Bitcoin and Ethereum – Weekly Technical Analysis – December 13th, 2021

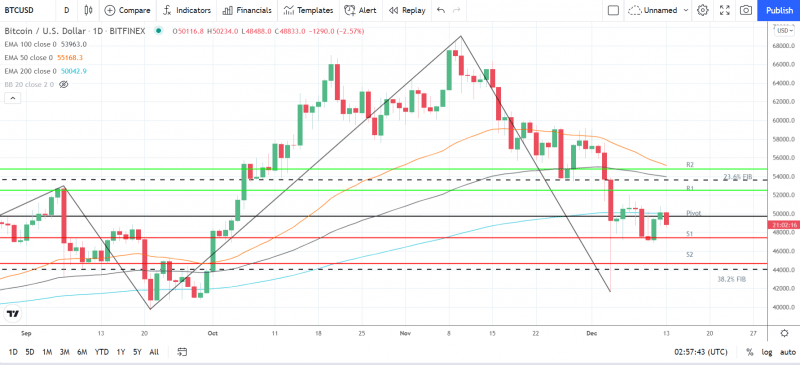

Bitcoin (BTC)

Bitcoin, BTC to USD, rose by 1.31% in the week ending 12th December. Partially reversing a 13.70% slide from the week prior, Bitcoin ended the week at $50,123.

A mixed start to the week saw Bitcoin rise to Tuesday intraweek high $51,970 before hitting reverse. Falling well short of the first major resistance level at $58,554, Bitcoin tumbled to a Saturday intraweek low $46,872.

Steering clear of the first major support level at $41,014, however, Bitcoin found weekend support to wrap up the week at $50,100 levels.

4-days in the green that included a 4.70% rally on Saturday delivered the upside.

At the time of writing, Bitcoin was down by 1.02% to $48,968. A mixed start to the week saw Bitcoin rise to an early Monday morning high $50,234 before falling to a low $48,488.

Bitcoin left the major support and resistance levels untested early on.

For the week ahead

Bitcoin would need to move back through the $49,655 pivot to bring the first major resistance level at $52,431 into play. Support from the broader market would be needed for Bitcoin to break out from last week’s high $51,970. Barring an extended crypto rally, the first major resistance level and the 23.6% FIB of $53,628 would likely cap any upside.

In the event of a breakout, Bitcoin could test resistance at $55,000 before any pullback. The second major resistance level sits at $54,753.

Failure to back move through the $49,655 pivot would bring the first major support level at $47,340 into play. Barring another extended sell-off, Bitcoin should avoid the second major support level at $44,557 and the 38.2% FIB of $44,144.

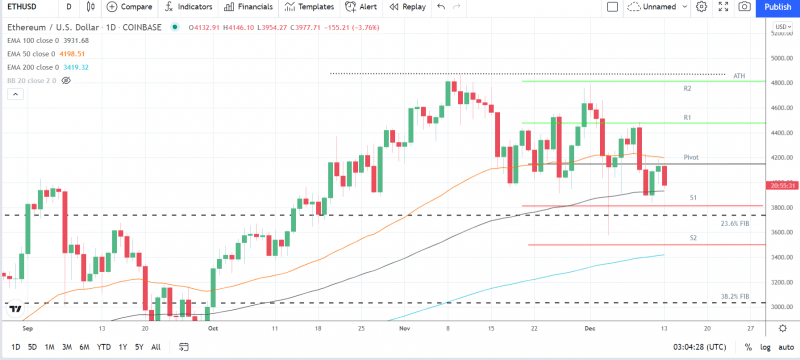

Ethereum (ETH)

Ethereum fell by 1.67% in the week ending 12th December. Following a 2.21% decline from the previous week, Ethereum ended the week at $4,203.

After a choppy start to the week, Ethereum rose to a Thursday intraweek high $4,491 before hitting reverse. Falling short of the first major resistance level at $4,800, Ethereum slid to a Saturday intraweek low $3,835.

Steering clear of the first major support level at $3,590, however, Ethereum broke back through to $4,100 levels to reduce the deficit.

3-days in the red that included a 7.53% sell-off on Thursday delivered the downside in the week.

At the time of writing, Ethereum was down by 3.76% to $3,978. A mixed start to the week saw Ethereum rise to an early Monday morning high $4,146 before falling to a low $3,954.

Ethereum left the major support and resistance levels untested early on.

For the week ahead

Ethereum would need to move through the $4,153 pivot level to bring the first major resistance level at $4,471 into play.

Support from the broader market would be needed, however, for Ethereum to break back through to $4,400 levels.

Barring an extended crypto rally, the first major resistance level and last week’s high $4,491 would likely cap any upside.

In the event of another extended breakout, Ethereum could test resistance at $5,000 before any pullback. The second major resistance level sits at $4,809. Ethereum would need plenty of support, however, to breakout from its ATH $4,868.

Failure to move through the $4,153 pivot would bring the first major support level at $3,815 and the 23.6% FIB of $3,738 into play. Barring an extended sell-off, however, Ethereum should steer clear of the second major support level at $3,497.

This article was originally posted on FX Empire

More From FXEMPIRE:

USD/JPY Forex Technical Analysis – Looking for Retest of Major Retracement Zone at 113.173 – 112.619

Economic Data Puts the EUR in Focus ahead of the ECB Policy Decision on Thursday

Pickup in German Wholesale Inflation Fails to Deliver EUR Support

Earnings Week Ahead: Lennar, Adobe, FedEx, Darden Restaurants and Fed’s Policy in Focus

Growing Crypto Scams in South Africa Forces Regulators to Act

Yahoo Finance

Yahoo Finance