BlackRock lists MSCI-tracking climate action ETF on SGX at record US$426 mil

At US$426 million ($579.45 million), the fund is the largest equity ETF launch in Singapore to-date.

BlackRock today listed the iShares MSCI Asia ex-Japan Climate Action ETF ICM on the Singapore Exchange (SGX) S68, with support from MSCI. At US$426 million ($579.45 million), the fund is the largest equity ETF launch in Singapore to-date and is anchored by Prudential and a consortium of investors including Temasek and Singlife.

According to BlackRock, the fund offers investors convenient access to best-in-class companies across Asia Pacific ex-Japan that are committed to reducing carbon emissions.

Priced with an annual management fee of 0.18%, the fund is built to track the MSCI Asia ex-Japan Climate Action Index, which provides exposure to the top 50% of companies in each Global Industry Classification Standard (GICS) sector, based on factors including approved science-based targets, management of climate risks and green business revenue, says BlackRock on Sept 14.

“For investors with low-carbon transition objectives, the fund opens access to pioneering companies at the forefront of the low-carbon transition,” says the world’s largest asset manager.

The fund is the third iShares ETF to track MSCI Climate Action Indexes, coming three months after launches in the US and Japan. The MSCI AC Asia ex-Japan Climate Action Index was launched on Oct 4, 2022.

According to an Aug 31 index factsheet, the index’s net returns were -6.26% over the prior month and 3.16% over three months.

Using data prior to the October 2022 launch, the index would have returned -20.47% in 2022 and -1.73% in 2021, following returns of 22.15% in 2020 and 18.90% in 2019.

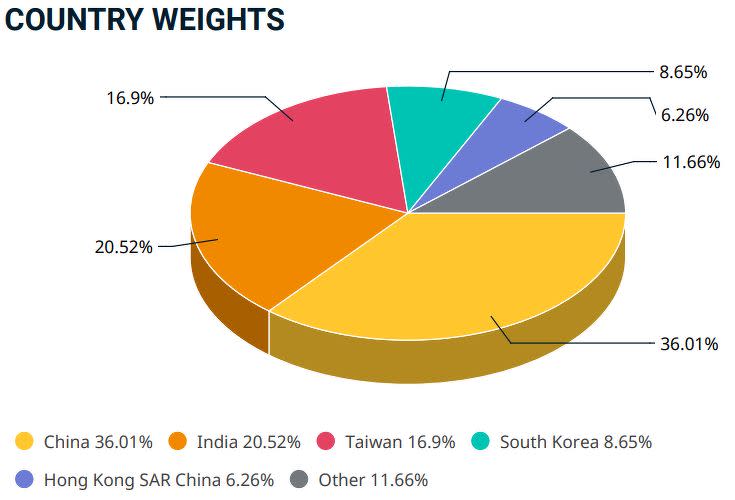

The index has 605 constituents, with an average weightage of 0.17%. DBS Group Holdings D05 is the only local stock among its top 10 constituents as at Aug 31, placing 10th with a weightage of 1.27%.

The top nine constituents, arranged in descending order, are Taiwan Semiconductor Manufacturing Company (TSMC), Alibaba Group Holding, Tencent Holdings, Reliance Industries, Meituan, Infosys, ICICI Bank, PDD Holdings Inc - ADR and Hong Kong Exchanges and Clearing.

Asia Pacific is the largest and fastest-growing region for energy transition investment, offering transformational opportunities for investors with climate-focused objectives, says Peter Loehnert, APAC head of iShares and index investments at BlackRock.

“This new ETF will provide them with an innovative, unique and powerful building block to access companies in the region leading the transition. As the world’s largest provider of ETFs, our aim is to offer clients an unrivalled choice of products to help them achieve their investment goals. We are pleased that our close partnership with SGX Group and MSCI has helped bring the fund to Singapore, a state that has had an outsized impact in global climate leadership,” adds Loehnert.

Climate change has emerged as a critical investment risk factor, and the decarbonisation of investment portfolios is an important first step, says Douglas Walls, head of index and analytics business for APAC at MSCI.

“The MSCI Climate Action Indexes are designed to represent the performance of companies that have been assessed to lead their sector peers in terms of their positioning and actions relative to a climate transition,” says Walls. “This industry has a key role to play in reaching net zero, and MSCI is proud to do our part in making innovative climate tools more widely available.”

SGX Group plays a vital role in galvanising stakeholders to mobilise capital and develop solutions to address climate change, says Michael Syn, senior managing director and head of equities at SGX Group.

“With the market and investors signalling their readiness for it, we have been working in partnership with BlackRock and MSCI to create a new global ecosystem of climate-related instruments such as this ETF and the climate action derivatives that were launched earlier this year,” says Syn. “By providing these tools, we are supporting investors in building a diversified portfolio of climate-conscious assets, enabling them to do their part for the transition while benefiting from the potential financial upside.”

Demand for the ETF is set to be bolstered by strong investor appetite with Asia Pacific being the largest and fastest growing region for energy transition investment. According to London-based research firm ETFGI, the Asia Pacific ex-Japan ETF market reported year-to-date net inflows of nearly US$44.2 billion as of end June, the second-highest on record.

Gillian Tan, assistant managing director (development and international) and chief sustainability officer at the Monetary Authority of Singapore, says the ETF adds to the suite of “innovative products” in Singapore that supports transition and decarbonisation efforts in Asia. “Looking ahead, Singapore welcomes the development of solutions that facilitate decarbonisation, while meeting the investment and risk management needs of issuers, asset owners and investors in the region.”

Kyung-Ah Park, head, ESG investment management and managing director, sustainability, Temasek, says: “As a sustainability-focused long-term investor, we are committed to catalysing the transition of the real economy and accelerating pathways towards net zero in line with climate science.”

Park adds: “The launch of more climate-aligned products. such as the iShares MSCI Asia ex-Japan Climate Action ETF. leverages Singapore’s financial hub infrastructure to provide investors with expanded opportunities to support companies committed to reducing their carbon emissions and contributes to the broader low carbon market ecosystem.”

Infographics: MSCI

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

SGX Group announces new structure to increase growth opportunities

MSCI launches sustainability institute, led by former ESG, climate research head

The Edge Singapore wins The Hidden Gem at SGX Orb Awards for the fourth consecutive year

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance