The Bank of Japan Maintains Negative Interest Rates Yet Again (but Things Might Be About to Change)

The Bank of Japan’s final monetary policy meeting of the year has concluded, and the key short-term interest rate of -0.1% has been maintained again. 100% of the economists surveyed in a Bloomberg poll correctly asserted that the two-day policy meeting would end with rates remaining unchanged, but other changes occurred.

The Bank of Japan (BoJ) further announced somewhat unexpectedly that it would increase the existing plus/minus 0.25 percentage point range for variations in yields on 10-year Japan government bonds to plus/minus 0.50 percentage points.

In contrast to many of its peers on the global stage, Japan’s central bank has been able to keep interest rates below negative for over 6 years since the country’s inflation rate is relatively low compared to that of other industrialised nations.

At their final meetings of the year, the Federal Reserve, the European Central Bank, and the Bank of England, and the Swiss National Bank, all chose for lower rises than they have in previous meetings, but they nevertheless used hawkish rhetoric on prices and interest rates this past week.

Inside the Bank of Japan Decision

In its statement, the bank commented on its country’s economic activity having progressed despite the fact that high commodity prices were an ongoing challenge. It expects the economy to grow at a pace above its potential growth rate.

Exports and industrial production as a whole were said to be trending towards improvement, and the supply-side issues that were felt during and in the immediate aftermath of the pandemic were starting to wane.

Despite the positive messaging of the bank, CPI inflation (minus fresh food) is now at around 3.5%, the highest level in 8 years. Having also raised its inflation projection for 2022 to 2.9% from 2.3%, many believe the Bank of Japan will be under greater pressure to address the rising cost of living soon if nothing changes.

The latest inflation figures from the Statistics Bureau of Japan will be available on Friday and the yearly National Core CPI for November is expected to have increased to 3.7% from 3.6% (above the current 2% target).

Bank of Japan observers, however, believe a change will not occur until April, when Governor Haruhiko Kuroda steps down from his position. Despite the fact that inflation has been above the central bank’s 2% objective for seven consecutive months as of October, Kuroda has advocated for the need to keep ultra-easy policy in place until wage growth becomes more significant.

The statement did also go on to acknowledge risks from the ongoing Ukrainian war, the economic situation in other world economies and developments and impacts of foreign financial markets and exchange rates on Japanese prices and economic activity.

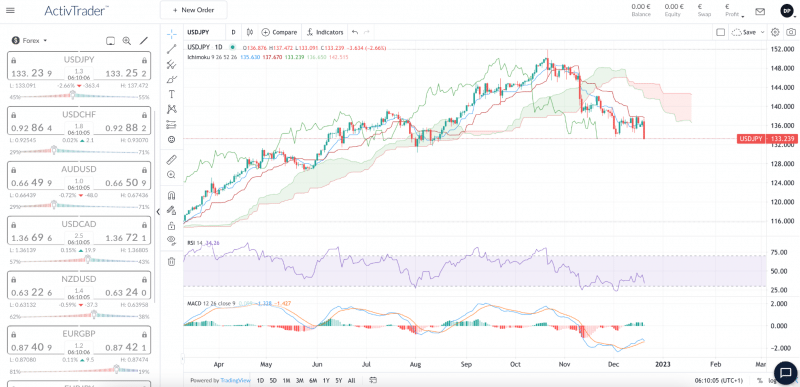

One aspect working in favour of the Bank of Japan currently though has been the recent decrease of the US dollar, which has helped calm fears of a depreciating yen. The Bank of Japan intervened in the currency markets in October when $1 was worth more than 150 yen, but the exchange rate hovering around $1 for 137.36 yen prior to the meeting is expected to have had a calming effect on policymakers and helped to make their decision.

After the news, the value of one dollar in Japanese yen was up by more than 2%, reaching 133.239 at the time of writing. The ActivTrades’ market sentiment indicator shows that its traders aren’t too sure about the direction of the currency pair, as 55% of all traders are buyers and 47% are sellers.

Daily USD/JPY chart – Source: ActivTrader online trading platform

Rising Costs Dampen Manufacturing Outlook

Pricing constraints and the likelihood of decreasing global demand are starting to cloud the future outlook for major sectors in the world’s third-largest economy. A poll by the Bank of Japan indicated that the mood of Japanese manufacturers sank to its lowest level in over two years in the fourth quarter of 2022.

The poll found that large manufacturers and non-manufacturers alike are concerned about the future of their businesses due to increased raw material prices and worries of a decline in global demand. The varied results show just how difficult it is for policymakers to encourage businesses to boost salaries and compensate families for the growing cost of living, which the Bank of Japan regards as essential for inflation to meet its 2% objective.

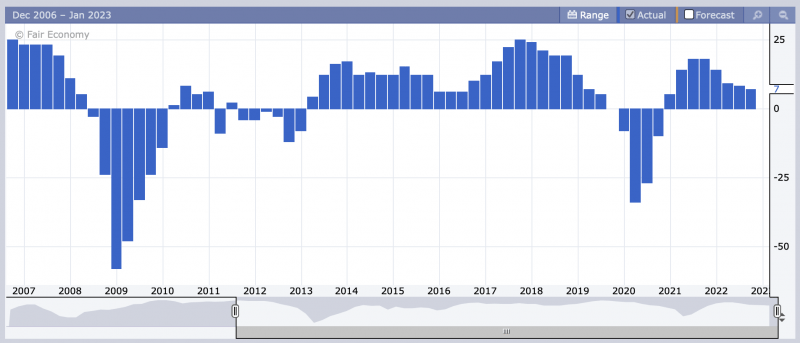

The Tankan Manufacturing Index revealed that the leading indicator for major manufacturers’ mood dropped to plus 7 in December from plus 8 in September, reflecting a decline for the fourth consecutive quarter and the lowest level since March 2021.

Positivity in Services Sector

The non-manufacturing sector in Japan fared far better in the fourth quarter as the easing of COVID-19 limitations boosted demand for travel, food, and personal services. Despite the fact that inflationary pressures are currently a drag on the sector’s potential development, the fourth quarter Tankan Large Non-Manufacturers Index surged to 19, much above both the consensus estimate of 17 and the previous quarter’s mark of 14.

Japan’s economy was boosted by the reopening after the COVID-19 pandemic in the first quarter of this year due to the increase in tourism and the subsequent increase in domestic spending. Retail sales in the nation have been on a declining trend in recent months though, suggesting that the recovery may be stalling.

So, what’s next for the Japanese growth and the Japanese financial markets?

Disclaimer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ActivTrades Corp is authorised and regulated by The Securities Commission of the Bahamas. ActivTrades Corp is an international business company registered in the Commonwealth of the Bahamas, registration number 199667 B.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance