Bear of the Day: Hasbro (HAS)

Hasbro, Inc. HAS is seeing a slowdown as consumers feel inflationary pressures. This Zacks Rank #5 (Strong Sell) is expected to see earnings decline 11% this year.

Hasbro is a global branded entertainment leader through gaming, consumer products and entertainment. Some of its brands including Magic: The Gathering, Dungeons & Dragons, Hasbro Gaming, Nerf, Transformers, Play-doh and Peppa Pig.

A Miss in the Third Quarter of 2022

On Oct 18, 2022, Hasbro reported its third quarter earnings and missed on the Zacks Consensus by $0.11. Earnings were $1.42 versus the Zacks Consensus of $1.53.

Revenue fell 15%, or 12% on a constant currency basis, to $1.68 billion. The results were impacted by the acceleration of Consumer Products shipments by its retailers into the second quarter due to anticipated supply chain challenges, as well as Magic: The Gathering set releases and entertainment content scheduled for release in the fourth quarter versus the third quarter like last year.

All three of its segments saw declines. Consumer Products, it's largest segment, fell 10% to $1.16 billion from $1.28 billion a year ago.

Wizards and Digital Gaming fell 16% to $303.5 million from $360.2 million in 2021. Entertainment dropped 35% to $211.6 million from $327.1 million a year ago.

Hasbro also saw "increasing price sensitivity for the average consumer" in the quarter.

As a result, Hasbro guided to flat fourth quarter year-over-year revenue, with strength coming from its Wizards and Digital Gaming segment.

The company also has a 3-year cost cutting program which is aimed to drive $250 to $300 million per year in savings.

Full Year 2022 and 2023 Earnings Estimates Cut

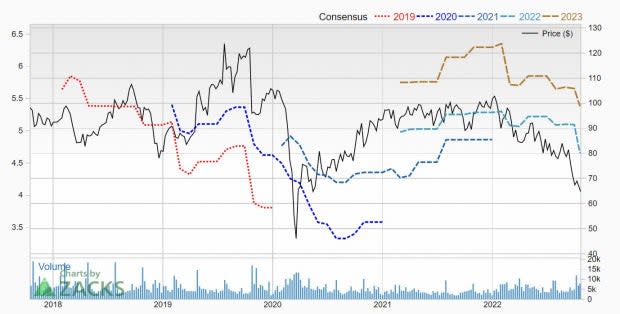

Given the earnings miss and the company's guidance, it's not surprising that analysts have been lowering earnings estimates.

For 2022, 6 estimates were cut in the last 30 days, including 1 in the last week, which has pushed the Zacks Consensus Estimate down to $4.65 from $5.09. That's an earnings decline of 11% because the company made $5.23 last year.

Analysts are also bearish on 2023, with 6 estimates cut in the last 30 days and 2 cut in the last week. The 2023 Zacks Consensus Estimate has come down to $5.38 from $5.68 during that time. However, that's still earnings growth of 15.7% from 2022.

Image Source: Zacks Investment Research

Committed to Its Dividend

Hasbro pays a juicy dividend, currently yielding 4.3%.

If you're worried that it may not be "safe" from cuts, in its press release, Hasbro said it was "committed" to its "industry-leading" dividend.

The next quarterly dividend of $0.70 will be paid on Nov 15, 2022, to shareholders of record as of Nov 1, 2022.

Shares are Cheap

Hasbro shares are down 37% year-to-date and have entered into value territory.

It trades with a forward P/E of 13.9 and has a P/S ratio of just 1.5.

But if the US enters into a recession in 2023, will these shares get even cheaper?

Investors interested in entertainment and gaming might want to wait on the sidelines for those earnings to turn back around before diving in.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance