Bear of the Day: DICK'S Sporting Goods (DKS)

DICK'S Sporting Goods DKS operates as a major omnichannel sporting goods retailer, offering athletic shoes, apparel, accessories, and a broad selection of outdoor and athletic equipment for team sports, fitness, camping, and more.

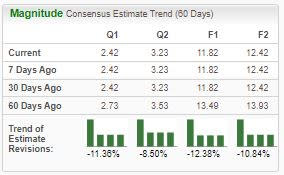

Analysts have taken their earnings expectations lower, landing the stock into an unfavorable Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

The company resides in the Zacks Retail – Miscellaneous industry, which is currently ranked in the bottom 25% of all Zacks industries. Let’s take a closer look at how the company currently stacks up.

DICK’S Sporting Goods

DKS shares have faced adverse price action over the last three months, down 18% and widely underperforming relative to the general market. As circled below, the company’s latest quarterly release was met with a wave of sellers.

Image Source: Zacks Investment Research

Elevated inventory shrink was the primary driver behind the negative knee-jerk reaction among market participants, which massively affected the company’s profitability throughout the period. Further, DICK’S lowered its current year EPS outlook, adding fuel to the fire sale within shares.

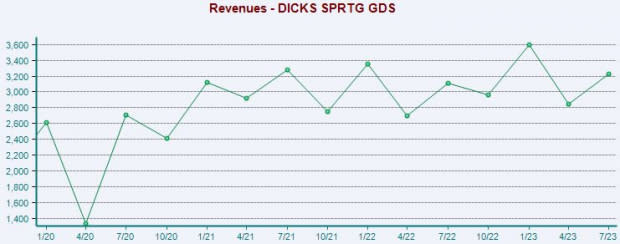

Regarding top and bottom line expectations in the above-mentioned quarter, the company fell short of the Zacks Consensus EPS Estimate handily and posted a modest revenue surprise. DKS’ revenue has primarily remained stagnant over the last few years, as we can see illustrated below.

Image Source: Zacks Investment Research

Shares now yield a respectable 3.6% annually, nicely above the company’s respective Zacks industry average. Earlier in the year, DICK’S boosted its dividend payout by 105%, continuing its commitment to increasingly rewarding shareholders.

The company’s earnings are forecasted to pull back 2% this year on 4% higher revenues, further reflecting the profitability crunch DKS has experienced. Still, growth resumes in FY25, with Zacks Consensus Estimates suggesting a 5% earnings bump paired with a 3% sales improvement on a year-over-year basis.

Image Source: Zacks Investment Research

Bottom Line

Negative earnings estimate revisions from analysts and crunched profitability stemming from elevated inventory shrink paint a challenging picture for the company’s shares in the near term.

DICK’S Sporting Goods DKS is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance