BP's GTA FPSO Moves Away After Typhoon Muifa Hits China

BP plc’s BP floating production, storage and offloading (“FPSO”) vessel for the Greater Tortue Ahmeyim (“GTA”) project drifted off the quayside as Typhoon Muifa made landfall on China’s east coast.

The GTA project, operated by BP, is an offshore liquefied natural gas projecton the maritime borders of Mauritania and Senegal. The FPSO is being developed at the COSCO shipyard in Qidong, China. The tropical storm moved through the shipyard.

Typhoon Muifa was the strongest typhoon in the Yangtze River Delta in the past 10 years. It is the second-highest in China’s tropical cyclone classification system, with the maximum wind speed near its center reaching 42 meters per second.

The FPSO’s mooring systems were affected by the typhoon. This resulted in the vessel drifting 200 meters off the quayside. Attempts are being made to return the vessel to the quayside. No injuries have been reported during the incident.

The costs of returning the FPSO to the quayside, along with any possible damage, are likely to be covered by insurance. It is uncertain whether the incident will impact the vessel’s sail away date, which is expected in the fourth quarter of 2022. The project is designed to achieve the first gas in the third quarter of 2023 and the first LNG at 2023-end.

The project is expected to produce up to 10 million tons of liquefied natural gas per year. It will produce gas from an ultra-deepwater subsea system and mid-water FPSO vessel, which will process the gas by removing heavier hydrocarbon components. After that, the gas will be transferred to a floating liquefied natural gas facility at a nearshore hub on the Mauritania and Senegal maritime border.

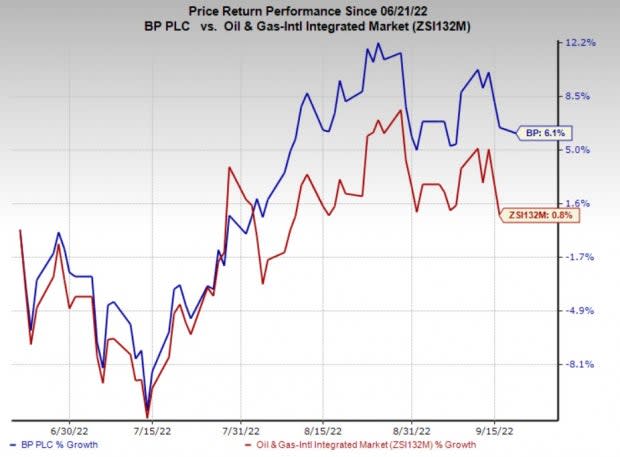

Price Performance

Shares of the company have outperformed the industry in the past three months. The stock has gained 6.1% compared with the industry's 0.8% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

BP currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Imperial Oil Limited IMO is one of the largest integrated oil companies in Canada. IMO remains strongly committed to returning money to investors via dividends. Imperial Oil announced a third-quarter 2022 dividend of 34 Canadian cents per share.

Imperial Oil has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 60 days. The company currently has a Zacks Style Score of A for Value and Growth. IMO is expected to see earnings growth of 180.6% in 2022.

Schlumberger Limited SLB is the largest oilfield services player, with a presence in every global energy market. For 2022, SLB revised its revenue outlook upward to at least $27 billion.

Schlumberger has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 60 days. The company beat the Zacks Consensus Estimate for earnings in the prior four quarters, delivering an earnings surprise of 9.1%. SLB is expected to see earnings growth of 57.8% in 2022.

Marathon Petroleum Corporation MPC is a leading independent refiner, transporter and marketer of petroleum products. MPC repurchased shares worth $4.1 billion in the May-July period of 2022 and completed more than 80% of its target of buying back common stock worth $15 billion.

Marathon Petroleum has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 60 days. The company currently has a Zacks Style Score of A for Value and Growth. MPC is expected to see earnings growth of 763.3% in 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

Schlumberger Limited (SLB) : Free Stock Analysis Report

Imperial Oil Limited (IMO) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance