B2Gold (BTG) Provides Upbeat Assessment Results for Gramolate

B2Gold Corp. BTG has announced the results of a new Preliminary Economic Assessment (“PEA”) for its fully owned Gramalote gold project, which indicate its potential to become a medium-scale, low-cost, open pit gold mine. The Gramalote Project boasts significant infrastructure advantages, such as a reliable water supply, proximity to highways that suggest efficient transportation links and access to a skilled labor force. Excellent metallurgical characteristics of the ore, which ensure high recovery rates at low processing costs, and a relatively low strip ratio add to the operational advantages.

The assessment, prepared in accordance with National Instrument 43-101, indicates that the Gramalote Project has an estimated life of 12.5 years. Over its lifespan, it is estimated to yield an average of 185,000 ounces of gold per year. The processing rate is envisioned to be 6 million tons per year. The average grade to be processed is estimated at 1.26 grams per ton (g/t) of gold over the first five years and 1.00 g/t of gold over the life of the project. The project is expected to have the lowest quartile all-in-sustaining costs of $886 per gold ounce over its life.

The project’s estimated pre-production capital runs to $807 million. This includes approximately $93 million for mining equipment and $63 million for contingency. Free cash flow (after tax) is expected at around $1.38 billion over the life of the project.

Earlier the Gramalote project operated under a joint venture between B2Gold and AngloGold Ashanti plc AU, with each holding 50%. While the project offered benefits in the form of a low strip ratio, declining processing costs and a favorable relationship with the local stakeholders, the 2022 Gramolate study suggested that it failed to meet the investment threshold of each joint venture partner. B2Gold, in Sep 2023, acquired AngloGold’s stake and became the sole owner of the Gramalote project.

Per BTG, the previous analysis of the project was done on a larger scale to provide meaningful production growth to both companies. However, under a single owner, it would be possible to analyze lower capital intensity and higher-return development opportunities for the project.

Following the acquisition, B2Gold completed a detailed review of the Gramalote Project in 2023, examining various aspects such as size, power supply, mining and processing options, tailings design, resettlement and potential construction sequencing. It also explored options to reduce costs. Per its results, the company initiated the PEA study for the project.

The mineral resource estimate for the Gramalote Project that forms the basis for the PEA includes indicated mineral resources of 192.2 million tons grading 0.68 g/t gold for a total of 4,210,000 ounces of gold and inferred mineral resources of 85.4 million tons grading 0.54 g/t gold for a total of 1,480,000 ounces of gold.

B2Gold plans to start feasibility work with the targeted completion by mid-2025. The main work programs for the feasibility study include geotechnical and environmental site investigations for the processing plant and waste dump footprints, as well as capital and operating cost estimates.

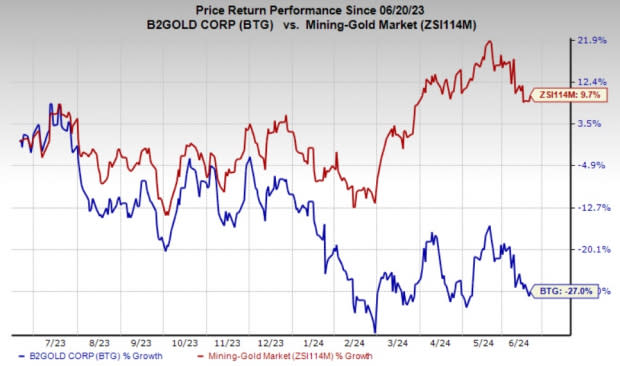

Price Performance

Shares of the company have lost 27% in the past year against the industry’s 9.7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

B2Gold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS and Ecolab Inc. ECL. CRS sports a Zacks Rank #1 (Strong Buy) at present and ECL carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $4.31 per share, which indicates year-over-year growth of 278%. The consensus estimate for earnings has moved 3% north in the past 30 days. It has an average trailing four-quarter earnings surprise of 15.1%. CRS shares have surged 93% in a year.

The Zacks Consensus Estimate for Ecolab’s 2024 earnings is pegged at $6.59 per share, indicating an increase of 26.5% from the prior year’s reported number. It has an average trailing four-quarter earnings surprise of 1.3%. ECL shares have gained 34.7% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

AngloGold Ashanti PLC (AU) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

B2Gold Corp (BTG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance