Biotech Stock Roundup: GSK, CVAC Revise Agreement, Updates From MRNA, RNAC & More

It was a regular week for the biotech sector with quite a few important pipeline and regulatory updates. Among these, GSK plc GSK and CureVac N.V. CVAC were in the spotlight as the companies restructured their existing collaboration agreement into a new licensing agreement.

Recap of the Week’s Most Important Stories:

GSK, CVAC Restructure Agreement: GSK and CureVac announced a restructuring of their existing collaboration into a new licensing agreement. Both companies collaborated in 2020 to develop mRNA vaccines for infectious diseases. GSK and CVAC currently have vaccine candidates for seasonal influenza and COVID-19 in phase II, and avian influenza in phase I development.

Per the terms of the new agreement, GSK will assume full control of developing and manufacturing mRNA candidate vaccines for influenza and COVID-19, along with commercialization rights. Meanwhile, CureVac will receive an upfront payment of €400 million and up to an additional €1.05 billion in development, regulatory and sales milestones and tiered royalties in the high single to low teens range. CVAC also retains exclusive rights to the additional undisclosed and preclinically validated infectious disease targets from the prior collaboration. In addition, CureVaC has the liberty to independently develop and partner mRNA vaccines in any other infectious disease or other indication.

Setback for Rocket: Rocket Pharmaceuticals RCKT announced that the FDA has issued a complete response letter (CRL) to its biologics license application (BLA) seeking approval for its gene therapy Kresladi (marnetegragene autotemcel) to treat patients with severe leukocyte adhesion deficiency-I (LAD-I). The regulatory body asked for ‘limited’ additional information on the therapy’s Chemistry Manufacturing and Controls (CMC), which is a part of the BLA submission. Rocket claims that it has already met the agency officials to align on the scope of the additional CMC data requested so it can move quickly toward a potential approval.

This is the second time that the FDA has requested additional information from the company on Kresladi’s CMC. Earlier this February, the FDA extended the review period of the Kresladi BLA by an additional three months to June 2024 to review the CMC information submitted by Rocket in response to the agency’s request.

BARDA Funding for Moderna: Moderna MRNA announced that the Biomedical Advanced Research and Development Authority (“BARDA”) has awarded $176 million to the company to accelerate the development of mRNA-based pandemic influenza vaccines. The funding will boost late-stage development of an mRNA-based vaccine program aimed at preventing the spread of the H5N1 virus, also known as bird flu, in humans.

Moderna plans to use the above funds to support the late-stage development of mRNA-1018, its investigational pandemic influenza vaccine against H5 and H7 avian influenza viruses. The deal with BARDA also includes options for large-scale production and pandemic response. Currently, mRNA-1018 is being evaluated in an ongoing phase I/II study in healthy adults aged 18 years and older. While data from this study is expected later this year, management intends to provide an update on its late-stage plans soon.

Moderna currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Updates From RNAC: Cartesian Therapeutics, Inc. RNAC announced positive top-line results from its phase IIb study evaluating lead candidate Descartes-08 in patients with generalized myasthenia gravis (MG), an autoimmune disease associated with muscle weakness.

A total of 36 heavily pre-treated, highly symptomatic MG patients were randomized equally to receive either Descartes-08 or placebo, administered as six weekly outpatient infusions without preconditioning chemotherapy in this phase IIb double-blind, placebo-controlled, crossover study. Patients receiving placebo were eligible to cross over to Descartes-08 treatment at the conclusion of the trial’s blinded follow-up assessment after three months. The study achieved its primary endpoint with statistical significance in the pre-specified modified intent-to-treat efficacy population. Results showed 71% of MG patients treated with Descartes-08 had 5-point or greater improvements in MG Composite score at month three compared to only 25% treated with placebo.

Moreover, Descartes-08 responders experienced deep improvements across the MG severity scales at month three. The safety profile of the candidate continues to support outpatient administration. Cartesian expects to hold an end-of-phase II meeting with the FDA by year-end.

Descartes-08 is also being evaluated for systematic lupus erythematosus (SLE). Cartesian also announced the dosing of the first patient in its mid-stage open-label study evaluating Descartes-08 in patients with SLE.

Despite the positive results from the MG study, shares of RNAC plunged. This can likely be attributed to the company’s announcement of a $130-million private placement equity financing through the sale of shares priced at $20 each.

The net proceeds from this financing, together with the existing cash, cash equivalents, and marketable securities, should enable the company to fund its pipeline programs for Descartes-08 and general corporate purposes and working capital.

Performance

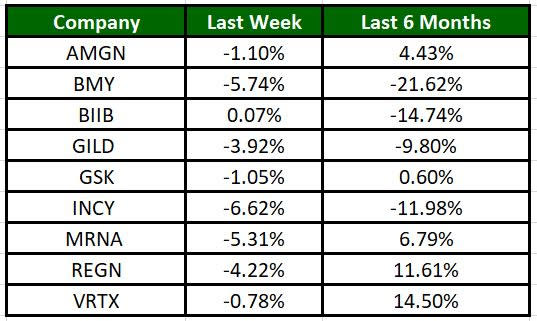

The Nasdaq Biotechnology Index has lost 2.09% in the past four trading sessions, and Incyte’s shares have risen 6.62% during the same time frame. In the past six months, shares of VRTX have rallied 14.50%. (See the last biotech stock roundup here: Biotech Stock Roundup: ALNY Up on Study Success, ALIM on Merger News & Other Updates)

Image Source: Zacks Investment Research

What's Next in Biotech?

Stay tuned for more pipeline updates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Moderna, Inc. (MRNA) : Free Stock Analysis Report

Rocket Pharmaceuticals, Inc. (RCKT) : Free Stock Analysis Report

CureVac N.V. (CVAC) : Free Stock Analysis Report

Cartesian Therapeutics, Inc. (RNAC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance