Beyond net-zero pledges, Asia's banks must assess nature risks, announce sectoral plans: WWF-Singapore

Leading banks are putting in the work but half the banks assessed have made little or no progress since 2021, says WWF-Singapore.

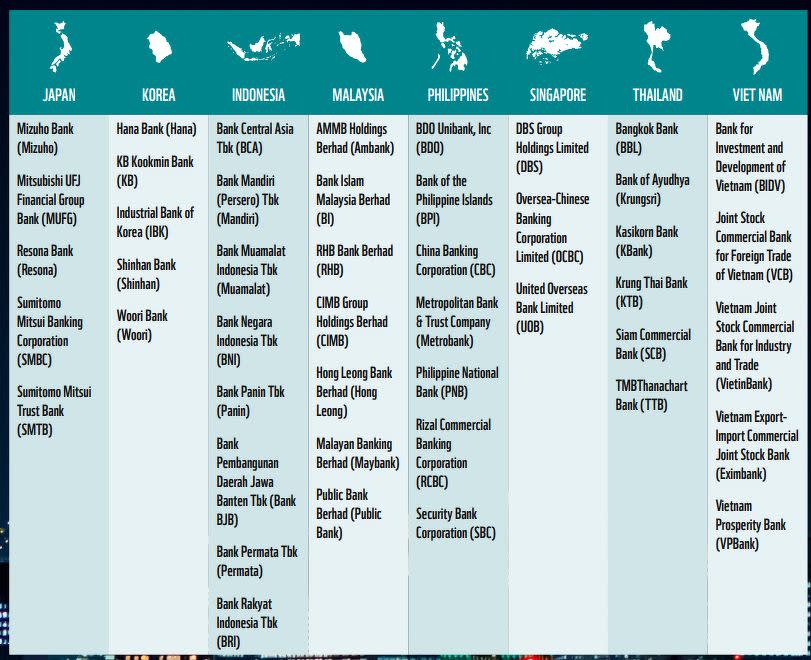

The World Wide Fund for Nature Singapore’s (WWF-Singapore) 2022 Sustainable Banking Assessment (SUSBA), which now includes 36 Asean banks and 10 major Japanese and South Korean banks, finds that more than double the number of banks from 2021's assessment have committed to achieving net-zero financed emissions by 2050.

The report, released on Jan 12, says more Asian banks have made commitments to achieve net-zero financed emissions by 2050, increasing from seven banks in 2021 (15%) to 18 banks in 2022 (39%).

However, the report also finds that although leading banks continue to enhance their environmental and social risk management policies and processes, half the banks assessed have made little or no progress since 2021.

“Many have not yet put basic environmental and social policies and procedures in place. As the chasm between leader and laggard banks in the region widens, laggard banks risk becoming disproportionately exposed to [such] risks. It is critical that all banks in the region rapidly progress so that we have a chance to achieve the 1.5°C goal,” reads WWF-Singapore’s report.

Equally, when it comes to nature-related risks, banks need to go beyond recognition and commitment and expand their capacity to manage these risks within their policies.

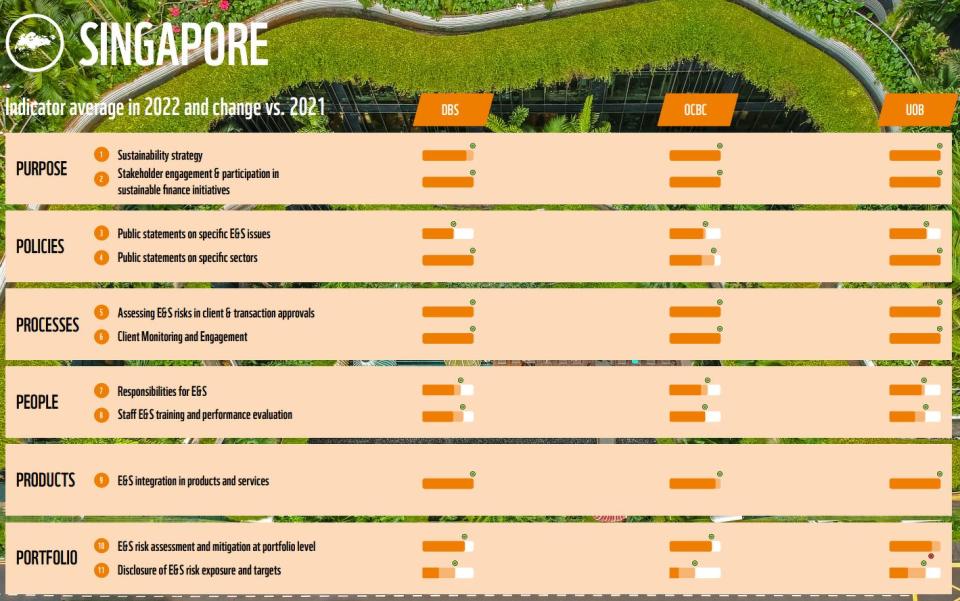

The report assess banks across their sustainability strategy, stakeholder engagement, public statements on environmental and social issues, assessing risks to clients, staff sustainability training and disclosure of targets, among others.

Where should banks go from here? Banks that have made net-zero commitments, such as members of the Net-Zero Banking Alliance (NZBA), should start to implement detailed sector-based decarbonisation plans to ensure they meet their interim targets, says WWF-Singapore.

Remaining banks should commit to net-zero and develop science-based targets, aligned with 1.5°C scenarios, to decarbonise their portfolios by 2050 along with credible transition plans, adds WWF-Singapore.

Banks should also develop and disclose a detailed, verifiable and actionable science-based transition plan that includes relevant climate, nature and social issues.

Spotlight on nature

Banks need to develop capabilities to manage nature-related risks, says the conservation organisation.

Singaporean, Indonesian and Malaysian banks, on average, meet at least 70% of the criteria for recognising nature-related risks. Thai, Japanese and Korean banks meet around 50%-60% of the criteria; followed by Philippine and Vietnamese banks, which are in the 20%-30% range.

After acknowledging these risks, banks must now implement such checks when assessing clients, says WWF-Singapore. “For example, this includes the adoption of no deforestation and no conversion commitments, sustainability certification, avoidance of key biodiversity and protected areas in operations and performing water stewardship. In this regard, there’s a stark contrast between banks’ recognition and integration of risks within their policies.”

According to WWF-Singapore, Singaporean banks only meet 40% of the criteria for setting client expectations on nature-related risk while other assessed countries meet only 20% of the criteria or lower.

Kristina Anguelova, WWF-Singapore’s head of Asia sustainable finance, says: “Developing capacity to identify, assess and manage nature-related risks will be crucial for banks given the targets set by the recent Kunming-Montreal Global Biodiversity Framework (GBF) and the Taskforce on Nature-related Financial Disclosures (TNFD) framework.”

The Kunming-Montreal Global Biodiversity Framework includes four goals and 23 targets to be achieved by 2030. Announced in December 2022 at the UN Biodiversity Conference (COP 15) in Kunming, China, it is one of the latest efforts to halt and reverse global biodiversity loss.

Sector-specific plans important

In 2022, an increasing number of banks in Asia developed and disclosed specific energy sector policies (49% in 2022, up from 29% in 2021) and offered financial products and services to support sustainability improvements in the sector (70% in 2022, up from 54% in 2021).

The main gap continues to be setting science-based targets for the energy sector, with only 11% of banks setting such targets, says WWF-Singapore. “An analysis of energy transition-related regulations also suggests that regulators are not yet requiring banks to set science-based targets and develop transition plans.”

In particular, sector-specific assessment amplifies banks’ critical role against climate change, says WWF-Singapore. “A number of banks, including DBS, UOB and Shinhan Financial Group, have also published sector-based decarbonisation plans with interim 2030 targets.”

Singapore’s three banks have all joined the NZBA, a United Nations-supported private sector collaboration among more than 120 banks with US$70 trillion ($96.7 trillion) in global banking assets.

Signatories commit to transitioning the operational and attributable greenhouse gas emissions from their lending and investment portfolios to align with net-zero pathways by 2050 or sooner. Within 18 months of joining the NZBA, banks must set 2030 targets, or sooner, along with a 2050 target. Banks must also set intermediary targets every five years from 2030.

Financial institutions play an important role in safeguarding ecosystems and set client expectations to move towards sustainably sourced commodities, says WWF-Singapore. Of the 46 assessed banks, 11 banks disclosed palm oil policies, an improvement from 2021 when only three banks reported the same.

However, despite increased coverage of bank policies within the palm oil sector, WWF-Singapore highlights the need for greater traceability and certification along the supply chain. Ideally, palm oil exporters themselves must ensure commodities are deforestation-free, adds WWF-Singapore.

Meanwhile, the energy sector — which is the source of three-quarters of global greenhouse gas emissions — emphasised a greater need for more banks to set science-based targets to transition their energy portfolio, regardless of current incentives from regulators.

Asia’s regulators must do more

According to WWF-Singapore, most regulators from the countries assessed are not yet requiring banks to set science-based targets and develop transition plans.

Regulators are pivotal in guiding the future, says WWF-Singapore. “The 2022 assessment further highlights the pivotal position of regulators within the finance sector to implement and align environmental and social risk management requirements and to ensure financial stability for banks.”

The report shows that there is still wide variation in assessed banks’ environmental and social integration performance both across the region and within most countries, adds the organisation. “Regulators are uniquely positioned to raise the bar, and level the playing field, by both aligning and enhancing ESG risk management and disclosure requirements throughout the region. They can further help banks to meet these requirements by supporting capacity-building and by initiating implementation task forces.”

“With nearly half of the planet’s biodiversity hotspots located in Asia-Pacific, preserving this region will be critical in meeting global climate and nature ambitions,” says WWF-Singapore.

“The SUSBA 2022 assessment is a testament to WWF-Singapore’s continuous efforts to rally financial institutions to recognise their role to tackle climate change,” says R. Raghunathan, CEO of WWF-Singapore. “We look forward to deepening our engagement with regional banks and to see them make meaningful progress towards our net-zero ambitions.”

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

WWF-Singapore appoints former SGX CEO Hsieh Fu Hua as chairman

Are banks ready to weather climate risks? MSCI says 'none are fully prepared'

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance