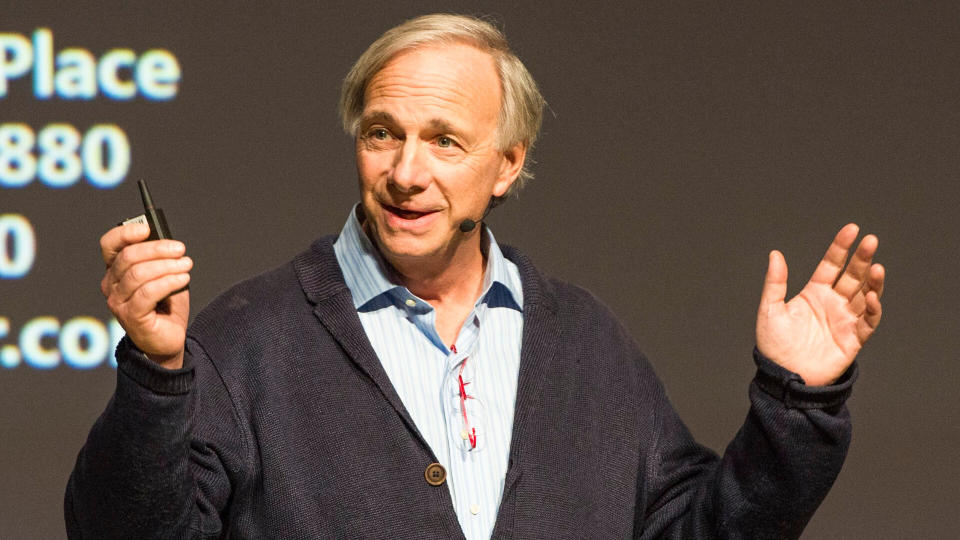

Billionaire Ray Dalio: The Investment Mistake That Could Leave You Broke

Ray Dalio is the billionaire founder of the world’s largest hedge fund. While perhaps not a household name to the degree of Warren Buffett, Dalio is greatly respected within the industry, and when he speaks, investors in the know listen.

Grant Cardone Says Passive Income Is the Key To Building Wealth: Here’s His No. 1 Way To Get It

Learn: 3 Things You Must Do When Your Savings Reach $50,000

In a conversation with CNBC in 2018, Dalio outlined a number of mistakes that investors tend to make, including highlighting what he believed to be the No. 1 miscalculation. Here are the main points that Dalio was trying to stress to investors during both that interview and through subsequent comments.

Dave Ramsey used these four investment rules to build his wealth.

The Single Biggest Mistake That Investors Make

Dalio said the biggest mistake investors make is falling prey to recency bias. When markets are doing well, investors tend to feel like that trend will continue, and so they buy into the market and feel complacent.

However, Dalio said that view is all wrong, saying that investors tend to look at that environment as an all-clear signal rather than viewing the market as being more expensive. The opposite is also true, with investors thinking that down markets are bad markets that they don’t want any part of, rather than viewing it as a time to scoop up inexpensive shares.

Dalio said this recency bias is tied to investors tending to overlook the cyclical nature of markets. Major, secular trends are a historical reality in the market. The Great Depression preceded the boom of the 1950s, and the 2008 housing market collapse, which took the stock market down with it, was followed by the longest-running bull market in history.

I’m a Self-Made Millionaire: These Are the 6 Investments Everyone Should Make During an Economic Downturn

What Investors Have To Do

For investors to succeed, Dalio suggested, they need to both identify bubbles and have the courage to make counter-cyclical investment moves. Tying back to the cyclical nature of the markets, Dalio said investors need to identify when the market is booming and understand that a bust period is all but inevitable at some point.

This in turn leads to Dalio’s next suggestion of investing counter-cyclically. His specific advice was to “do the opposite of most people, which is to sell in bubbles and buy in busts.”

This obviously takes some discipline and the ability to avoid trading on emotions, but it’s also likely part of the reason that Dalio is a billionaire.

The Importance of Asset Diversification

In addition to counter-trend investing, Dalio also stressed the importance of diversification for individual investors, particularly in troubling times.

In September 2023, Dalio spoke at the Milken Institute Asia Summit in Singapore and noted, “I would like to have diversification, because what I don’t know is going to be much greater than what I do know.”

If one of the most connected, successful and wealthiest investors — who has access to a vast array of resources, knowledge and information — says there are more things he won’t know than he will, that means diversification is absolutely critical for the average investor.

Dalio also said, “Diversification can reduce your risk without reducing your return, if you know how to do it well.”

Lowering risk without reducing return is the holy grail of investing, so Dalio is suggesting that investors would be making a mistake by avoiding diversification.

Watch Out for Disruption

On a more specific level, Dalio said it would be a mistake to overlook the coming disruptions in the world, particularly on the artificial intelligence front.

As he told CNBC, “Pay attention to the implications of the great disruptions that are going to take place because the world will be radically different in five years. And it’s going to become radically different year by year.”

But Dalio said it might be a mistake to invest in those companies that are developing artificial intelligence, preferring instead those who adopt this technology.

“It’s like going through a time warp,” Dalio said. “We’re going to be in a different world. And the disruptors will be disrupted. I don’t need to pick those who are creating the new technologies. I need to really pick those who are using the new technologies in the best possible way.”

Historically speaking, Dalio is likely right. Oftentimes, “first movers” in technology fall by the wayside, as other companies pick up on the technology and leverage it in profitable ways.

Meanwhile, the original companies, who had to spend all the research and development dollars, aren’t able to capitalize quite as deftly. Plus, it can be hard to pick which companies in a rapidly developing field will be the winners and which will be the losers. A company that simply uses the technology in a profitable manner, on the other hand, carries much less risk.

Bottom Line

Dalio is the billionaire manager of a hedge fund, so his investment style and philosophy might not apply to every small investor. But the investment mistakes he discusses, and the reasons behind them, do have merit — even at the micro level. If you want to help protect your investment dollars, it pays to consider the lessons Dalio’s trying to teach.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Billionaire Ray Dalio: The Investment Mistake That Could Leave You Broke

Yahoo Finance

Yahoo Finance