Biotage And Two Other Swedish Exchange Stocks Estimated As Undervalued

Amidst a backdrop of fluctuating global markets, Sweden's economic landscape presents unique opportunities for investors seeking value. As various sectors experience shifts influenced by broader economic events, identifying undervalued stocks becomes crucial for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

Name | Current Price | Fair Value (Est) | Discount (Est) |

RVRC Holding (OM:RVRC) | SEK44.96 | SEK87.59 | 48.7% |

Nordic Waterproofing Holding (OM:NWG) | SEK160.60 | SEK308.08 | 47.9% |

Lindab International (OM:LIAB) | SEK225.60 | SEK425.34 | 47% |

Dometic Group (OM:DOM) | SEK67.00 | SEK129.38 | 48.2% |

edyoutec (NGM:EDYOU) | SEK0.57 | SEK1.06 | 46.3% |

Stille (OM:STIL) | SEK205.00 | SEK395.12 | 48.1% |

Biotage (OM:BIOT) | SEK168.10 | SEK318.73 | 47.3% |

Flexion Mobile (OM:FLEXM) | SEK8.16 | SEK16.03 | 49.1% |

Hexatronic Group (OM:HTRO) | SEK55.06 | SEK106.39 | 48.2% |

Sinch (OM:SINCH) | SEK23.73 | SEK43.73 | 45.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Biotage

Overview: Biotage AB (publ) specializes in solutions and products for drug discovery and development, analytical testing, as well as water and environmental testing, with a market capitalization of SEK 13.45 billion.

Operations: The company generates SEK 1.98 billion in revenue from its healthcare software segment.

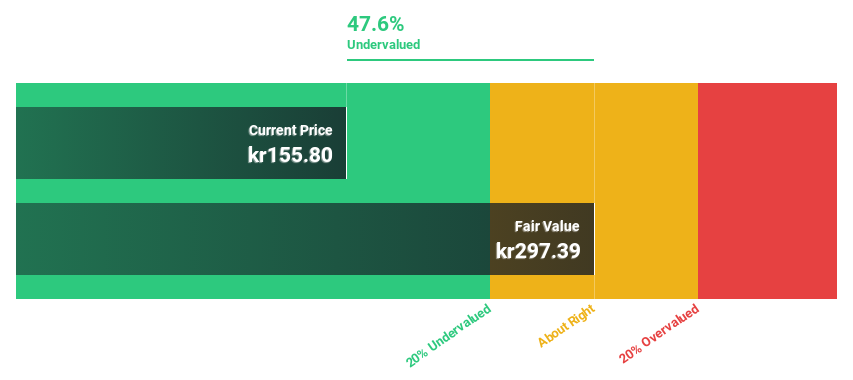

Estimated Discount To Fair Value: 47.3%

Biotage, priced at SEK 168.1, is substantially undervalued based on discounted cash flow analysis, with an estimated fair value of SEK 318.73, indicating a potential underpricing of 47.3%. Despite a recent dip in net income and earnings per share as reported in Q1 2024 results—SEK 33 million and SEK 0.42 respectively—Biotage's future looks promising with expected annual earnings growth of about 20% over the next three years, outpacing the Swedish market's forecasted growth. Additionally, its revenue growth projection stands at a robust 11.2% annually.

Xvivo Perfusion

Overview: Xvivo Perfusion AB is a Swedish medical technology company that specializes in developing and marketing machines and solutions for evaluating and preserving transplantable organs, operating globally with a market capitalization of SEK 13.15 billion.

Operations: The company generates revenue through three primary segments: Services (SEK 81.13 million), Thoracic (SEK 414.34 million), and Abdominal (SEK 147.49 million).

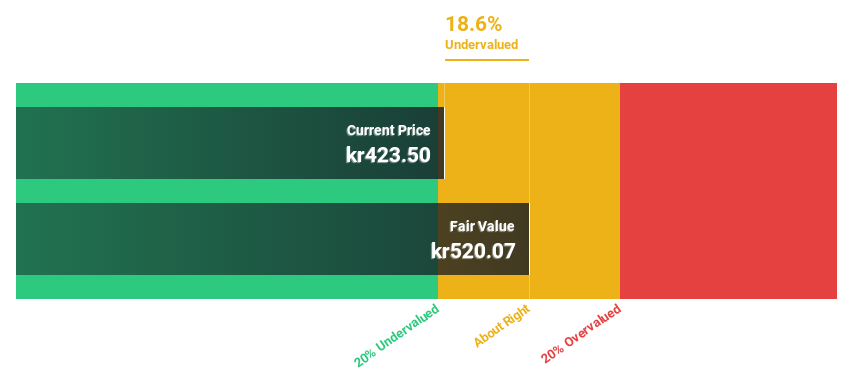

Estimated Discount To Fair Value: 27.6%

Xvivo Perfusion, with a recent sales increase to SEK 186.02 million and net income rising to SEK 22.79 million in Q1 2024, demonstrates robust financial health. The company's stock, currently valued at SEK 417.5, is considered undervalued by more than 20%, with a fair value estimated at SEK 576.4 based on discounted cash flow analysis. Despite a low forecasted return on equity of 8.6% in three years, Xvivo shows significant promise with expected earnings growth of approximately 36% annually over the same period, substantially outpacing the Swedish market's growth projections.

Yubico

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services, with a market capitalization of SEK 20.75 billion.

Operations: The company generates revenue primarily from its Security Software & Services segment, totaling SEK 1.93 billion.

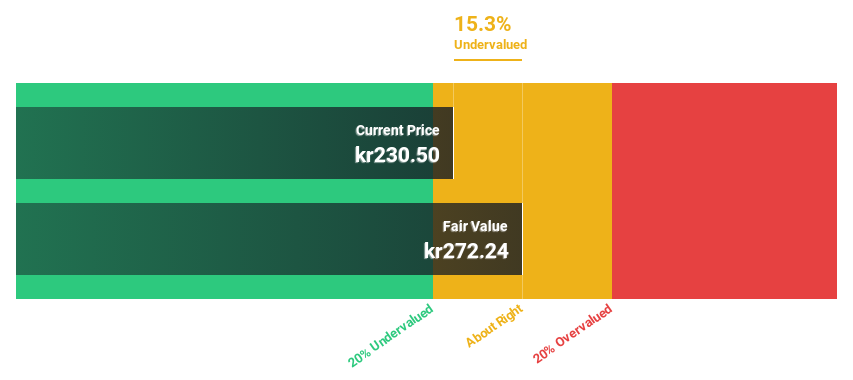

Estimated Discount To Fair Value: 18.4%

Yubico, priced at SEK 241, trades below its fair value of SEK 295.21, reflecting a modest undervaluation based on cash flows. Despite substantial shareholder dilution last year and lower profit margins (8.6% this year from 16.9% previously), the company shows strong growth potential with earnings expected to increase by 43.8% annually over the next three years—significantly outpacing the Swedish market's forecast of 14.7%. However, Yubico has less than three years of financial data available, which may limit detailed long-term analysis.

The analysis detailed in our Yubico growth report hints at robust future financial performance.

Click here to discover the nuances of Yubico with our detailed financial health report.

Make It Happen

Delve into our full catalog of 44 Undervalued Swedish Stocks Based On Cash Flows here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BIOT OM:XVIVO and OM:YUBICO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance