Baillie Gifford's Strategic Reduction in Alnylam Pharmaceuticals Holdings

Overview of the Recent Transaction

On June 1, 2024, Baillie Gifford (Trades, Portfolio) executed a significant transaction involving the sale of 590,921 shares of Alnylam Pharmaceuticals Inc (NASDAQ:ALNY), marking a notable reduction in their investment. This move decreased their holding by 8.92%, resulting in a total of 6,032,656 shares. The transaction was carried out at a price of $148.43 per share, impacting Baillie Gifford (Trades, Portfolio)'s portfolio by -0.07%. This strategic adjustment reflects a nuanced shift in the firm's investment stance towards Alnylam Pharmaceuticals.

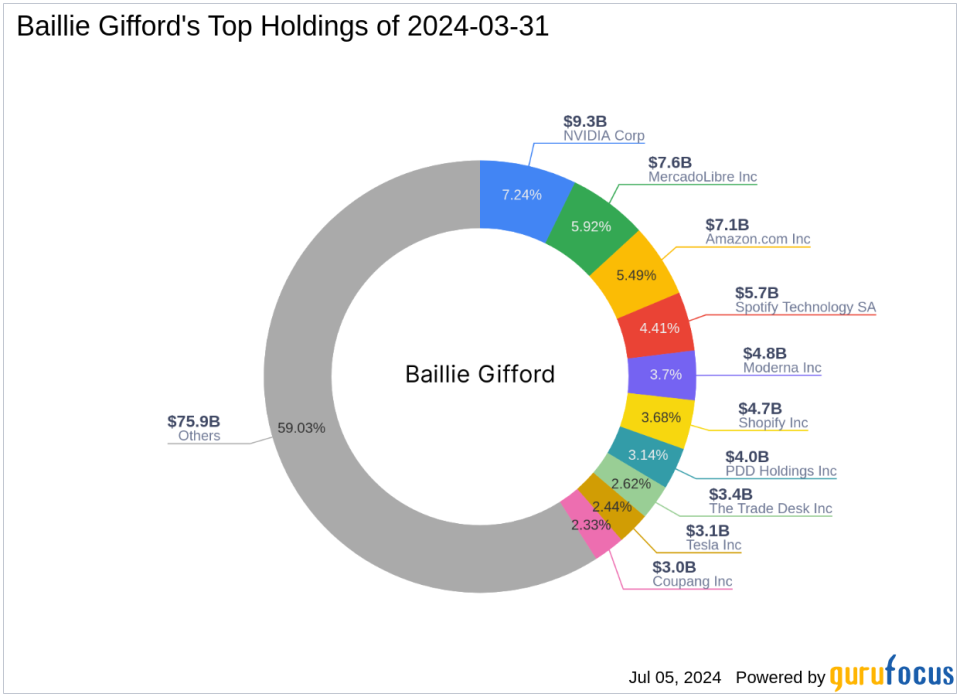

Profile of Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio), an esteemed investment management firm, has been at the forefront of global investment opportunities for over a century. With a commitment to long-term, bottom-up investing, the firm focuses on identifying companies with potential for sustained growth. Baillie Gifford (Trades, Portfolio) manages a diverse portfolio, emphasizing professional excellence and integrity in client relationships. The firm's investment philosophy is deeply rooted in rigorous fundamental analysis and proprietary research, aiming to exploit global opportunities over extended periods.

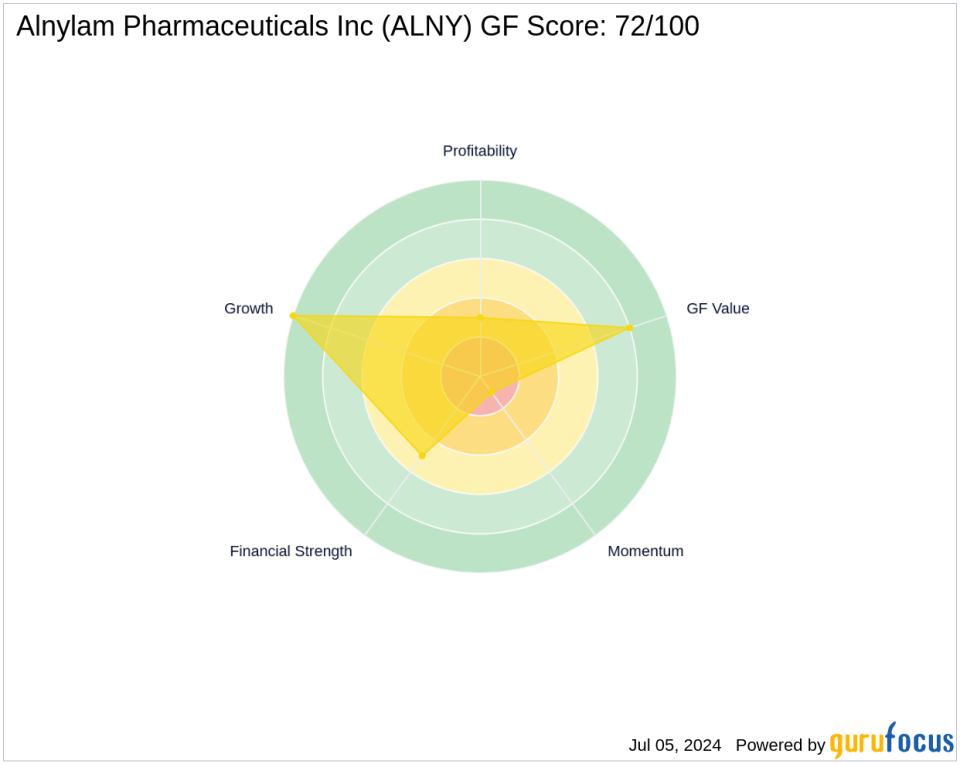

Introduction to Alnylam Pharmaceuticals Inc

Alnylam Pharmaceuticals, a pioneer in RNA interference (RNAi) therapeutics, has been instrumental in developing treatments for various genetic and metabolic disorders. Since its IPO in 2004, Alnylam has launched several successful drugs, including Onpattro and Amvuttra, and maintains a robust pipeline of clinical programs. The company's innovative approach has positioned it as a leader in the biotechnology sector, with a market capitalization of $31.6 billion and a stock price of $249.8, significantly undervalued according to the GF Value of $354.97.

Analysis of the Trade's Impact

The recent transaction by Baillie Gifford (Trades, Portfolio) has slightly reduced its exposure to Alnylam Pharmaceuticals, adjusting the firm's portfolio to a 0.7% position with a 4.77% holding in the company. This recalibration suggests a strategic realignment, possibly in response to the stock's current market valuation and its significant undervaluation relative to the GF Value.

Market Performance and Sector Context

Alnylam Pharmaceuticals has shown impressive market performance with a year-to-date price increase of 28.15% and a staggering 3995.08% increase since its IPO. The biotechnology sector, where Alnylam operates, continues to attract significant investment, reflecting in the robust growth metrics and innovative product pipelines characteristic of this industry. Baillie Gifford (Trades, Portfolio)'s continued investment, albeit reduced, underscores a calculated approach to capitalizing on sectoral growth while managing portfolio risk.

Insights from Other Significant Investors

Other notable investors in Alnylam Pharmaceuticals include Vanguard Health Care Fund (Trades, Portfolio), Dodge & Cox, and Joel Greenblatt (Trades, Portfolio). These investments highlight the broad confidence in Alnylams market strategy and its potential for sustained growth. Comparative analysis of these holdings provides valuable insights into different investment approaches and confidence levels in Alnylam's future.

Future Outlook and Industry Trends

The biotechnology sector is poised for continued innovation, with RNAi therapeutics playing a crucial role. Alnylam Pharmaceuticals, with its strong pipeline and market presence, is well-positioned to capitalize on these trends. Investors considering this sector should closely monitor industry developments and company-specific growth metrics to make informed decisions.

This strategic move by Baillie Gifford (Trades, Portfolio), amidst evolving market conditions and Alnylam's promising outlook, offers a nuanced glimpse into the dynamics of sophisticated investment strategies in the biotechnology sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance