Baillie Gifford Adjusts Stake in Duolingo Inc

Overview of Baillie Gifford (Trades, Portfolio)'s Recent Transaction

On December 1, 2023, Baillie Gifford (Trades, Portfolio), a prominent investment management firm, made a significant adjustment to its investment in Duolingo Inc (NASDAQ:DUOL), a leading technology company in the language learning space. The firm reduced its holdings by 895,203 shares, resulting in a -19.94% change in its position. This transaction had a -0.17% impact on Baillie Gifford (Trades, Portfolio)'s portfolio, with the trade executed at a price of $213.30 per share. Following the sale, Baillie Gifford (Trades, Portfolio)'s remaining stake in Duolingo Inc amounts to 3,593,426 shares, representing a 0.7% position in the firm's portfolio and a 10.04% ownership of the traded stock.

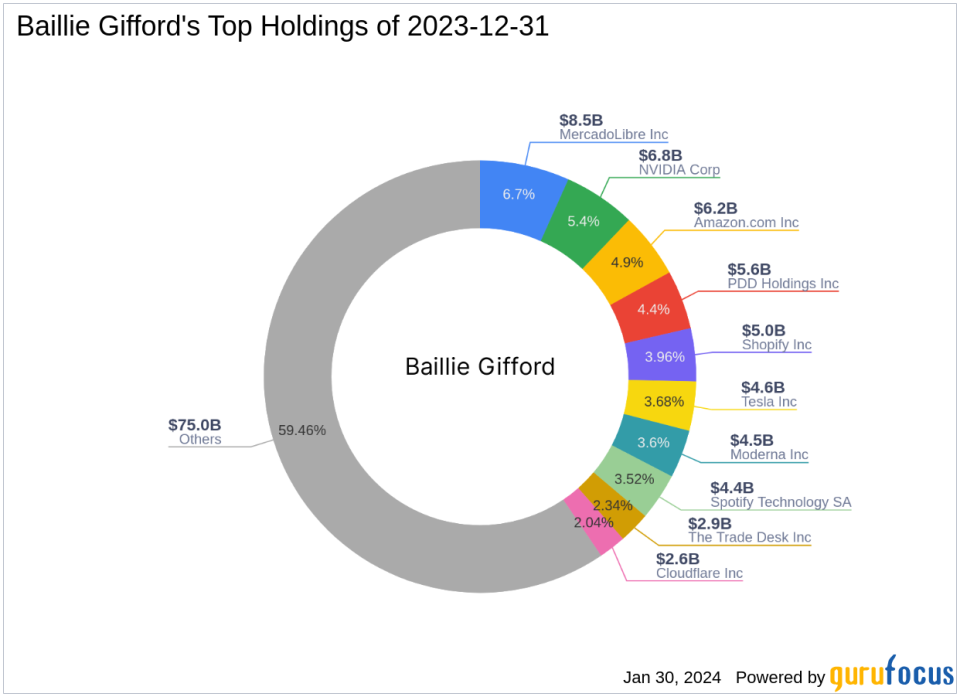

Profile of Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio), with over a century of experience in investment management, operates with a client-first philosophy, often closing products to new business to maintain the quality of service and strategy integrity. The firm manages assets for some of the world's largest professional investors, including pension funds and financial institutions across various continents. Baillie Gifford (Trades, Portfolio)'s investment approach is rooted in thorough fundamental analysis and proprietary research, aiming to identify companies with the potential for sustainable, above-average growth over a typical five-year horizon or more. The firm's top holdings include tech giants such as Amazon.com Inc (NASDAQ:AMZN) and NVIDIA Corp (NASDAQ:NVDA), reflecting its strong inclination towards the technology sector.

Introduction to Duolingo Inc

Duolingo Inc, founded in the USA and publicly traded since July 28, 2021, has revolutionized language learning through its mobile platform. The company's offerings, which include the Duolingo Language Learning App and the Duolingo English Test, leverage advanced data analytics and artificial intelligence to enhance the learning experience. With a market capitalization of $8.09 billion, Duolingo generates revenue through subscriptions, in-app advertising, and its English proficiency test. Despite its innovative approach and market presence, the company's financial performance indicates a PE Ratio of 0.00, suggesting it is currently not profitable.

Trade Impact Analysis

Baillie Gifford (Trades, Portfolio)'s decision to reduce its stake in Duolingo Inc has slightly decreased the firm's exposure to the education technology sector. The trade's impact on the portfolio was minimal, but it reflects a strategic move by the firm, possibly in response to Duolingo's current financial metrics and market performance. With a current stock price of $192.62, Duolingo's shares have declined by -9.7% since the trade date, indicating a potential reassessment of the stock's value by Baillie Gifford (Trades, Portfolio).

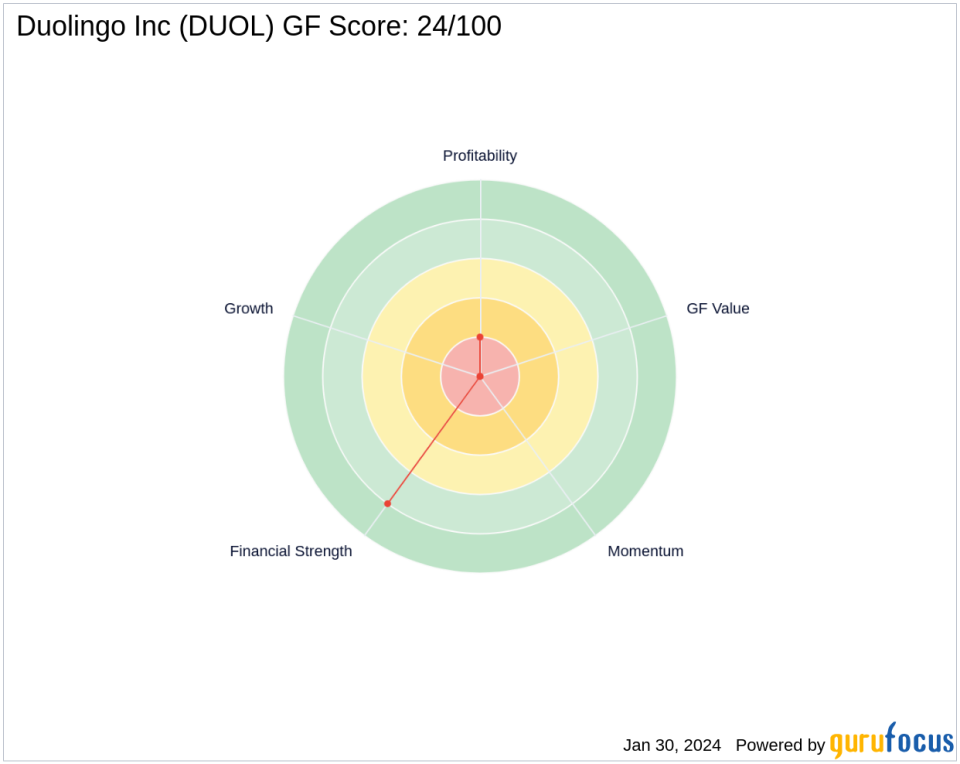

Market Performance and Sector Context

Duolingo's stock performance has been under scrutiny, with a GF Score of 24/100, indicating potential challenges ahead. The company's financial strength and profitability ranks are not particularly strong, with a Growth Rank and GF Value Rank of 0/10. In the broader context, Baillie Gifford (Trades, Portfolio)'s top sectors include Technology and Consumer Cyclical, with Duolingo fitting into the firm's technology-oriented investment strategy. The software industry, where Duolingo operates, is highly competitive and dynamic, which may influence the firm's investment decisions.

Other Notable Investors in Duolingo

Gotham Asset Management, LLC stands as the largest guru shareholder in Duolingo Inc, while other notable investors like Ron Baron (Trades, Portfolio) also maintain stakes in the company. The presence of these significant investors underscores the interest in Duolingo's business model and market potential, despite the current financial performance.

Conclusion

Baillie Gifford (Trades, Portfolio)'s recent reduction in Duolingo Inc shares is a strategic move that aligns with the firm's long-term investment philosophy and portfolio management. While the trade has had a limited impact on Baillie Gifford (Trades, Portfolio)'s overall portfolio, it reflects a careful reassessment of Duolingo's growth prospects and market position. For value investors, this transaction highlights the importance of monitoring financial performance indicators and market trends when making investment decisions. The potential implications of Baillie Gifford (Trades, Portfolio)'s trade decision could signal a shift in investor sentiment towards Duolingo Inc, warranting close attention to future developments.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance