Broadcom (AVGO) Q2 Earnings Beat Estimates, Revenues Rise Y/Y

Broadcom AVGO reported second-quarter fiscal 2024 non-GAAP earnings of $10.96 per share, beating the Zacks Consensus Estimate by 1.58% and increasing 6.2% year over year.

Net revenues increased 43% year over year to $12.48 billion, surpassing the Zacks Consensus Estimate by 3.71%. The upside can be attributed to VMware that contributed $2.7 billion in revenues for the second quarter, up from $2.1 billion in the prior quarter.

AI-related revenues surged 280% year over year to $3.1 billion, which was also a major driver of overall revenue growth.

The stock has risen 34% compared with the Zacks Computer & Technology sector’s growth of 8.1% year to date.

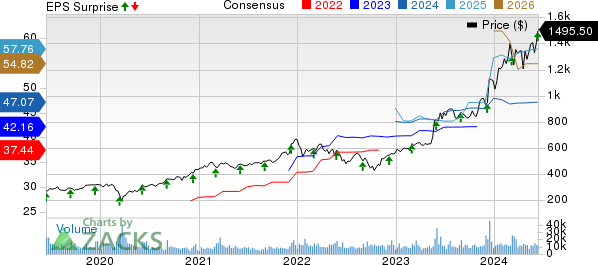

Broadcom Inc. Price, Consensus and EPS Surprise

Broadcom Inc. price-consensus-eps-surprise-chart | Broadcom Inc. Quote

Top-Line Details

Semiconductor solutions revenues (58% of net revenues) totaled $7.2 billion, up 6% year over year and beat the Zacks Consensus Estimate by 0.77%. The uptick was driven by the strong adoption of hyperscaler.

Networking revenues of $3.8 billion rose 44% year over year and contributed 53% to Broadcom’s semiconductor revenues. The company witnessed strong demand for its custom AI accelerators, networking switches, routers and Network Interface Card from hyperscale customers.

Storage connectivity revenues of $824 million contributed 11% to semiconductor revenues. It plunged 27% year over year.

Broadband revenues declined 39% year over year to $730 million and contributed 10% to semiconductor revenues. Wireless revenues of $1.6 billion contributed 22% to semiconductor revenues and were up 2% year over year.

Industrial resale revenues of $234 million declined 10% year over year.

Infrastructure software revenues (42% of net revenues) soared 175% year over year to $5.3 billion.

Bookings in the software segment grew from $1.9 billion in fiscal first quarter to $2.8 billion in fiscal second quarter, reflecting strong customer commitment and future revenue streams.

Operating Details

The non-GAAP gross margin was flat on a year-over-year basis to 76%.

Research and development, as a percentage of net revenues, increased 130 bps year over year to 12.3%. SG&A expenses increased 400 bps to 6.7%.

Adjusted EBITDA increased 31% year over year to $7.4 billion. The adjusted EBITDA margin contracted 560 bps on a year-over-year basis to 59.5%.

The non-GAAP operating margin contracted 470 bps year over year to 57.2%.

Balance Sheet & Cash Flow

As of May 5, 2024, cash and cash equivalents were $9.8 billion compared with $11.87 billion reported as of Feb 4, 2024.

Total debt (including the current portion of $2.42 billion) was $74 billion as of May 5, 2024, compared with $76 billion as of Feb 4, 2024.

Broadcom generated $4.58 billion cash flow from operations compared with $4.81 billion in the previous quarter. The free cash flow was $4.44 billion compared with $4.69 billion in the prior quarter.

AVGO raised a quarterly common stock dividend of $5.25 per share for the second quarter of fiscal 2024.

On Mar 29, 2024, the company paid out a cash dividend of $5.25 per share of common stock, totaling $2.44 billion.

Guidance

For fiscal 2024, the company expects revenues of $51 billion, including contribution from VMware, suggesting an increase of 42% from the prior-year reported levels.

Adjusted EBITDA is expected to be 61% of projected revenues.

AI revenues are expected to rise $11 billion.

Zacks Rank & Other Stocks to Consider

Currently, AVGO has a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader technology sector are Arista Networks ANET, Badger Meter BMI and Dropbox DBX, each sporting a Zacks Rank #1(Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks’ shares have gained 34.4% in the year-to-date period. The long-term earnings growth rate for ANET is pegged at 15.68%.

Badger Meter’s shares have jumped 22.6% in the year-to-date period. The long-term earnings growth rate for BMI is projected at 15.57%.

Shares of Dropbox have declined 26.3% in the year-to-date period. The long-term earnings growth rate for DBX is pegged at 11.44%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance