Are banks ready to weather climate risks? MSCI says 'none are fully prepared'

“Coming regulations mean that banks need to be able to quantify the exposure of their balance sheets to climate-related risks.”

Among corporates, conversations around net zero have shifted from “Why?” to “How?”. Faced with a looming recession, however, will their decarbonisation pledges withstand pressures on their bottomlines?

Singapore lenders’ commitments to net zero cannot be understated. Together, the three local banks account for nearly half of the Straits Times Index, with DBS Group Holdings at 19.7%, Oversea-Chinese Banking Corporation (OCBC) at 11.9% and United Overseas Bank (UOB) at 11.8% of the weightage respectively.

Following UOB’s entry into the Net-Zero Banking Alliance (NZBA) in November, all three local banks are now members of the United Nations-backed private sector collaboration. The NZBA counts more than 120 members with some US$70 trillion ($96.7 trillion) in global banking assets.

Member banks must set 2030 decarbonisation targets, or sooner, along with a 2050 target. Before those deadlines arrive, however, how do our banks fare in climate stress tests?

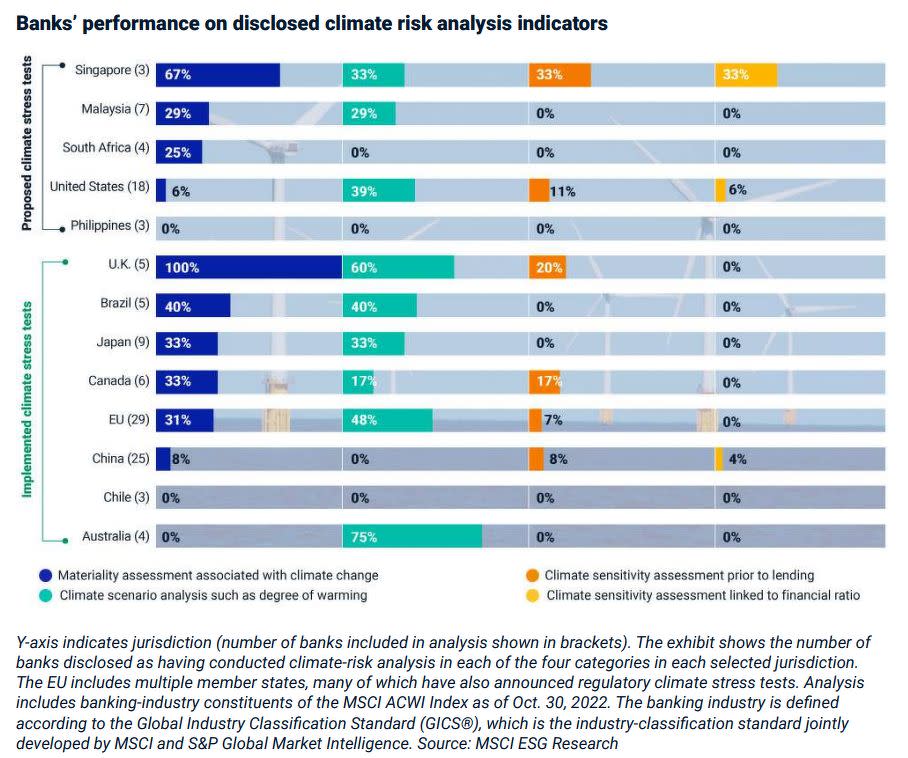

In at least 18 jurisdictions, banks already are, or soon will be, subject to regulatory climate stress tests. Climate scenario analysis is distinct and separate from bank stress tests; they assess the resilience of financial institutions under hypothetical climate scenarios, such as severe flooding.

The US Federal Reserve Board, for one, announced in September that six of the nation’s largest banks — Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo — will participate in a pilot climate scenario analysis exercise throughout 2023.

Yet, most banks’ preparedness leaves much to be desired, according to MSCI.

“While some banks were better placed than others, none could claim to be fully prepared,” write MSCI ESG Research’s Simone Ruiz-Vergote, Sita Subramanian and Liang Anqi in MSCI’s 11th annual ESG & Climate Trends to Watch report, released Dec 7.

MSCI’s report highlights 32 emerging risks set to impact corporations and investors worldwide in 2023 and beyond. These range from emerging asset classes, such as carbon credits, to turning points for ESG assets like green bonds and nuclear energy.

On banks’ climate preparedness, MSCI analysts cite recent climate stress tests conducted by the European Central Bank (ECB), Bank of England, Hong Kong Monetary Authority and Bank of Canada, which revealed data gaps and lack of historical information.

A major challenge lies in underdeveloped modelling capabilities, which limit sector-level analysis. “Fewer than 10% of banks assessed by the ECB use sufficient forward-looking and granular climate risk information in risk management practices,” say MSCI’s analysts.

Climate risk modelling is also hampered by difficulties in measuring so-called Scope 3 emissions — carbon emissions that result from the bank’s entire portfolio of loans and investments.

“With or without net zero targets, coming regulations mean that banks need to be able to quantify the exposure of their balance sheets to climate-related risks going forward,” note Ruiz-Vergote, Subramanian and Liang. “Remediating the climate-related data and modelling shortfalls exposed by climate stress tests to date will be paramount.”

Risk of 8%-9% credit loss per year: MAS

At home, the Monetary Authority of Singapore (MAS) has incorporated a range of long-term climate scenarios as part of its 2022 Industry-Wide Stress Test exercise.

One scenario measured potential material losses for banks and insurers from a severe flooding event across the Asean-5 economies. The result? Banks projected their flood-related credit losses to consume 15% of their net profits.

Physical and transition risks, meanwhile, could have a significant impact on banks’ and insurers’ balance sheets over the long term. MAS warns that annualised credit losses for banks could be 8% to 9% of net profits each year.

“Overall, banks’ and insurers’ climate risk assessment capabilities remain at an early stage, with much scope for iterative refinement as challenges are gradually addressed,” reads MAS’s Financial Stability Review 2022, released Nov 25.

In their feedback, many banks and insurers highlighted that standardised and granular data used to assess climate risks were either unavailable or difficult to obtain, says the regulator.

“For instance, banks and insurers noted extensive gaps in entity-specific data relevant for counterparty-level assessment, especially for smaller and non-listed counterparties. Examples of such data fields include greenhouse gas emissions, locations of individual entities’ assets, and forward-looking information about entities’ transition plans.”

In addition, even where entity-specific data was available, banks and insurers raised potential consistency and comparability issues due to the absence of standardised reporting or disclosure requirements.

In response, some banks employed the Environmental Risk Questionnaire developed by Singapore’s Green Finance Industry Taskforce, which aims to provide a consistent baseline template for banks’ data gathering efforts from their customers.

Released in April, the questionnaire covers a variety of areas, including legal risks, alignment with major reporting frameworks and sustainable finance strategy, among others.

Road to net zero

One of the most important elements to assess for banks is the carbon-related risks that are sitting on the banks’ loan books, which are classified as financed emissions and fall under Scope 3 GHG emissions reporting. These represent both a crucial part of their climate stress tests as well as their long-term net-zero decarbonisation targets.

While these Scope 3 figures have been notoriously difficult to measure, Singapore’s three local banks are tackling the issue progressively, and have mostly released sector-specific decarbonisation roadmaps towards 2050.

DBS took the first stab at target-setting in September. “As Southeast Asia’s largest bank by assets, we recognise the responsibility we have — to support a fair and just transition to the benefit of people across the region in which we operate,” reads its pathway document.

The bank aims to reach net-zero emissions by 2050, with its first “interim checkpoint” in 2030.

DBS’s plan covers nine sectors, of which seven of them — power, oil and gas, automotive, aviation, shipping, steel and real estate — have emissions reduction or alignment delta targets of between 71% and 100% by 2050, against a 2020 baseline.

Notably, DBS aims to slash its absolute emissions from the oil and gas sector by 92% by 2050, from a baseline of 38.6 million tonnes of carbon dioxide equivalent (MtCO2e) in 2020.

That said, DBS stopped short of setting targets on the chemicals and food and agribusiness sectors, citing a lack of data. The bank aims to increase data coverage by 2030, where 66% of its large corporate clients will report their emissions and physical output.

Meanwhile, UOB's commitments cover six sectors — power, automotive, oil and gas, real estate, construction and steel — which make up about 60% of its corporate lending portfolio. UOB also commits to no new project financing for upstream oil and gas projects approved for development after 2022.

By 2050, UOB will reduce emissions intensity for the remaining five sectors by between 85% and 100%, against a 2021 baseline. By the end of this decade, UOB says it will reduce emissions intensity by between 20% and 61% for these five sectors.

Finally, OCBC aims to unveil its sectoral financed emission targets by the first half of 2023.

“The combination of credible emissions reduction targets and comprehensive reporting on financed emissions by the banks is vital,” says Miranda Carr, Head of Applied ESG & Climate Research at MSCI.

These will help assess, on one side, the financial risks they face from climate change, and on the other, their own contributions to climate change, adds Carr. “These dual risks mean the banks have a responsibility to both shareholders and stakeholders on tackling climate change and stronger commitments on this issue should be welcomed.”

Infographic: MSCI ESG Research

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

ADDX fractionalises venture debt fund by Temasek subsidiary and UOB

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance