Best Credit Cards for Lazy People (2023): Low Maintenance, Hassle-Free Payments

Sipping a cocktail while you type away on your laptop under the shade of your beach umbrella then shutting off at 4 pm when the work has been done?

That’s a typical “lazy girl job” that offers you flexibility and remote work while not requiring much effort. The “lazy girl job” trend has been all abuzz on TikTok in recent months, featuring women talking about their seemingly cushy jobs with flexible schedules and not needing to do much, while still getting paid decently. The trend is a rejection of hustle culture and the idea that workers need to overwork themselves in order to be successful.

While a “lazy girl job” may be something we all want, it’s not always possible for everyone. But a financial life hack that can save you time and effort is having the right credit card to suit your lifestyle.

If you’re the type of person where every little bit of convenience counts, you want something where you don’t have to keep track of payments, fees, redeeming rewards, etc. — basically something low maintenance. Here are some things you might be looking out for:

Low maintenance

We’re talking minimal annual fees—or free in the first couple of years—an easy application, and fast approval process. This will save you time and if you are looking to use it immediately to hit a minimum spend to be eligible for your newcomer reward, you’ll want a card that is approved quickly. You’ll also want one that has a $0 minimum spend per month so that you do not get charged should you not meet the minimum spending for that month.

Automated processes

Many credit cards offer automated cashback and rewards programmes. With these automated processes, this means you can earn rewards on your purchases without having to do anything extra. You can also set up automatic bill pay so you never have to worry about missing a payment.

Automated processes also help frequent travellers especially those who want to earn miles. If you prefer a cashback card, look for one that you know can help you gain cashback automatically in the category you spend most on, such as groceries, online shopping or petrol.

Hassle-free payments

Many credit cards make it easy to pay recurring bills to various organisations such as electricity, utilities, telco, insurance and town council bills. Some also reward you for it in the form of points or cashback, so you gain something in return.

You’ll also want one that’s compatible with the payment app you use. Many cards these days are compatible with Apple Pay, Google Pay, and Samsung Pay.

Customer support 24/7

Most credit card companies offer 24/7 customer support in case you have any problems with your account. This gives you peace of mind knowing that you can always get help if you need it.

Online account management

Many banks allow you to manage your credit card account online or on your mobile app. This means you can check your balance, make payments, and redeem rewards without having to call customer service.

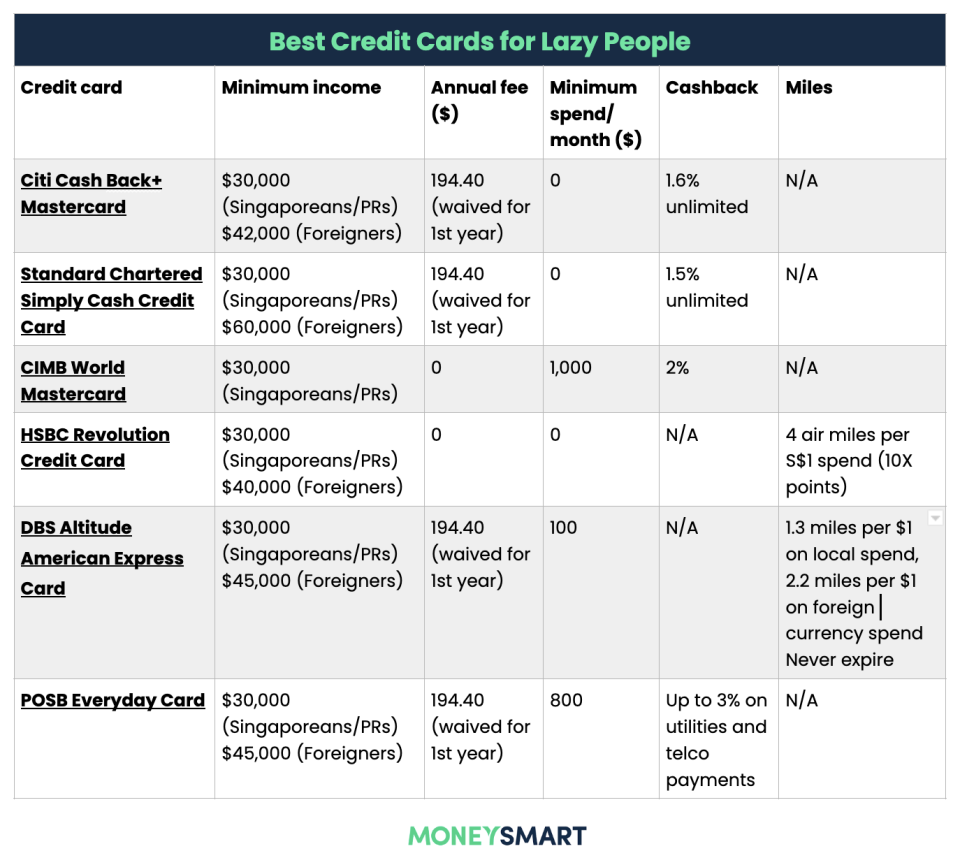

We’ve done the work. Here are the 6 best credit cards for lazy people

1) Citi Cash Back+ Mastercard

One of the main draws of the Citi Cash Back+ Mastercard is the $0 minimum monthly spend. Say for 1 month you’re trying to be thrifty because you’re saving money for your house renovation, you don’t have to worry about being charged for not hitting the minimum spend that month. When the next month comes and you do need to buy all your furniture, you can use the card, AND get unlimited cash back.

Cash Back Alan Partridge GIFfrom Cash Back GIFs

It’s 1.6% cashback on purchases across all online shopping and lifestyle categories. This includes groceries, petrol, dining, entertainment, and overseas spending, though note the foreign currency transaction fee of 3.25%.

MoneySmart Exclusive

Faster Gift Redemption

Citi Cash Back+ Mastercard®

MoneySmart Exclusive:

Get an Sony WH-1000XM5 Wireless Noise Cancelling Headphones (worth S$575) OR a Nintendo Switch OLED Gaming Console (worth S$549) OR a S$450 Amazon SG Gift Card OR S$300 Cash via PayNow when you apply and spend a min. of S$500 in "Qualifying Spends" within 30 days from card approval date. T&Cs apply

Valid until 15 Oct 2023

More Details

Key Features

1.6% cashback on your spend

No minimum spend required and no cap on cash back earned

Cash back earned does not expire

Redeem your cash back instantly on-the-go with Pay with Points or for cash rebate via SMS

With Citi PayAll, you can earn and accumulate Citi Miles, Citi ThankYou PointsSM or Cash Back quickly when you pay your big-ticket bills such as rent, insurance premiums, education expenses, taxes, utilities and more

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

2) Standard Chartered Simply Cash Credit Card

Another credit card with no monthly minimum spend, the Standard Chartered Simply Cash Credit Card is an easy everyday card for those who want a fuss-free cash back card.

This one offers a flat 1.5% unlimited cashback on eligible spend in categories such as dining, online shopping, groceries, entertainment, and other local and overseas spend.

It’s useful for car owners as it also offers petrol discounts for Techron fuel Platinum 98 and Premium 95.

Sponsored

MoneySmart Exclusive

FLASH DEAL | APPLE WATCH SERIES 9

Standard Chartered Simply Cash Credit Card

MoneySmart Exclusive:

[FLASH DEAL | Apple Watch Series 9]

Get up to S$350 Cash via PayNow* OR a Sony WH-1000XM5 Wireless Noise Cancelling Headphones (worth S$575) OR a Nintendo Switch OLED (worth S$549) OR a Titan V1 7-Speed Foldable Bike (worth S$399) when you apply and spend a min. of S$500 in Eligible Transactions.

PLUS, redeem a FREE Apple Watch Series 9 GPS 41mm (worth S$599) when you are the first 2 successful applicants to submit the MoneySmart Claim Form at 2pm and 9pm daily! T&Cs apply.

Valid until 14 Oct 2023

More Details

Key Features

Flat 1.5% cashback rate for all eligible purchases

No cashback cap and no minimum spend

Enjoy dining and shopping discount privileges at over 3,000 outlets in Asia with Standard Chartered’s The Good Life benefits program

2 year annual fee waiver, no minimum spend required

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

3) CIMB World Mastercard

A no-annual fee-for-life credit card, the CIMB World Mastercard is one for those who can never remember to call the bank to have their annual fee waived. What’s more, you can even get up to 4 supplementary cards and STILL not have to pay annual fees at all.

It also offers 2% unlimited cashback on Wine & Dine, Online Food Delivery, Movies & Digital Entertainment, Taxi & Automobile, Luxury Goods categories when you spend a minimum of $1,000 in the same month.

The card also allows you access to over 1,000 airport lounges via LoungeKey, so it’s definitely a handy card to take along when travelling. It’s also easier to hit the minimum spend too if you take it with you for overseas trips.

Golf enthusiasts will also be glad to know that the card lets you have 50% off green fees at various golf courses around the region.

MoneySmart Exclusive

Unlimited 2% cashback

CIMB World Mastercard

MoneySmart Exclusive:

Get S$250 Cash via PayNow OR $270 eCapita Vouchers OR an Apple AirPods 3rd Gen with Lightning Charging Case (worth $261.40) OR a ErgoTune Classic Ergonomic Chair (worth S$399) when you apply and spend a min of S$988. T&Cs apply.

PLUS enjoy up to 3% Unlimited Cashback* from CIMB with min. spend of S$2,500 per month. T&Cs apply.

Valid until 31 Oct 2023

More Details

Key Features

2% Unlimited Cashback on Wine & Dine, Online Food Delivery, Movies & Digital Entertainment, Taxi & Automobile, Luxury Goods. 1%* Cashback on all other spends.

1% Unlimited Bonus Cashback with min. spend of S$2,500 per month. Promo valid till 31 Oct 2023.

Access to Over 1,000 Airport Lounges via Mastercard® Airport Experiences Provided by LoungeKey

50% Off Green Fees at golf courses across the region

No annual fees for life

Apply for up to 4 supplementary cards and have annual fees waived for all supplementary cards

Access to over 1,000 regional deals & discounts across Singapore, Malaysia and Indonesia

4) HSBC Revolution Credit Card

Yet another no-annual fee and no minimum-spend card, the HSBC Revolution Credit Card is a rewards card that lets you earn points and miles. You get 10X reward points (equivalent to 4 miles or 2.5% Cashback) on online purchases and contactless payments, and 1X reward point for all other spending.

What’s more, this is a card that rewards you for contactless payment.

So for those who don’t like to rifle through their wallets for the right card or even carry wallets around, simply wave your phone and pay via Visa PayWave or Apple Pay to get 10X points/4 miles on your dining, grocery, food delivery, travel bookings and other online spend.

You can redeem your rewards points for home, dining, retail, travel, or charity cash vouchers online or use it to offset your transactions. If you prefer collecting miles, convert the points to miles via the HSBC Mileage Programme, which has a $42.80 annual programme fee.

It’s also a useful card for those who like to dine out as you get free access to dining, lifestyle and travel deals with the ENTERTAINER with the HSBC app.

Use this card for big-ticket purchases such as home renovations, travel bookings, and educational fees.

MoneySmart Exclusive

Earn Points for Everyday Spending

HSBC Revolution Credit Card

Get a Samsonite ZELTUS 69cm Spinner Exp Luggage with built-in scale (worth S$680) or S$150 cashback for new HSBC credit cardholders. Existing HSBC credit cardholders receive $50 cashback. Min. spends of S$1,000 upon card approval required and marketing consent provided upon applying. T&Cs apply.

Valid until 31 Dec 2023

More Details

Key Features

10X Reward points (equivalent to 4 miles or 2.5% Cashback) on online purchases and contactless payments.

1X Reward point for all other types of spending.

No min. spend required.

No annual fee

Receive complimentary access to ENTERTAINER with HSBC app, with over 1,000 1-for-1 deals on dining, lifestyle and travel worldwide.

Cap of 10,000 rewards points per calendar month on eligible purchases. Other terms apply.

5) DBS Altitude American Express Card

Touted as an entry-level miles card, the DBS Altitude American Express Card is great for lazy folks who want to get into the miles game. The miles you accumulate never expire, so you can redeem them whenever you want.

Earn up to 2.2 miles per $1 on overseas spend in foreign currency, or up to 1.3 miles per $1 on local spend.

To further maximise how you earn your miles, make your travel bookings at selected partners. For purchases made on Expedia, earn up to 6 miles per $1 on flight, hotel and travel packages, or up to 10 miles per $1 if you book hotels via Kaligo.

Note that miles are awarded in the form of DBS Points which are awarded for every S$5 spent (1 DBS Point = 2 miles) on a per-transaction basis.

You also earn 10,000 bonus miles when you pay for your annual fee of $194.40 after the first year.

What’s more, the card lets you make your payments in instalments at 0% interest over 6, 12 or 24 months for transactions at participating online and retail merchants. However, if you’re too lazy to track this, then it’s best to not use this feature lest you inadvertently get charged accidentally.

Online Promo

Earn Miles That Never Expire

DBS Altitude American Express Card

Online Promo:

Get up to 40,000 miles when you apply for an eligible DBS Altitude Credit Card and charge a min. spend of S$2,000 within 30 days from card approval date. T&Cs apply.

Valid until 30 Nov 2023

More Details

Key Features

Earn up to 10 miles per S$1 on all your spend

Enjoy first year annual fee waiver

Receive 10,000 bonus miles upon membership renewal with annual fee payment of S$194.40

Earn miles that never expire

Miles are awarded in the form of DBS Points which are awarded for every S$5 spent (1 DBS Point = 2 miles) on a per transaction basis.

Complimentary Mr and Mrs Smith SilverSmith membership

Enjoy exclusive dining, shopping and travel offers

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

6) POSB Everyday Card

As its name suggests, the POSB Everyday Card is one that you can use for your daily expenses. With cash rebates that never expire, it’s the ultimate card to use for recurring bill payments.

Get up to 3% cash rebates if you use this for utilities payments (e.g. SP Group, Sembcorp, Tuas Power, Geneco, Union Power, etc) and 2% if your provider is either iSwitch, Keppel Electric, or Senoko Energy — without any minimum spend.

Use this card for automatic phone bills too to get 3% cash rebates if you’re with either Singtel, Singtel GOMO, Starhub, Starhub giga, M1, MyRepublic, or Circles.Life, with a minimum spend of $800 per month.

It’s also a great card for groceries as you get 8% cash rebates at RedMart and 5% at Sheng Siong. Online shopping at one of these sites — Amazon.sg, Lazada, Qoo10, Shopee, RedMart and Taobao—also grants you 5% cash rebates.

The catch is to spend $800 per month but if you use it for everything, and thus reduce the number of other cards you have, you’d most likely have no problem hitting this amount.

Online Promo

Earn Cash Rebates that Never Expire

POSB Everyday Card

Online Promo:

Get S$150 Cashback when you apply with promo code 150CASH and make the min. spend of S$800 within 60 days of card approval. T&Cs apply.

Valid until 31 Jan 2024

More Details

Key Features

No minimum spend

Base cashback rate: 0.3% POSB Daily$ rebate for all purchases

Activate SimplyGo to use your card as an EZ-Link card. SimplyGo charges MRT and bus fares to your credit card, eliminating the need for auto top-ups

Link the POSB Everyday Card to your DBS or POSB Savings or Current account to use card at ATM

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

At a glance: Best credit cards for lazy people

Additional tips to maximise your lazy-friendly credit cards

While you want something that’s low maintenance in the long run, you still have to put in a tiny bit of effort if you want to get the most out of your credit card.

Use your credit card for all of your purchases. This will help you earn the most rewards and maximise your cashback or travel rewards.

Set up recurring payments for your bills and subscriptions. This will save you time and hassle, and it will also help you avoid late payments.

Take advantage of sign-up bonuses. Many credit cards offer sign-up bonuses to new customers. These bonuses can be worth hundreds or even thousands of dollars, so they’re a great way to start earning rewards right away. Check out MoneySmart’s latest credit card promotions.

Redeem your rewards regularly. Don’t let your reward points expire. Redeem them for cashback, miles, travel rewards, or vouchers as soon as possible.

We’ve streamlined these credit cards for you to help make your decision easier. It’s up to you to decide which card best suits your needs and lifestyle. Now, how about getting that lazy girl job next?

Do you know someone who could use one of these credit cards? Share this article with them!

The post Best Credit Cards for Lazy People (2023): Low Maintenance, Hassle-Free Payments appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post Best Credit Cards for Lazy People (2023): Low Maintenance, Hassle-Free Payments appeared first on MoneySmart Blog.

Original article: Best Credit Cards for Lazy People (2023): Low Maintenance, Hassle-Free Payments.

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance