Bear of the Day: Guess?, Inc (GES)

Company Overview

Zacks Rank #5 (Strong Sell) stock Guess?, Inc (GES) is a global fashion brand known for its trendy and contemporary clothing, accessories, and footwear. Established in 1981, the company specializes in casual and upscale apparel with a focus on denim. Guess offers various products, including jeans, dresses, handbags, and accessories, catering to a younger demographic. With a strong emphasis on style and innovation, Guess has become synonymous with youth culture and remains a prominent player in the fashion industry, operating numerous retail stores and selling its products through various channels worldwide.

Retail is a Lagging Sector – GES Lags Within Retail

Guess is witnessing persistent weakness across its retail business amid a dynamic macroeconomic environment. The trend continued in late 2024, with revenues in the Americas Retail segment falling 7% year-over-year. Though retail is lagging behind hot sectors such as technology, retailers such as Lululemon (LULU) and Abercrombie and Fitch (ANF) are thriving in the current environment. Unfortunately, Guess is not one of those retailers that are thriving. Over the past twelve months, ANF has been up a whopping 247% while GES only gained a feeble 3%. In other words, GES is lagging behind sector leaders and the general market – a sign of relative weakness.

Image Source: Zacks Investment Research

Negative ESP Score + Zacks Rank #5 = Trouble

The Zacks Earnings ESP (Expected Surprise Prediction) rates stocks based on recent earnings estimate revision activity. The idea behind the rating is that more recent information is, generally speaking, more accurate and is a better predictor of the future, which gives investors an advantage during earnings season. Zacks studies show that when a company has a Zacks Rank of #5 (Strong Sell) combined with a negative ESP score (like Guess does), the company is likely to miss earnings expectations and underperform the market over the next year.

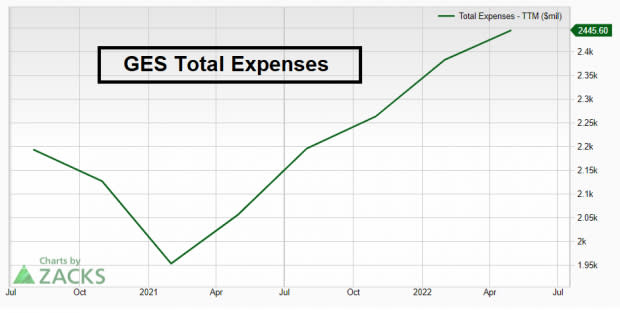

Red Flag: Expenses Rise

Another red flag for prospective GES investors is the lethal combination of stagnant revenue and earnings growth mixed with rising expenses. Inflationary pressures and rising performance-based compensation are major headwinds for the stock moving forward.

Image Source: Zacks Investment Research

Bottom Line

A negative ESP score, retail sector challenges, relative weakness, and soaring expenses are all reasons to avoid this struggling retailer.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance