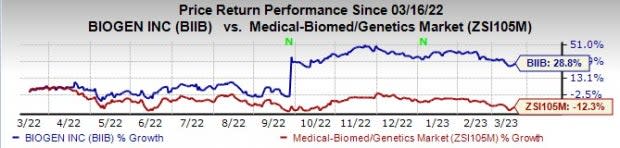

Biogen (BIIB) Up 29% in a Year Despite Multiple Challenges

Biogen’s BIIB stock has risen 28.8% in the past year against a decrease of 12.3% for the industry.

Image Source: Zacks Investment Research

Biogen is facing multiple challenges. Most of its key drugs are facing declining sales. Biogen’s multiple sclerosis (MS) revenues have been declining for the past few quarters. Importantly, sales of its key MS drug Tecfidera are declining, hurt by the launch of multiple generic products in the United States. New generic launches are ongoing in several EU countries. In 2023, Tecfidera revenues are expected to continue to decline as a result of increasing generic competition.

Regulatory applications seeking approval for a biosimilar referencing another MS drug, Tysabri have been filed in both the United States and Europe. A biosimilar could be launched upon approval in both the United States and EU in 2023, which can hurt sales.

Overall, the competitive landscape remains challenging for Biogen’s MS products with newer, competitive entrants.

Sales of Biogen’s spinal muscular atrophy (“SMA”) treatment, Spinraza are being hurt due to a decrease in demand as a result of increased competition, exacerbated by the impact of COVID-19 in 2020/2021

Biogen’s new Alzheimer’s drug, Aduhelm, approved by the FDA in June 2021, failed to generate meaningful sales. After the Centers for Medicare & Medicaid Services denied all Medicare beneficiaries access to Aduhelm, in its final NCD decision, Biogen decided to substantially wind down commercial operations of Aduhelm, retaining only minimal resources to manage patients’ access programs.

Meanwhile, pricing pressure and currency headwinds are hurting sales of Biogen’s biosimilar products. Also, revenues from Biogen’s share of profit from Roche’s drugs, Rituxan and Gazyva declined due to biosimilar competition.

Despite all these challenges, we are hopeful that the potential new product launches such as Leqembi (already approved) for Alzheimer’s disease and zuranolone for depression can help revive growth.

Biogen has a collaboration agreement with Sage Therapeutics SAGE to co-develop zuranolone in depression and movement disorders. Biogen and Sage Therapeutics’ zuranolone, a rapid-acting, once-daily, oral treatment, is under priority review in the United States (PDUFA action date of Aug 5, 2023) for the treatment of both major depressive disorder and postpartum depression. Last month, Biogen and Sage announced that the FDA has informed them that it does not currently plan to convene an advisory committee meeting to discuss the NDA for zuranolone.

A key driver of the stock price was FDA’s accelerated approval for Biogen and partner Eisai’s Leqembi (lecanemab), an anti-amyloid beta protofibril antibody drug, in January to treat early Alzheimer’s disease (early AD).

Eisai submitted a supplemental biologics license application (sBLA) to the FDA for traditional approval of Leqembi the same day it received the accelerated approval.

The sBLA was based on data from the large phase III confirmatory study, Clarity AD, on lecanemab, which showed that treatment with lecanemab in the early stages of the disease reduced the rate of clinical decline on the CDR-SB scale by 27% compared to placebo. The FDA will study the Clarity AD data to determine whether to convert the accelerated approval of Leqembi to a traditional approval

Eisai’s marketing authorization applications for lecanemab are also under review in Japan, China and EU.

Biogen expects Leqembi to generate “modest in-market revenue” in 2023 though costs to market the drug will exceed revenues. The drug is not expected to contribute much to revenues until the CMS grants reimbursement for the drug under Medicare plans, which is expected to happen once Leqembi gets traditional approval. If reimbursed, Leqembi has the potential to generate blockbuster sales.

Following the failure of Aduhelm, Biogen announced a set of near-term operational priorities to drive renewed growth and value creation over time. The initiatives are expected to result in significant cost savings annually. The savings are expected to be invested in strategic initiatives over time.

Also, sales of Spinraza are expected to improve in 2023. Biogen is seeing some signs of stabilization in patient use in the United States.

Zacks Rank & Stocks to Consider

Biogen has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked biotechs are Ligand Pharmaceuticals LGND and CRISPR Therapeutics CRSP. While Ligand Pharmaceuticals has a Zacks Rank of 1, CRISPR Therapeutics has a Zacks Rank #2 (Buy).

Estimates for Ligand Pharmaceuticals’ 2024 earnings per share have increased from $3.07 to $3.10 over the past 90 days. Ligand Pharmaceuticals’ stock has declined 34% in the past year.

Ligand Pharmaceuticals beat earnings expectations in one of the trailing four quarters. The company delivered a four-quarter negative earnings surprise of 10.07%, on average.

Loss estimates for 2023 for CRISPR Therapeutics have narrowed from $8.21 per share to $7.54 per share over the past 90 days. CRISPR Therapeutics stock has lost 31.5% in the past year.

CRISPR Therapeutics beat earnings expectations in two of the four trailing four quarters while missing in the other two. The company delivered a four-quarter earnings surprise of 3.19%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Sage Therapeutics, Inc. (SAGE) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance