Bringing Back the Classics: Abercrombie & Fitch's Resurgence

New kids on the block, playing hooky from school, and that sweet summer vibe.

Do you remember? Do you remember that summer of 1999?

The late ‘90s were undoubtedly an interesting period, a time which coincided with the release of the hit song “Summer Girls” by American pop group LFO. It was also around the time that the Abercrombie brand really started to gain momentum. Abercrombie & Fitch ANF stock surged from under $5/share in 1997 to just under $60/share by late 2007. The retailer delivered a ten-bagger performance (and more) over the course of a decade, a phenomenal return by any measure.

Despite some wild price fluctuations in the ensuing years, ANF stock entered what can only be categorized as a long-term downtrend, touching as low as $7.41/share when the coronavirus pandemic hit. But a mind-blowing reversal has now taken shape, and it didn’t take nearly as long for the stock to regain many of those former levels. Let’s take a deeper look at this highly-rated company.

An Incredible Turnaround Story

Abercrombie & Fitch, a Zacks Rank #1 (Strong Buy), operates as a specialty retailer of premium, high-quality casual apparel for men, women, and kids through a network of approximately 760 stores. The company operates across North America, Europe, Asia, and the Middle East, in addition to several e-commerce websites. Its beginnings trace back to the 19th century, when David Abercrombie founded the original company as an upscale sporting goods store.

The modern-day fashion retailer has endured through many difficult times, including the shuttering of hundreds of stores during turbulent market periods. Fast forward to today, and the company appears to be firing on all cylinders. Continued momentum in the Abercrombie brand along with sequential improvement in the Hollister brand bode well for the company in the coming months and years.

Abercrombie & Fitch has exceeded earnings estimates in each of the past four quarters, with an average earnings surprise of 725%. Digging into the most recent quarterly results, ANF delivered second-quarter earnings of $1.10/share, a staggering 746.15% beat over the $0.13/share consensus estimate. Net sales rose 16.2% year-over-year. Consistently beating earnings estimates by a wide margin is a recipe for stock outperformance.

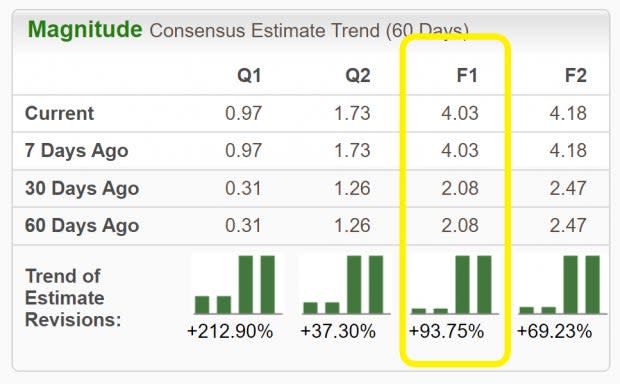

Analysts covering ANF are in agreement and have been raising earnings estimates across the board. For the current fiscal year, estimates have been raised by 93.75% in the past 60 days. The 2023 Zacks Consensus EPS Estimate now stands at $4.03/share, a whopping 1,512% improvement versus last year.

Image Source: Zacks Investment Research

Clearly, the fundamental growth is there for this company. Is the share price following suit?

Technical View

ANF stock has advanced more than 230% in the past year. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

Image Source: StockCharts

Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping up. The stock has been making a series of higher highs while showing relative strength.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, Abercrombie & Fitch has recently witnessed positive revisions. As long as this trend remains intact (and ANF continues to deliver earnings beats), the stock will likely continue its bullish run this year.

Bottom Line

Favorable margin trends, strong brand recognition, and a set of long-term initiatives have helped this company turn the corner to a new phase of growth. The second-quarter results prompted management to raise its guidance for the remainder of 2023, driven by strong sales and store optimization plans.

Backed by robust fundamentals and a healthy track record of earnings beats, ANF stock may very well eclipse its former highs. And while the company may not be the new kid on the block anymore, it appears its best days are ahead of it.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance