Bitcoin ETFs See $65M Net Outflows on Monday, Breaking 19-Day Record Streak

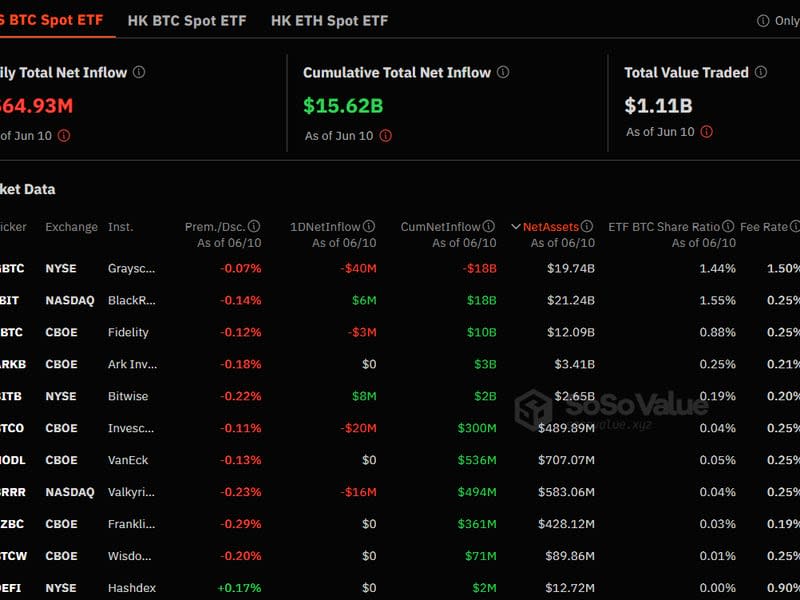

The 19-day streak of net inflows for U.S.-listed spot bitcoin exchange-traded funds (ETFs) ended on Monday with a combined $65 million in net outflows.

Grayscale’s GBTC led the outflows with $40 million, continuing its trend as the worst-performing ETF by outflows since going live in January.

A record 19-day streak of net inflows in U.S.-listed spot bitcoin exchange-traded funds (ETFs) ended Monday as the products saw a combined $65 million in net outflows, preliminary data shows.

Bitcoin ETF Flow (US$ million) - 2024-06-10

TOTAL NET FLOW: -64.9

(Provisional data)

IBIT: 6.3

FBTC: -3

BITB: 7.6

ARKB: 0

BTCO: -20.5

EZBC: 0

BRRR: -15.8

HODL: 0

BTCW: 0

GBTC: -39.5

DEFI: 0

For all the data & disclaimers visit:https://t.co/4ISlrCgZdk— Farside Investors (@FarsideUK) June 11, 2024

Grayscale’s GBTC led outflows among its counterparts at $40 million. GBTC continues its infamous run of being the worst-performing ETF by outflows since going live in January, racking up a cumulative $18 billion in outflows.

Invesco and Galaxy Digital’s BITCO saw net outflows of $20 million. Valkyrie's BRRR ETF racked net outflows of $16 million. Fidelity's FBTC saw $3 million in net outflows in its first negative flow since early May, The Block reported.

The ETFs last reported a net outflow of $84 million on May 10 after a dismal month in April that saw weeks of outflows. Inflows since picked up and saw the products add more than $4 billion in 19 days of trading.

Such outflows came amid a market-wide slide in the cryptocurrency market and losses in broader stock markets. Traders on Monday warned of a volatile week ahead of a week as investors await a U.S. CPI reading on Wednesday and U.S. treasury secretary Janet Yellen’s speech scheduled on Friday – which can cause a reaction in riskier assets such as cryptocurrencies.

The Fed’s monetary policy is also to be decided at a two-day Federal Open Market Committee (FOMC) meeting starting today, which may further add to market uncertainty based on comments.

Bitcoin has been down 2.7% in the past 24 hours, reversing gains from last week when it briefly traded over a two-month high of $70,000.

CORRECTION (June 11, 10:57 UTC): Corrects date of FOMC meeting in penultimate paragraph.

Yahoo Finance

Yahoo Finance