Bitcoin: Time to Buy the Dip?

Every so often, there is a monumental moment in a field that changes it dramatically and forever. For instance, in the sports world, Caitlin Clark’s ability to make long-distance three-point shots accurately has changed women’s basketball meteorically. The mass excitement generated by Caitlin Clark and her main rival Angel Reese has led to the highest attendance numbers on record and roughly half the games selling out in the once mocked and underappreciated Woman’s National Basketball Association (WNBA).

Is Bitcoin at a similar moment?

Bitcoin: The Decade’s Top Performing Asset

Bitcoin has morphed into a decade’s long “overnight success” in financial markets. Like Clark, Bitcoin has unique attributes that have led to its undeniable success, such as its:

Deflationary Monetary Policy: There will never be more than 21 million Bitcoin.

Decentralized Protocol: Because Bitcoin is not government-issued, users do not have to worry about censorship or government intervention. Also, Bitcoin holders do not have to rely on third parties like banks to store their Bitcoin.

Global and Digital Network: A global and digital currency makes international remittances simpler and opens up the crypto world to anyone interested in participating.

Bitcoin’s performance over the past decade proves that the world was hungry for a decentralized digital asset. Since 2011, Bitcoin has gained a mind-boggling 21,372,237%, equating to an annualized return of 148.9% (data via @charliebilello).

Bear Market or Temporary Dip?

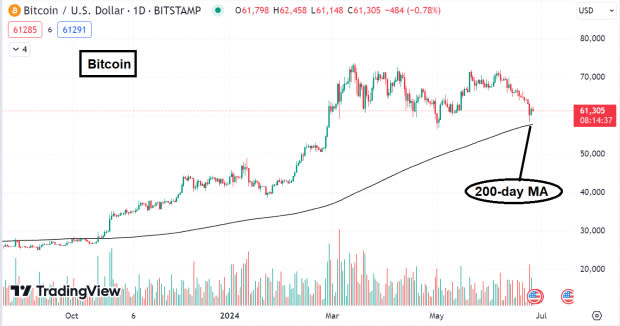

Despite Bitcoin’s long-term performance, it has dropped from over $70,000 to $60,000 over the past few days. Is the weakness the start of a bear market or a buy-the-dip opportunity for bulls to sink their teeth into?

Five reasons the Bitcoin weakness will be short-lived:

1. 200-day Moving Average Looms: Bitcoin is retreating to its 200-day moving average for the first time since late 2023. After a long rally and a subsequent retreat, buyers typically will defend the 200-day.

Image Source: TradingView

2. Mt. Gox Supply Shock to be Short-lived: In 2010, Mt. Gox was the largest crypto exchange in the world and was responsible for 70% of Bitcoin transactions worldwide. However, a massive hack led to the loss of thousands of Bitcoins and the abrupt shutdown and bankruptcy of the exchange in 2014. Despite the massive losses, some of the Bitcoin was “found” and is being distributed to victims of the hack. The repayment of Bitcoin is causing short-term selling pressure but the weakness is likely to be temporary and will subside over time.

3. Political and Regulatory Winds are Changing: Both leading presidential candidates have evolved their crypto stance from anti-crypto to pro-crypto over the last few months. Whether the change in rhetoric is to simply court the crypto vote, the dramatic change is worth noting and is bullish for the industry. Meanwhile, Donald Trump is reportedly in talks to speak at the Bitcoin 2024 convention in July.

4. Lower Interest Rates Expected: The CME FedWatch Tool gives a 76% probability of a rate cut in November and a 93% chance of an ease in December. Lower interest rates are typically bullish for “risk on” assets like Bitcoin.

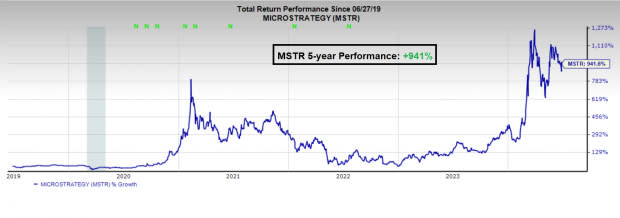

5. Bitcoin on the Balance Sheet: MicroStrategy (MSTR) was the first public company to add Bitcoin to its balance sheet, and the results have been spectacular. Shares are up nearly 1,000% over the past five years.

Image Source: Zacks Investment Research

Meanwhile,Semler Scientific (SMLR) recently announced that it will add Bitcoin to its balance sheet and started with a $40 million purchase. Finally, Michael Dell recently made headlines after he retweeted positive Bitcoin comments. Could Dell Technologies (DELL) be next? Either way, Bitcoin proxies like Coinbase (COIN), Marathon Digital (MARA), and Hut 8 (HUT) should benefit.

Bottom Line

Bitcoin’s weakness is likely to be short-lived due to temporary headwinds like the Mt. Gox supply shock. A purchase near the 200-day MA offers investors an asymmetric reward-to-risk opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Marathon Digital Holdings, Inc. (MARA) : Free Stock Analysis Report

Semler Scientific Inc. (SMLR): Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

Hut 8 Corp. (HUT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance