Best Semiconductor Stocks to Buy for July 2023

Here are 3 of the best semiconductor stocks to buy for July 2023.

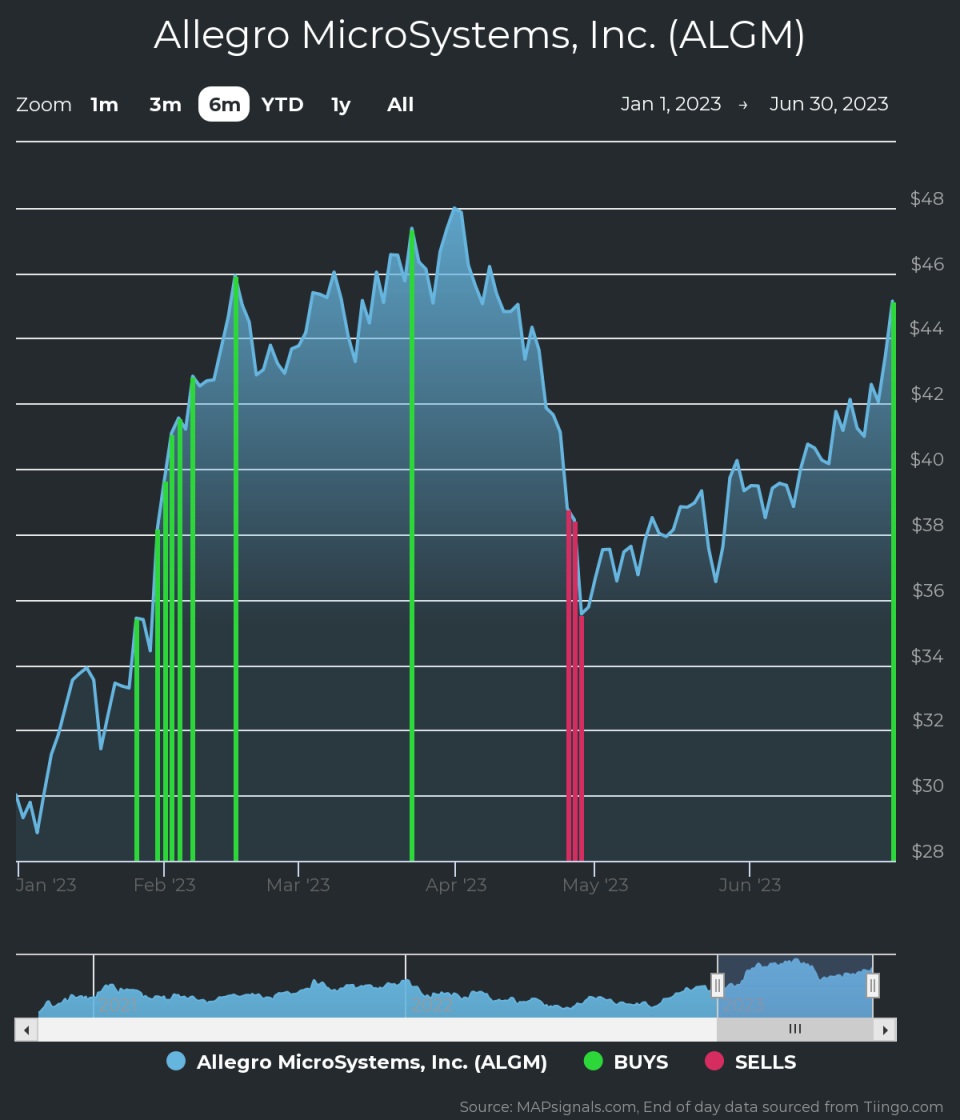

Allegro MicroSystems, Inc. (ALGM) Analysis

First is semiconductor firm Allegro MicroSystems (ALGM). The stock has rocketed 50% in 2023.

This company is on the smaller side with an $8.6B market cap.

The stock has been a Big Money favorite recently which you can see in the MAPsignals chart below. YTD there’ve been 9 unusually large volume inflows (green bars). This appears to be institutional accumulation:

Heavy demand for a stock can be bullish over the longer term. With a 12-month forward P/E of 30, shares could be attractive after a pullback. According to FactSet, the company is estimated to earn $1.40 per share in fiscal year 2024, up from $1.16 estimates in 2023.

High-quality growth stocks are attracting big capital in 2023.

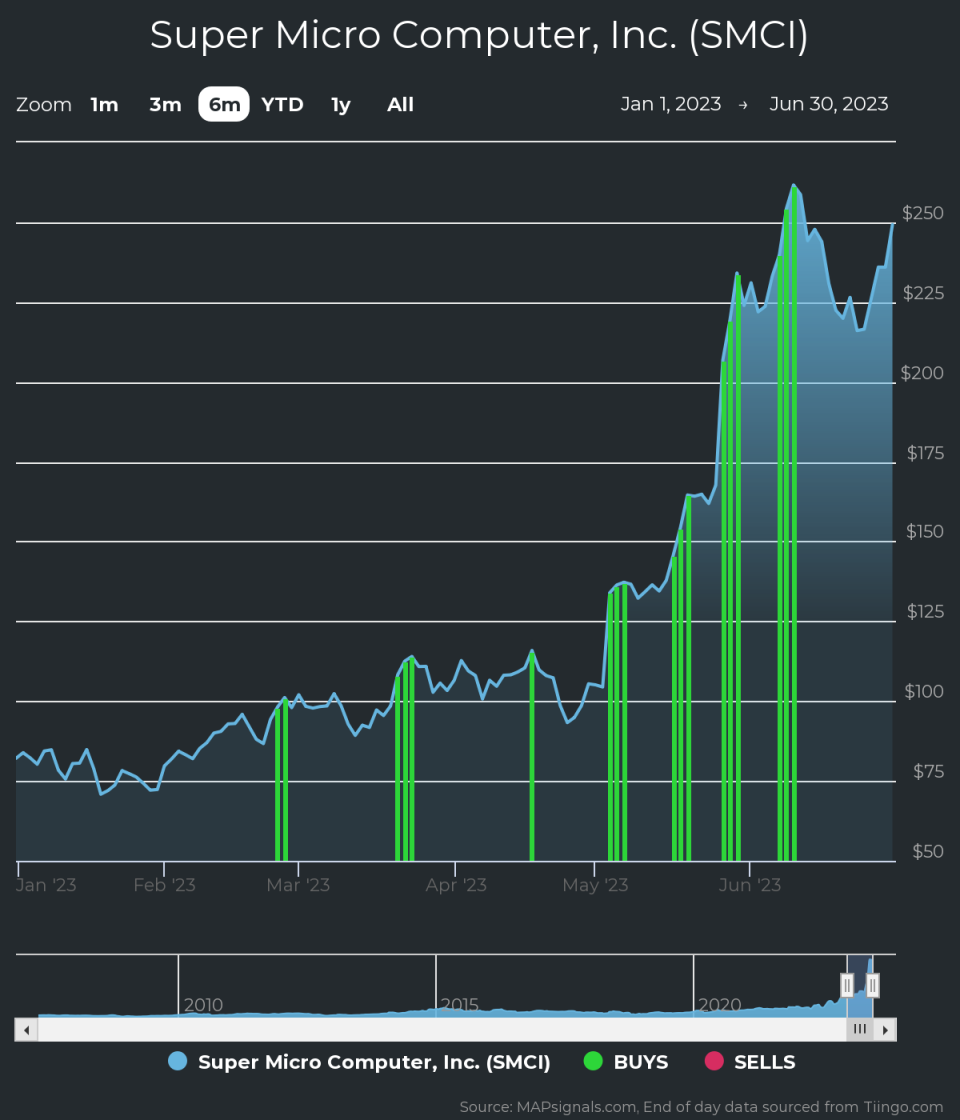

Super Micro Computer, Inc. (SMCI) Analysis

Next up is Super Micro Computer, Inc. (SMCI) which is an A.I. darling, jumping a dizzying 203% in 2023.

Look at this, YTD there’ve been 18 days where the stock lifted in price alongside chunky volumes. That’s a tailwind powering the stock higher:

The company has a solid growth profile as earnings are set to explode to $14.46 per share in fiscal 2024. That’s up from $8.39 earned in 2022!

With a forward P/E pegged at 17.2X, this name could be worth a spot in a growth-oriented portfolio.

Solid fundamentals and healthy institutional support make this stock a potential opportunity.

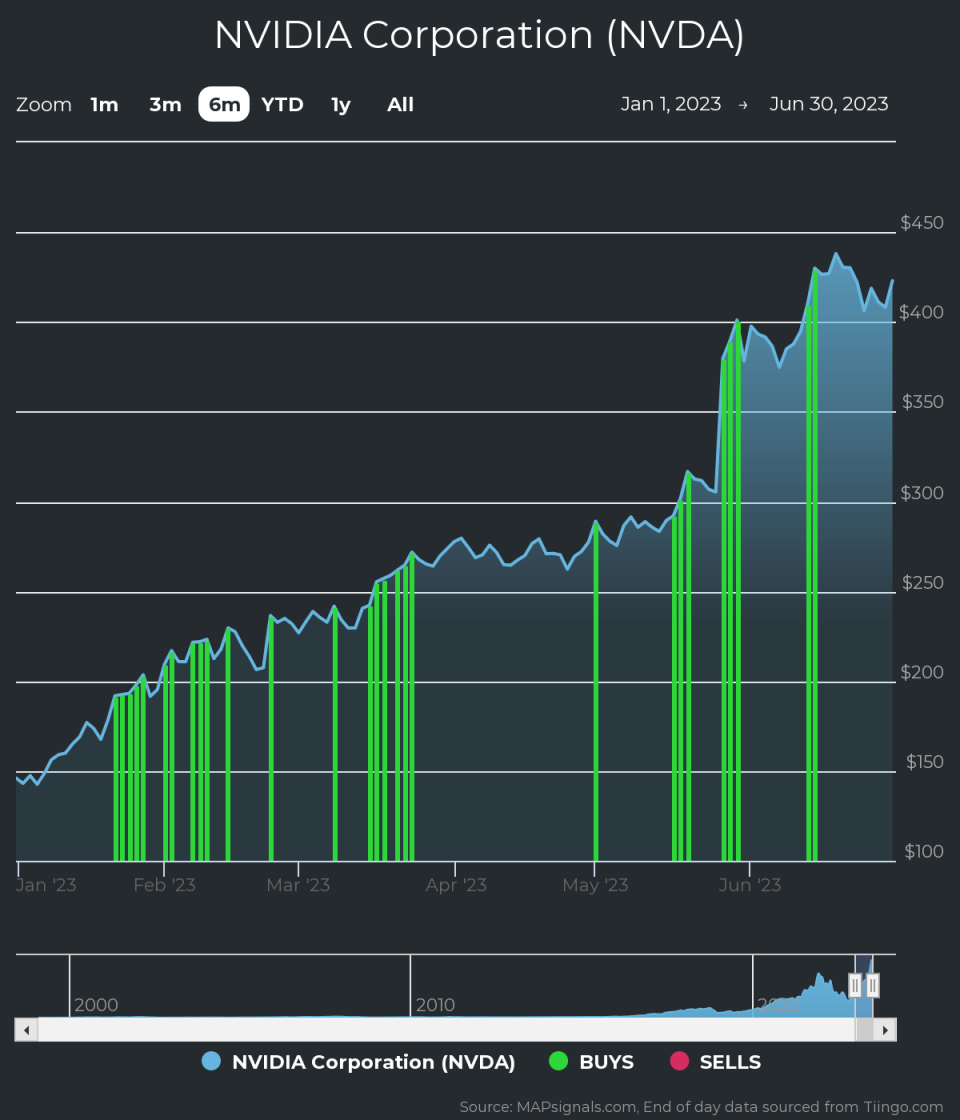

NVIDIA Corp. (NVDA) Analysis

The number 3 semiconductor firm is superstock NVIDIA Corp. (NVDA). This company has been ramping in 2023, soaring an incredible 189%. Investors are excited about their cloud and AI prospects.

The chart speaks for itself as the stock has clocked 28 unusual inflow buy signals, as shown in the MAPsignals chart below:

I call this profile, the Stairway to Heaven. Don’t fight the Big Money.

When sizing up stocks, it’s important to check the fundamental picture too. The company is expected to earn $9.98 per share in fiscal year 2025, well north of the $7.22 EPS estimate in 2024.

Keep in mind, the forward PE sits at just over 48X, which is expensive.

This could be a solid addition to a growth portfolio after a meaningful pullback.

Bottom Line and Explanatory Video

ALGM, SMCI, & NVDA represent 3 of the best semiconductor stocks for July 2023 in my opinion. Unusual buying pressure plus a favorable fundamental picture, make these stocks worthy of extra attention.

Each of these names have been top-rated multiple times at my research firm, MAPsignals. We have a ranking process that showcases stocks like these on a weekly basis.

If you want to take your investing to the next level, learn more about the MAPsignals process here.

Follow our free insights here.

Disclosure: As of the time of this writing, the author no positions in ALGM, SMCI, or NVDA at the time of publication.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance