Better Buy: First REIT Vs Parkway Life REIT

REIT investors who are faced with a plethora of choices need to make the inevitable comparison as to which REIT to own.

We compared two industrial REITs last month when we put Mapletree Industrial Trust (SGX: ME8U) and Mapletree Logistics Trust (SGX: M44U) side by side.

For this round, we decided to investigate the healthcare segment as the themes of ageing populations and increased healthcare spending have been brought up time and again.

The local exchange features just two healthcare REIT – First REIT (SGX: AW9U) and Parkway Life REIT (SGX: C2PU), or PLife REIT.

We compare these two REITs on various metrics to determine which makes the better investment choice.

Portfolio composition

First off, we look at each REIT’s portfolio to determine which is more diversified.

PLife REIT takes the cake as its portfolio contains 63 properties comprising three hospitals in Singapore, a specialist centre in Kuala Lumpur, and 59 nursing homes in Japan.

First REIT has 32 properties with a greater concentration of hospitals (11) versus nursing homes (17). The remaining properties comprise integrated buildings housing hospitals, malls, a hotel, and country club.

PLife REIT also has nearly twice the assets under management compared with First REIT.

Winner: PLife REIT

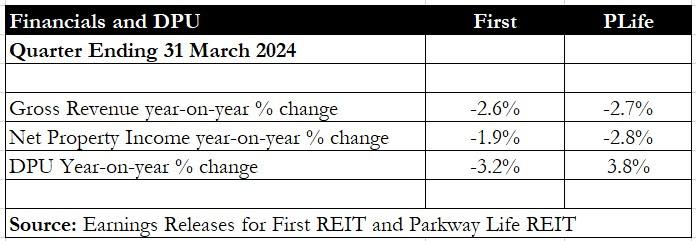

Financials and DPU

Moving on to each REIT’s financials, both healthcare REITs reported a slight year-on-year dip in revenue and net property income.

First REIT’s financial results were impacted by a stronger Singapore dollar against the Indonesian Rupiah and Japanese Yen.

PLife REIT reported the same reason for the dip in revenue and net property income but this was offset by contributions from newly-acquired nursing homes in October 2023.

PLife REIT also saw distribution per unit (DPU) post a 3.8% year-on-year increase compared to First REIT which saw DPU fall by 3.2% year on year.

Winner: PLife REIT

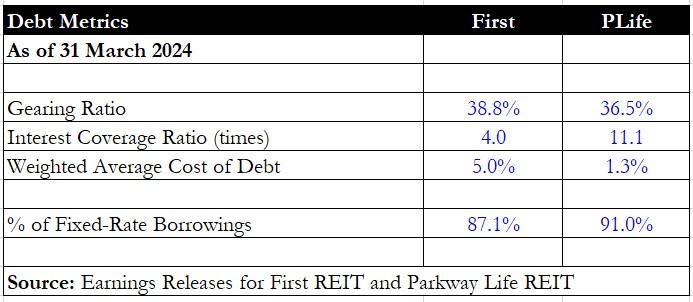

Debt metrics

The next aspect is each REIT’s debt metrics.

PLife REIT has a lower gearing ratio compared with First REIT and also has a significantly higher interest coverage ratio at 11 times versus four times.

Crucially, PLife REIT’s cost of debt was sharply lower at 1.3% versus 5% for First REIT.

This difference is because PLife REIT has a large portion of its debt in Japanese Yen where the cost of debt is much lower

Close to three-quarters of First REIT’s loans are denominated in Singapore dollar with the remainder in Japanese Yen.

PLife REIT also has a higher proportion (91%) of its debt pegged to fixed rates compared to First REIT (87.1%).

Fixed-rate debt helps to mitigate a sharp rise in finance costs due to rising interest rates.

The good news is that First REIT has no refinancing requirements till May 2026 while PLife REIT does not need to refinance its debt till March 2025.

Winner: PLife REIT

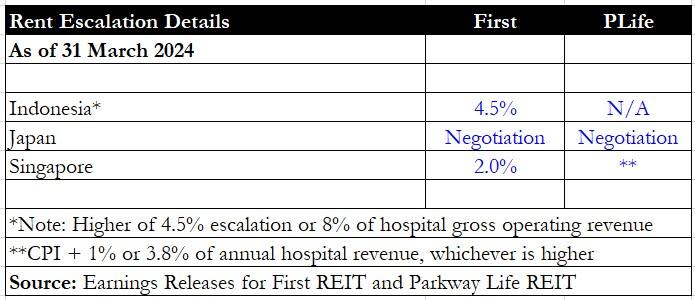

Rent escalation clauses

We also compared an aspect that is seldom seen in many other REITs – that of in-built rental escalation clauses within tenancy agreements.

Such clauses help the REIT to enjoy organic rental growth and beat inflation.

First REIT negotiated a good deal in that its Indonesian assets will enjoy the higher of 4.5% increase in base rent or 8% of the hospital’s gross operating revenue.

Its Japan assets are subject to rental negotiation every two to three years for 12 assets and every five years for the remaining two assets.

Singapore’s assets will see a fixed rental increment of 2% per annum.

For PLife REIT’s Singapore assets, the rent review formula consists of the higher of 3.8% of annual hospital revenue of one plus the inflation rate.

Its Japanese assets also have an “up-only” rental review with downside rental protection for the bulk of its nursing homes.

First REIT wins on this attribute as its Indonesian assets should see healthy organic rental growth and the country takes up nearly three-quarters of the REIT’s total assets under management.

Winner: First REIT

Operating metrics

First REIT’s properties enjoy full occupancy while PLife REIT’s property in Kuala Lumpur is only 31% occupied, thereby giving the REIT an occupancy rate of 99.7%.

Both REITs have very long weighted average lease expiries of more than 10 years.

Winner: First REIT

Distribution yield

First REIT has a significantly higher forward distribution yield of 9.8% compared with PLife REIT’s 4.2%.

This could be due to First REIT’s Indonesian assets where the currency has seen consistent depreciation against the Singapore dollar.

First REIT also went through a major restructuring and recapitalisation exercise back in May 2021 which may have dented sentiment.

Winner: First REIT

Get Smart: Expansion plans

Reviewing the two healthcare REITs, PLife REIT is the winner as it has a longer track record of uninterrupted core DPU growth stretching all the way back to its IPO in 2007.

PLife REIT also enjoys a much lower cost of debt, putting it in a better position to manage the higher interest rate environment.

First REIT may have an overall higher distribution yield but it has only been three years since the restructuring.

A bright spot is that First REIT has undertaken an acquisition of 12 Japanese nursing homes in December 2021, shortly after its recapitalisation exercise.

The REIT followed up with the purchase of another two Japanese nursing homes in September 2022.

First REIT’s manager intends to increase the share of assets in developed markets (such as Japan) to 50% by 2027. Currently, just 25.5% of its properties are in developed markets as of the end of 2023.

PLife REIT also has expansion plans – the manager intends to leverage its strong network in Japan for further acquisitions and to also build a third key market that can enhance its overall growth.

Attention Dividend Investors: Now’s the time to tap into high-yield REITs in Singapore. We’ve just released our latest report, revealing the full details on five Singapore REITs, each boasting distribution yields of 5.5% or higher. With a focus on stability and performance, these REITs could be the missing piece in your dividend-focused portfolio. Download the FREE report now to unlock these high-yield treasures.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Royston Yang owns shares of Mapletree Industrial Trust.

The post Better Buy: First REIT Vs Parkway Life REIT appeared first on The Smart Investor.

Yahoo Finance

Yahoo Finance