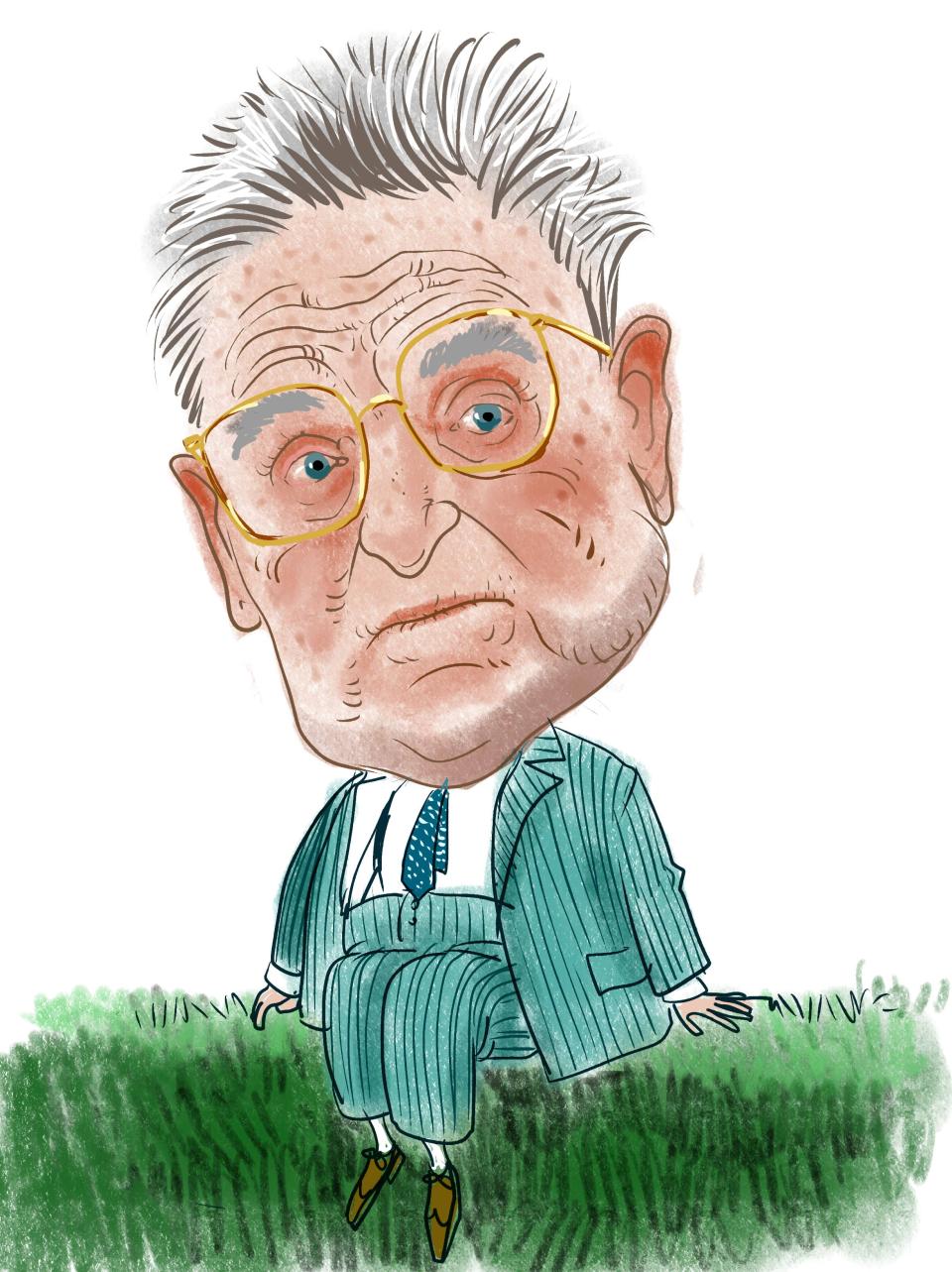

Here’s Billionaire George Soros’s Favorite Weight Loss Stock

We recently published a list of 9 Best Stocks to Buy in 2024 According to Billionaire George Soros. Since Novo Nordisk A S (NYSE:NVO) ranks 3rd in the list, it deserves a deeper look.

Billionaire George Soros has been one of the most active and divisive figures in the Wall Street. Often a right-wing target, the billionaire handed over the control of his $25 billion empire to his son Alexander Soros last year. The 93 year-old Hungarian American is known as the philosopher investor in the Wall Street, mainly due to his contributions to philosophy and his deep desire to leave his mark in the world of philosophy, which many believe he fulfilled thanks to his General Theory of Reflexivity for capital markets.

George Soros founded Soros Fund Management in 1970. Since its inception through 2010, the fund posted on average a 20% annual rate of return. A Wall Street Journal report earlier this year said that Soros Fund Management has posted a compound annual return of 13.5% over the past three years through June 30, 2023.

READ NEXT: Billionaire Paul Tudor Jones’ Top Dividend Picks and Analysts Are Upgrading These AI Stocks

George Soros in his book The New Paradigm of Financial Markets wrote a chapter titled “Autobiography of a Failed Philosopher” in which he talked in detail about how many, including his son and his biographer, started accepting the idea that Soros was a failed philosopher. Soros talks in detail about his childhood, his relationship with his father who at one point, according to Soros, lost all ambition in life and did not amass any wealth. A Jew by birth, Soros decided to come to the UK after the Nazi occupation of Hungary. Soros’ first interactions with philosophy started when he was impressed by the works of Karl Popper. But Soros’ dreams of creating a career in philosophy could not realize for several reasons, some of which he talks about in his book:

“I would have preferred to stay within the safe walls of academe—I even had a teaching assistant job prospect at the University of Michigan in Kalamazoo, but my grades were not good enough, and I was forced to go out into the real world. After several false starts, I ended up working as an arbitrage trader, first in London and then in New York.* At first I had to forget everything I had learned as a student in order to hold down my job, but eventually my college education came in very useful. In particular, I could apply my theory of reflexivity to establish a disequilibrium scenario or boom-bust pattern for financial markets. The rewarding part came when markets entered what I called far-from-equilibrium territory because that is when the generally accepted equilibrium models broke down.”

For this article we scanned Billionaire Soros’s Soros Fund Management’s Q1 portfolio and chose its top 9 stock picks. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

Novo Nordisk A S (NYSE:NVO)

Billionaire George Soros’s Q1’2024 Stake Value: $102,413,894

It seems billionaire George Soros’s fund went bearish on Novo Nordisk A S (NYSE:NVO) during the first quarter as the fund cut its stake in Novo Nordisk A S (NYSE:NVO) by 49%, ending the period with a $102.4 million stake. However, Wall Street is growing bullish on the stock amid Novo Nordisk A S’s (NYSE:NVO) promising position in the weight loss industry, where total addressable market is expected to $80 billion – $100 billion according to some industry estimates. Analysts believe Novo Nordisk A S’s (NYSE:NVO) Wegovy’s potential to reduce cardiovascular risks has created new growth catalysts for the stock. Novo Nordisk A S (NYSE:NVO) has seen sales growth of about 30% on a YoY basis in the recent quarters following the launch of Ozempic and Wegovy. During the first quarter Novo Nordisk A S (NYSE:NVO) said sales of Ozempic and Wegovy jumped 25% on a YoY basis, with sales in North American operations rising 34%. For the full year, Novo Nordisk A S (NYSE:NVO) expects sales growth in the range of 19% to 27% at constant exchange rates, slightly up from its previous projection of 18% to 26%. Because of this high growth, Novo Nordisk A S’s (NYSE:NVO) forward P/E of 32.63 based on 2025 earnings estimate isn’t as high when compared to peers.

Polen Global Growth Strategy stated the following regarding Novo Nordisk A/S (NYSE:NVO) in its fourth quarter 2023 investor letter:

“As we discussed in last quarter’s commentary, Novo Nordisk A/S (NYSE:NVO) is a newer addition to the strategy. Over the fourth quarter, we continued to build the position to an average weight. As a reminder, Novo Nordisk is a global pharmaceutical company based in Denmark and has long been the leader in developing insulin for diabetes patients. In recent years, the company’s innovation into GLP-1 drugs has been shown not only to help diabetics control blood sugar levels but also to have significant efficacy in weight loss. Obesity has become a global epidemic, creating materially negative knock-on effects for humans that range from an increase in cardiovascular events and, thus, higher mortality to a lower general quality of life. We believe that, over time, payors will recognize the value of these obesity treatments to both patients and the overall healthcare system.”

Overall, Novo Nordisk A S (NYSE:NVO) ranks 3rd in Insider Monkey’s list of 9 Best Stocks to Buy in 2024 According to Billionaire George Soros. You can visit 9 Best Stocks to Buy in 2024 According to Billionaire George Soros to see other stock picks of Billionaire George Soros. While we acknowledge the potential of Novo Nordisk A S (NYSE:NVO), our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than Novo Nordisk A S (NYSE:NVO) but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: Michael Burry Is Selling These Stocks and Jim Cramer is Recommending These Stocks.

Disclosure: None. This article is originally published at Insider Monkey.

Yahoo Finance

Yahoo Finance