Bank of Baroda Leads Three Key Dividend Stocks In India

The Indian market has shown robust performance recently, with a 1.4% increase in the last week and an impressive 45% climb over the past year. In this context of strong growth and anticipated earnings expansion of 16% per annum, dividend stocks like Bank of Baroda have become particularly appealing for investors seeking both stability and income.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Balmer Lawrie Investments (BSE:532485) | 4.89% | ★★★★★★ |

Bhansali Engineering Polymers (BSE:500052) | 4.44% | ★★★★★★ |

D. B (NSEI:DBCORP) | 4.67% | ★★★★★☆ |

Castrol India (BSE:500870) | 4.16% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.31% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.98% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 9.06% | ★★★★★☆ |

Balmer Lawrie (BSE:523319) | 3.28% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.65% | ★★★★★☆ |

Bank of Baroda (NSEI:BANKBARODA) | 3.06% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

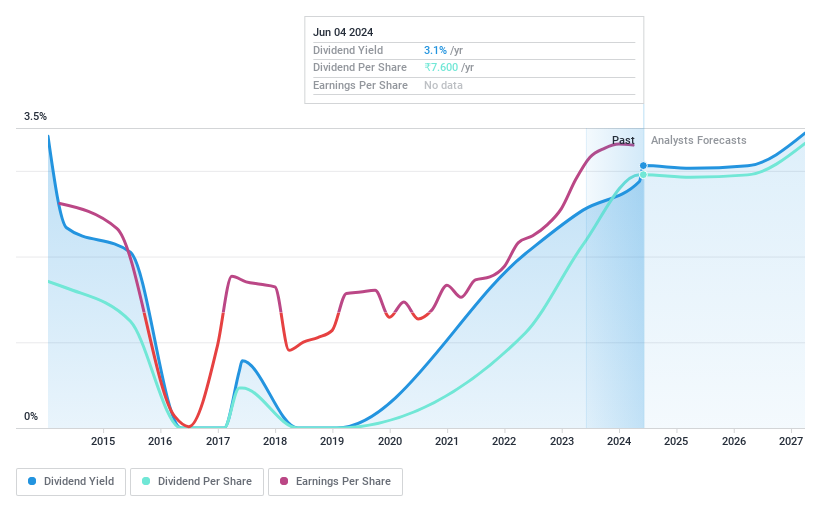

Bank of Baroda

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Baroda Limited, with a market capitalization of approximately ₹1.28 trillion, offers a wide range of banking products and services to individual customers, government entities, and corporations both in India and globally.

Operations: Bank of Baroda Limited generates revenue from various segments, including Treasury (₹3.22 billion), Other Banking Operations (₹1.09 billion), Corporate/Wholesale Banking (₹4.96 billion), and Retail Banking which is split into Digital Banking (₹0.01 billion) and Other Retail Banking (₅4.91 billion).

Dividend Yield: 3.1%

Bank of Baroda, with a recent dividend announcement of INR 7.60 per share for FY 2023-2024, reflects a commitment to shareholder returns despite its earnings dip in Q4 2024 to INR 51.32 billion from INR 52.55 billion the previous year. The bank's dividend coverage remains robust with a low payout ratio of 20.9%, suggesting sustainability. However, concerns linger due to its high bad loans ratio at 2.9% and historically volatile dividend payments, indicating potential risks in maintaining consistent future dividends amidst executive reshuffles and strategic shifts like the potential divestiture of Nainital Bank to PremjiInvest.

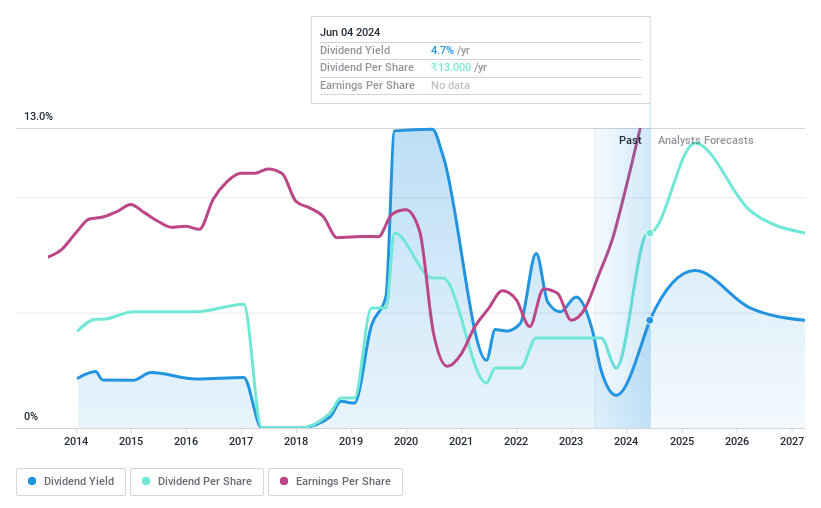

D. B

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D. B. Corp Limited operates in newspaper printing and publishing, radio broadcasting, and digital news platforms, with a market capitalization of approximately ₹49.62 billion.

Operations: D. B. Corp Limited generates revenue primarily through its printing and publishing business, which contributed ₹22.43 billion, and its radio segment, which added ₹1.59 billion.

Dividend Yield: 4.7%

D. B. Corp Limited announced a third interim dividend of INR 8 per share, reflecting a payout ratio of 54.4%, suggesting earnings sufficiently cover dividend payments. Despite recent robust financial performance with net income rising to INR 4,255.23 million from INR 1,690.85 million year-over-year and significant sales growth, the company's historical dividend track record remains unstable with volatile payouts over the past decade. The appointment of Upendra Kumar Gupta as President Finance & Accounts could influence future financial strategies and sustainability of dividends given his extensive experience in finance across various industries.

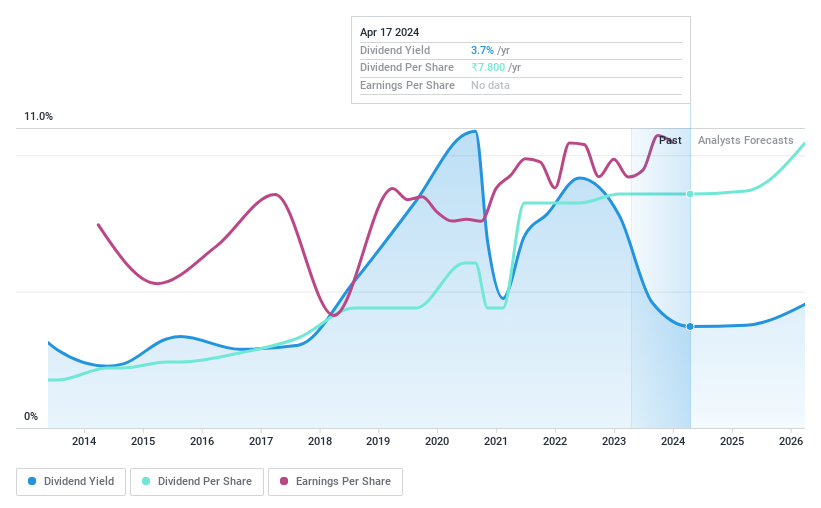

PTC India

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PTC India Limited operates in the trading of power across India, Nepal, Bhutan, and Bangladesh with a market capitalization of approximately ₹53.41 billion.

Operations: PTC India Limited generates revenue primarily through its power trading segment, which accounted for ₹163.77 billion, and its financing business, contributing ₹7.85 billion.

Dividend Yield: 4.3%

PTC India has seen a 5.6% annual growth in earnings over the past five years, supporting its dividend payments which have also increased during the last decade. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 51.8% and 7.7%, respectively. However, despite a low price-to-earnings ratio of 10.5x compared to the Indian market average of 30.2x, PTC's share price has been highly volatile recently, and its dividend track record shows instability with significant fluctuations in payouts over the past ten years.

Delve into the full analysis dividend report here for a deeper understanding of PTC India.

Our valuation report here indicates PTC India may be undervalued.

Turning Ideas Into Actions

Reveal the 27 hidden gems among our Top Dividend Stocks screener with a single click here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:BANKBARODANSEI:DBCORP

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance