Bonnie Chan lauds 'resilience' of HKEX as new listing rules boost pace of Hong Kong's IPOs

The momentum of Hong Kong's initial public offerings (IPO) has picked up since April, auguring well for the exchange as it claws its way back in the rankings of the world's top spots for fundraising.

"We are vetting about 110 listing applications, many of them coming in the second quarter," Bonnie Chan Yi-ting said in an interview with the Post, a week after her 100th day as chief executive officer of Hong Kong Exchanges and Clearing (HKEX), the world's fourth-largest capital market. "The pipeline is very healthy."

As many as 70 listing applications have been submitted so far this year, 46 per cent more than the second half of 2023, she said.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

Hong Kong's capital market, which had wallowed in a bear market for three years during the Covid-19 pandemic, has picked up since Chan's appointment. The city's benchmark Hang Seng Index rose 11 per cent in her first 100 days, while the market's average daily turnover jumped 35 per cent to HK$121 billion (US$15.5 billion).

Eighteen IPOs have raised a combined HK$8.7 billion since April, a notable pickup from the five that raised HK$2.18 billion in January, and a fallow February.

"While it is good to be high on the league table, the success of our listing framework [is measured] not just by the ranking, but by what we bring to the market," said the former lawyer, who headed the listings operation at HKEX before her promotion in March. "That is a better focus instead of just purely chasing numbers."

A major turning point occurred in mid-April, when the China Securities Regulatory Commission (CSRC) unveiled five measures to bolster fundraising in Hong Kong. The regulator said it would support qualified industry leaders to raise funds in Hong Kong, and relax the eligibility criteria for exchange-traded fund products in the connect cross-border investment mechanism.

New IPO applications have surged since the CSRC announcement, with 19 submissions in May alone, compared with 10 a month earlier, according to the exchange's data.

Even before then, the HKEX had been laying the foundation to build what Chan called "resilience", to ensure that the financial marketplace would always be available to connect businesses with capital, instead of being merely a fair-weather exchange.

"As an exchange operator, we face a unique set of challenges," she said. "We operate in an environment where things surrounding us are fast-changing. We need to stay resilient because the entire market relies on us. We also anticipate changes and get ourselves ready for those changes."

Trained as a lawyer at the University of Hong Kong and Harvard Law School, Chan first joined the HKEX in 2007 as head of the exchange's IPO transactions. She rejoined in 2020 as head of the exchange's listing operations before being promoted to co-chief operating officer in charge of the exchange's operations and strategies.

One month into her new role, she kicked off the development of a proprietary technology platform called the Orion Derivatives Platform that can offer round-the-clock derivatives trading for global investors when it goes into service in 2028.

"This will be a multi-year exercise, but we think it is very crucial that we embark on this journey so that we can cater to the needs of our global clients" and enhance Hong Kong's position as Asia's risk management centre, she said.

Green financial and carbon credit trading platforms would be other key strategies of development for the HKEX to meet the goal of Hong Kong to act as a green financing hub.

About 80 per cent of the shares that change hands everyday in Hong Kong belong to companies based in mainland China, a connection with the world's second-largest economy that Chan described as the HKEX's "trump card" and "something that works", compared with other global exchanges.

Chan said a key strategy is to continue to attract Chinese and international listings, as well as to entice mainland and overseas investors to trade here. She also wants to introduce home-grown technology platforms and products.

"We will continue to build on our China strength," she said. "It is essentially a very targeted focus in terms of building the ecosystem, which involves three main elements - issuers, investors and products. Once you have built a very robust ecosystem, then the vibrancy will be enhanced, and then the liquidity will come."

She was partly vindicated with the successful listing last week by QuantumPharm, an unprofitable start-up that uses artificial intelligence and quantum physics in the discovery of pharmaceuticals.

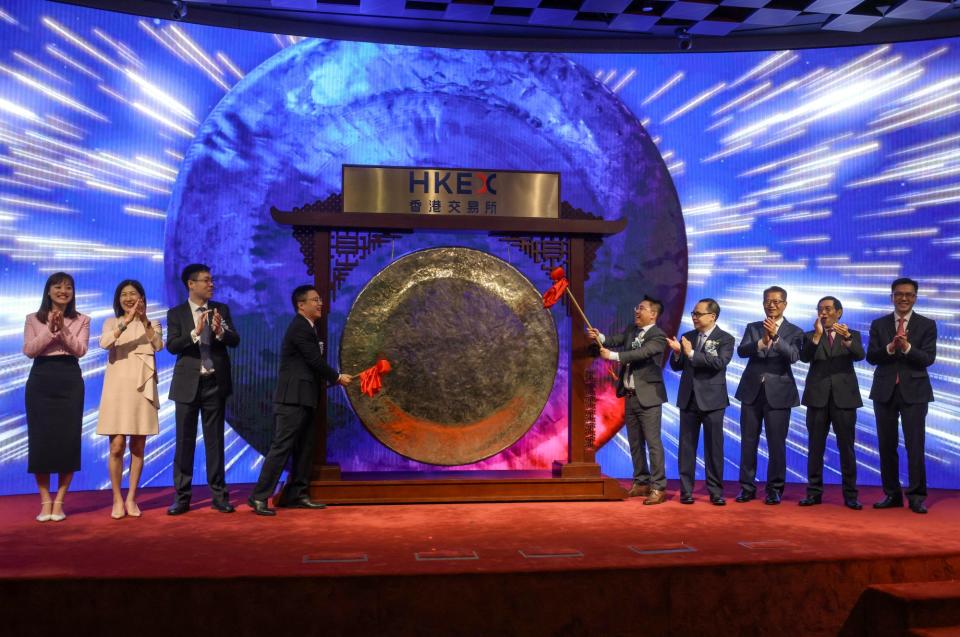

Top government and HKEX officials, and executives from QuantumPharm attend the company's listing ceremony on the Hong Kong stock exchange on June 13. Photo: Jonathan Wong alt=Top government and HKEX officials, and executives from QuantumPharm attend the company's listing ceremony on the Hong Kong stock exchange on June 13. Photo: Jonathan Wong>

QuantumPharm was the first listing under the exchange's Chapter 18C framework, which allows technology pioneers in strategic fields to raise capital even before they meet revenue and profit targets. The company's retail shares were overbought 103 times before they began trading at a premium to their IPO price.

"The significance of that is huge because we are opening a totally new channel for pre-revenue companies engaging in the technology intensive areas to seek public funding," said Chan, who wrote the 18C rules while she was the head of listing at the exchange.

"We want to make sure that we continue to create listing frameworks" that offer bespoke fundraising rules to attract companies, she said.

"We want to improve our listing regime to meet the needs of exciting companies, and new champions of the future to develop and fund their business," she said.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2024 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2024. South China Morning Post Publishers Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance