate cash. The strong adjusted EBITDA margin of 60% is particularly noteworthy, indicating that Broadcom Inc (NASDAQ:AVGO) maintains a high level of operational efficiency and profitability.

Management Commentary

"We are pleased to have two strong drivers of revenue growth for Broadcom in the first quarter and fiscal year 2024. First, our acquisition of VMware is accelerating revenue growth in our infrastructure software segment, as customers deploy VMware Cloud Foundation. Second, strong demand for our networking products in AI data centers, as well as custom AI accelerators from hyperscalers, are driving growth in our semiconductor segment," said Hock Tan, President and CEO of Broadcom Inc.

"Consolidated revenue grew 34% year-over-year to $12.0 billion, including the contribution from VMware, and was up 11% year-over-year, excluding VMware. Adjusted EBITDA increased 26% year-over-year to $7.2 billion," said Kirsten Spears, CFO of Broadcom Inc. "Free cash flow, excluding restructuring in the quarter, continued to be strong at $5.4 billion. We have started to pay down debt, beginning with $3 billion to date in 2024, and expect to continue to pay down debt in fiscal year 2024."

Outlook and Analysis

Broadcom Inc (NASDAQ:AVGO) has provided a positive outlook for fiscal year 2024, with revenue guidance of approximately $50.0 billion, which would represent a 40% increase from the prior year. The company

Explore the complete 8-K earnings release (here) from Broadcom Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance