Boeing (BA) Wins Deal to Deliver 40 737 MAX Jets to Avolon

The Boeing Company BA recently received a commitment from aviation finance company Avolon for delivering 40 of its 737-8 jets. This order remains subject to approval from Avolon’s primary shareholders.

The order, once delivered, will boost Boeing’s revenues for its commercial airplane business segment, which recorded a solid 25% year-over-year revenue improvement in the third quarter of 2023.

737 MAX, A Solid Revenue Earner

The 737 MAX caters to the single-aisle market with enhanced efficiency, improved environmental performance and increased passenger comfort. In particular, Boeing’s 737-8 MAX reduces fuel use and emissions by 20% while producing a 50% smaller noise footprint than the airplanes it replaces. The jets also offer increased comfort and relaxation for passengers, with modern technologies, greater space and larger pivoting overhead storage bins.

Such remarkable features must have bolstered demand for this jet family over the past few years. The latest order for 40 737-8 jets is a bright example of that.

Notably, Dublin-based Avolon has been a much-valued customer for Boeing’s 737 program. It ordered 40 737-8 jets in June and, with the latest agreement, has fulfilled its commitment to purchase 80 new airplanes this year.

Prospects in Commercial Aviation Market

With the woes of the pandemic behind us and economies across the globe witnessing growth once again, the demand for air travel can be expected to continue to rise in the near future. To this end, per a report by the Mordor Intelligence firm, the Commercial Aviation market size is expected to go from $218.97 billion in 2023 to $271.96 billion by 2028, at a CAGR of 4.43%.

Such solid market growth prospects should aid Boeing, one of the biggest jet manufacturers in the world. Impressively, during third-quarter 2023, Boeing secured 398 net orders for commercial jets, including 150 737 MAX 10 airplanes for Ryanair, 50 787 airplanes for United Airlines and 39 787 airplanes for Saudi Arabian Airlines. The company delivered 105 airplanes and the backlog amounted to $392 billion. Such developments, along with the company’s latest agreement with Avolon, should increase Boeing’s profitability in the coming days.

Opportunities for Peers

Apart from Boeing, aircraft manufacturers in the commercial aviation industry that may gain from the flourishing market prospects are as follows:

Embraer ERJ: The company has a huge portfolio of commercial jets. During third-quarter 2023, Embraer’s E195-E2 jet, the largest in the E-Jet family, received Type Certification from the Civil Aviation Administration of China. On Nov 29, 2023, Embraer received an order for 25 E195-E2 passenger jets from Porter Airlines.

ERJ boasts a long-term earnings growth rate of 17%. The Zacks Consensus Estimate for 2023 sales implies an improvement of 21.3% from the 2022 reported figure.

Airbus EADSY: In the first nine months of 2023, Airbus delivered 488 commercial aircraft comprising 41 A220, 391 A320 Family, 20 A330 and 36 A350. In December 2023, Airbus received multiple orders - four A330-900 from Azul Linhas Aereas, 150 A321s and 70 A350 from Turkish Airlines, 100 A321neo from Avolon and A350F from Cathay Group.

EADSY boasts a long-term earnings growth rate of 12.4%. The Zacks Consensus Estimate for 2023 sales implies an improvement of 12.9% from the 2022 reported figure.

Textron TXT: Its Textron Aviation business segment’s principal market includes general aviation aircraft, business jets and commercial transportation. In October 2023, the company announced its agreement with Hahn Air, which is set to become the European launch customer for TXT’s Cessna Citation CJ3 Gen2. The aircraft is expected to be delivered in 2026.

TXT boasts a long-term earnings growth rate of 11.7%. The Zacks Consensus Estimate for 2023 sales implies an improvement of 6.4% from the 2022 reported figure.

Price Performance

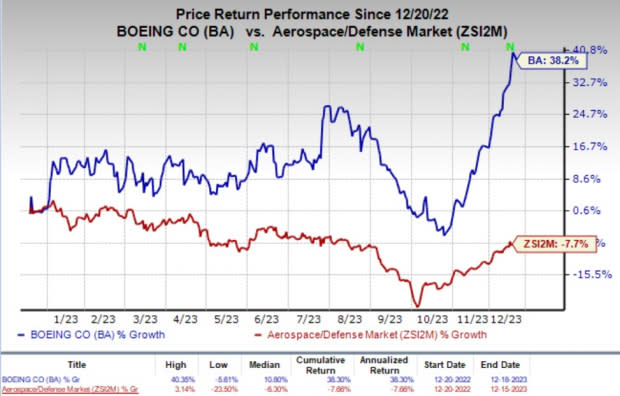

In the past year, shares of BA have rallied 38.2% against the industry’s 7.7% decline.

Image Source: Zacks Investment Research

Zacks Rank

Boeing currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Embraer-Empresa Brasileira de Aeronautica (ERJ) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance