Boutique projects shoring up quality, prices and rents: Huttons Asia

Macly Group’s Jansen House in District 19 is one of several new boutique projects to have been launched for sale this year. (Picture: Macly Group)

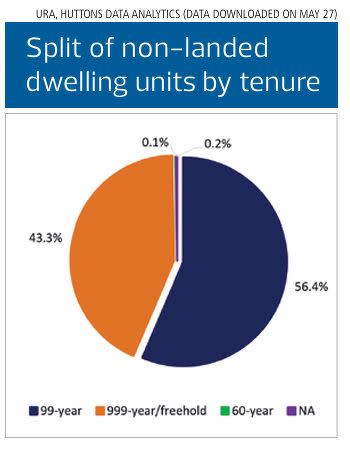

According to a research paper published by Huttons Asia, freehold and 999-year leasehold condominium units constitute 43.4% of Singapore’s non-landed private residential market. On the other hand, 99-year leasehold condo units make up 56.4% of the non-landed housing supply while a handful of 60-year leasehold developments represent the remaining 0.3%.

“The relatively high proportion of freehold and 999-year leasehold non-landed homes may come as a surprise to many homeowners given the perception that such homes are rare in Singapore,” says Lee Sze Teck, senior director of data analytics at Huttons Asia.

While data on the amount of land in Singapore held under a freehold or 999-year tenure is not publicly available, Huttons Research has extrapolated the data by matching caveated resale data with tenure information from URA Space.

Read also: Five-room flat at City Vue @ Henderson sells for $1.588 mil

According to Huttons’ research, there are about 142,000 non-landed private residential units in Singapore held under the freehold or 999-year leasehold tenure. Meanwhile, there are about 185,000 units with a 99-year leasehold tenure.

Only two projects in Singapore are listed with a 60-year leasehold tenure — Bedok Shopping Complex has about 13 years left on its lease which started in 1977 and The Hillford with a lease that began in 2013.

“Since 1967, all residential land sold by the government has been on a 99-year lease,” says Lee. “Therefore, the supply of freehold and 999-year leasehold residential sites is extremely limited and hinges solely on successful en bloc and intensification of older developments”.

District 10 has the greatest number of freehold/999-year leasehold non-landed units, with about 22,305. District 15 is the runner-up with 20,986 units while District 9 comes in at a close third place with 19,633 units.

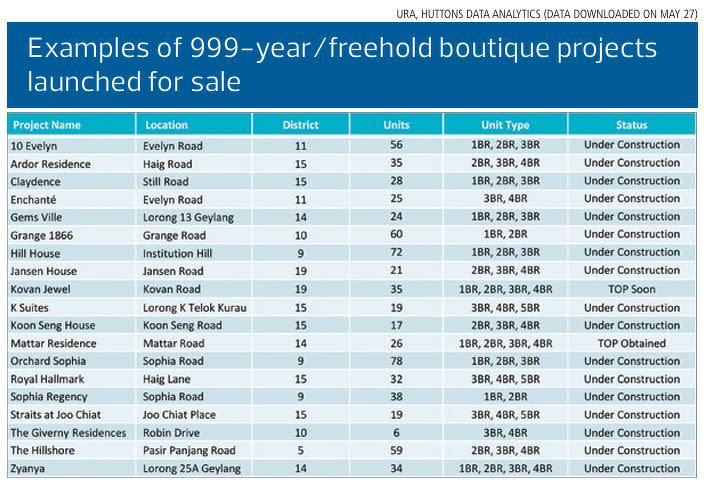

“Our research shows there are 1,942 freehold and 999-year leasehold projects in Singapore. In addition, 1,540 of these projects (79.3%) fall under the boutique category while the rest are larger-sized projects,” says Lee.

Consequently, District 15 has the most freehold/999-year leasehold projects at 377, followed by District 10 at 251 projects, and District 14 at 186 projects. Other areas with a noteworthy number of freehold/999-year projects include Districts 9, 11, 19, 12, 8 and 5.

Read also: Katong Plaza approved for hotel use, launches fourth collective sale at $188 mil

Lee says new boutique projects are a far cry from the shoebox apartments that dominated the market in the early 2000s and can hold their own as compelling residential developments.

“There are some buyers who eschew boutique projects for larger ones. The perception is that bigger is better because the size of the land is larger which provides space for more facilities. Some buyers also believe the price appreciation at larger projects is better and the maintenance fees are lower. Others have the impression that it is easier to sell or rent out a unit in a larger project,” he says.

However, in general, the maintenance fees of boutique projects and larger-sized developments are nearly on par, he points out. “For example, the maintenance fees for a three-bedroom unit in the 170-unit The Verandah Residences is around $400/month which is similar to a three-bedroom unit in the 35-unit Ardor Residence. Both projects have similar facilities such as a function room, BBQ pavilions, swimming pool and the gym,” says Lee.

On the rental market, transaction data suggests that boutique projects are highly rentable and typically achieve rents comparable to larger-sized projects, according to research by Huttons. “For example, three-bedroom units at The View at Meyer, a 45-unit project fetched an average monthly rent of $7,833 in 2023. The Seafront on Meyer, a 327-unit project, had an average rent of $7,411 per month in 2023. Both projects are around the same age,” says Lee.

He adds that boutique projects have also generally performed well on the secondary market, demonstrating strong capital appreciation and price appreciation. “For example, median prices at Malvern Springs, a 75-unit boutique project in District 15, more than doubled to $1,858 psf, translating into a CAGR of 5.25% over a 21-year period. Similarly, median prices at the 18-unit boutique project Residences @ Jansen almost doubled to $1,233 psf or a CAGR of 4.03% over a 17-year period.”

Nearly 80% of available freehold and 999-year leasehold projects in Singapore are boutique developments and as the proportion of freehold and 999-year leasehold land diminishes, these homes will become rarer and more desirable, says Lee.

Read also: Three-bedroom unit at Eden Residences Capitol for sale at $5.8 mil

“Boutique projects are akin to limited-edition art pieces, offering an exclusive and private environment for discerning buyers and tenants,” he says. “These developments, with fewer units, often boast attractive prices, appealing to those who value exclusivity and affordability.”

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

Katong Plaza approved for hotel use, launches fourth collective sale at $188 mil

Three-bedroom unit at Eden Residences Capitol for sale at $5.8 mil

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance