BAE Systems (BAESY) Wins $754M Contract for Armored Vehicles

BAE Systems Inc.’s BAESY Land and Armaments business unit recently secured a modification contract for procuring Armored Multi-Purpose Vehicles (AMPVs). The award has been offered by the Army Contracting Command, Detroit Arsenal, MI.

Valued at $754 million, the contract is projected to be completed by Feb 28, 2027.

What Favors BAE Systems?

With widespread geopolitical events, such as the Russian invasion of Ukraine and the ongoing hostility in the Middle East, having cast a shadow of increased militant threats across the globe, nations are rapidly expanding their defense arsenal. Considering the fact that armored combat vehicles like AMPVs are the primary offensive weapons in land missions, demand for technologically advanced combat vehicles is also on the rise.

It is imperative to mention here that BAE Systems is a renowned designer and manufacturer of both tracked and amphibious combat vehicles. Notably, in the United States, the company builds and upgrades a number of tracked combat vehicles, including the Bradley Fighting vehicles, M109 self-propelled howitzers and M88 recovery vehicles, in addition to AMPVs.

Notably, the AMPV is a family of next-generation, highly survivable vehicles essential to the future of the U.S. Army and its allies. It is the U.S. Army’s program to replace the Vietnam War-era and legacy M113 Family of Vehicles. The solid demand that AMPV enjoys in the U.S. combat vehicle space can be gauged from the fact that in August 2023, BAE Systems won an award worth $797 million for beginning the full-rate production of AMPV family of vehicles at a high and sustained rate. The latest contract win is another strong testament to that.

During 2023, the company’s Combat Mission Systems team in the United States expanded its operations at BAESY’s York, PA, site. It did so to facilitate the full-rate production of AMPVs. Successful deliveries of the armored vehicles should boost BAESY’s revenues in the near future.

What Lies Ahead?

As combat vehicles form an integral part of any military missions and arm them in their land warfare affairs, growth prospects for the global armored vehicle market remain solid with increasing defense spending worldwide.

To this end, the Morder Intelligence firm projects the global armored fighting vehicles market to register a CAGR of 5% during 2024-2029. Such abounding growth trends indicate ample growth opportunities for BAE Systems, as it enjoys a lucrative position in the armored vehicle market.

BAESY apart, other defense majors that are likely to reap the benefits of the expanding armored fighting vehicle market are Lockheed Martin LMT, RTX Corp. RTX and General Dynamics GD.

Lockheed’s manufacturing facilities in Ampthill, Bedfordshire, is its Armored Vehicle Centre of Excellence where the company designs, develops and delivers turrets for the British Army’s AJAX vehicles. LMT is currently engaged in the manufacture, integration and testing of 245 turrets at the Ampthill site. With increased demand for armored vehicles, the need for LMT-made turrets will also rise, thereby bolstering its future revenue growth.

Lockheed has a long-term earnings growth rate of 4.2%. The Zacks Consensus Estimate for LMT’s 2024 sales implies an improvement of 2.4% from the 2023 reported figure.

RTX, in collaboration with American Rheinmetall Vehicles, Textron Systems, L3Harris Technologies, Allison Transmission and Anduril Industries, is digitally designing America’s next-generation infantry fighting vehicle named Lynx. The Lynx XM30 incorporates RTX’s weapons, sensors, artificial intelligence and system integration expertise.

RTX’s long-term earnings growth rate is 10.2%. The Zacks Consensus Estimate for RTX’s 2024 sales indicates an improvement of 5.7% from the 2023 reported figure.

General Dynamics’ Land Systems business unit delivers powerful military vehicles, including the Abrams tank, Stryker combat vehicles, LAVs and AJAX armored fighting vehicles. In January 2024, the company announced that it has successfully completed the testing of its Advanced Reconnaissance Vehicle (ARV), which has been designed to serve as the Marine Corps’ “quarterback” on the mobile and multi-domain battlefield.

GD’s long-term earnings growth rate is 10.8%. The Zacks Consensus Estimate for GD’s 2024 sales indicates a surge of 9.1% from the prior-year reported figure.

Price Movement

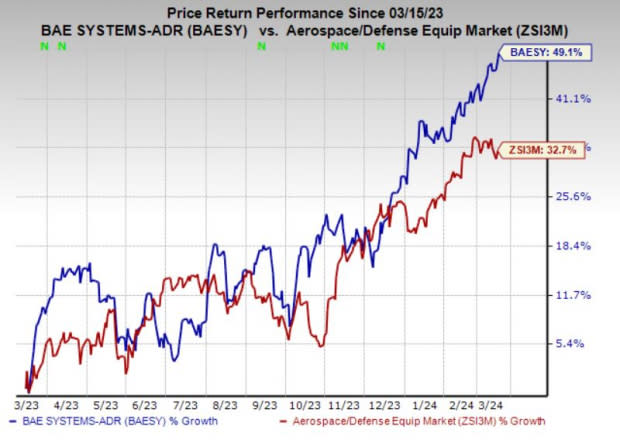

In the past year, shares of BAE Systems have rallied 49.1% compared with the industry’s growth of 32.7%.

Image Source: Zacks Investment Research

Zacks Rank

BAE Systems currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Bae Systems PLC (BAESY) : Free Stock Analysis Report

RTX Corporation (RTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance