Bénéteau And Two Other Leading Dividend Stocks On Euronext Paris

Amidst a backdrop of political shifts and economic uncertainties across Europe, France's market has shown resilience with the CAC 40 Index climbing significantly. In such an environment, dividend stocks like Bénéteau offer investors potential stability and steady returns, making them an appealing choice for those looking to navigate through fluctuating markets.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 7.13% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 9.61% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.86% | ★★★★★★ |

Métropole Télévision (ENXTPA:MMT) | 9.77% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.56% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.17% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.08% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 4.00% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.44% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 8.06% | ★★★★★☆ |

Click here to see the full list of 39 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

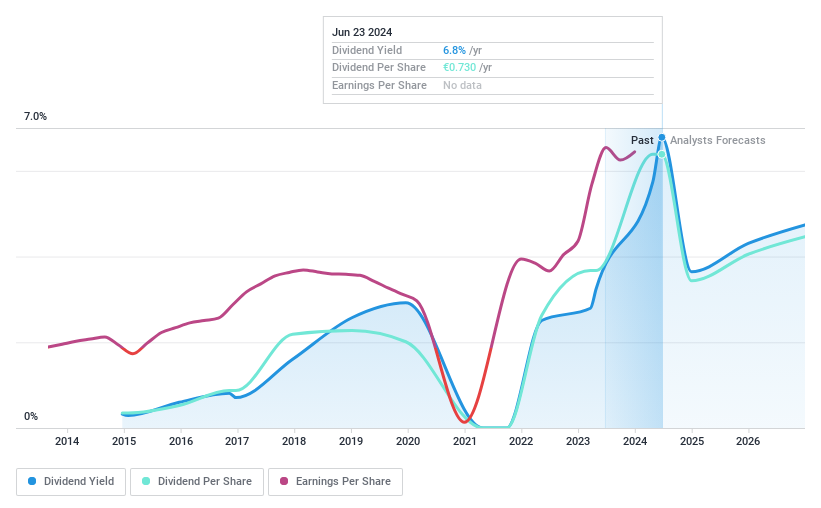

Bénéteau

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bénéteau S.A. is a company based in France that designs, manufactures, and sells boats and leisure homes both domestically and internationally, with a market capitalization of approximately €0.83 billion.

Operations: Bénéteau S.A. generates €1.47 billion in revenue primarily from its boat manufacturing and sales segment.

Dividend Yield: 7.1%

Bénéteau offers a high dividend yield at 7.12%, ranking in the top 25% of French dividend payers. Despite this, its dividends show signs of instability and unreliability over the past decade, with significant fluctuations and no consistent growth pattern. The company's earnings have increased by 84.1% over the last year, yet forecasts suggest a potential average decline of 1% annually for the next three years. Additionally, while Bénéteau's payout ratio stands at a sustainable 37.2%, its dividends are not well supported by either earnings or free cash flows, raising concerns about future sustainability and reliability in its dividend payments.

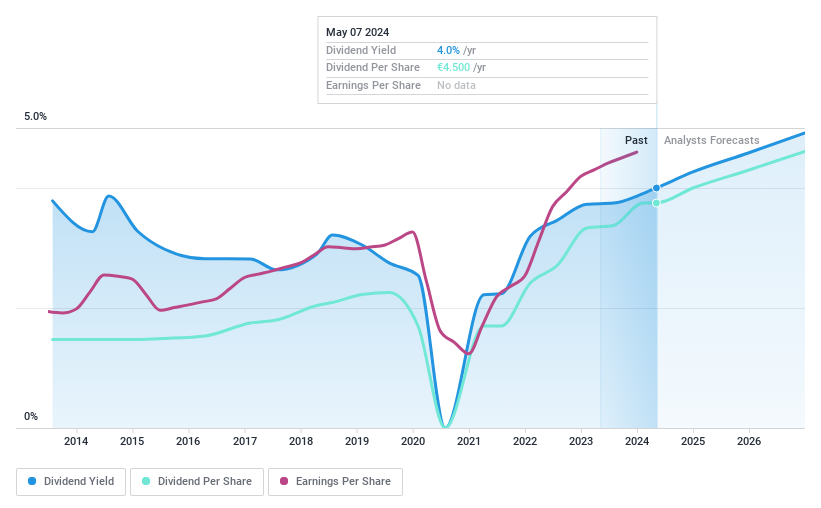

Vinci

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vinci SA operates in concessions, energy, and construction sectors across France and globally, with a market capitalization of approximately €59.90 billion.

Operations: Vinci SA's revenue is primarily generated through its VINCI Construction segment, which includes Eurovia and totals €31.46 billion, followed by VINCI Energies at €19.33 billion, and its concessions segments with VINCI Autoroutes at €6.88 billion and VINCI Airports at €4.23 billion.

Dividend Yield: 4.3%

Vinci SA demonstrates a mixed outlook for dividend investors. While the company's dividends have increased over the past decade, they exhibit volatility and unreliability, with significant drops observed. Currently, Vinci's dividend yield stands at 4.26%, which is below the top quartile of French dividend payers at 5.21%. However, its dividends are sustainably covered by earnings and cash flows, with payout ratios of 54.4% and 35.4% respectively, indicating a reasonable level of safety in its dividend payments amidst a backdrop of fluctuating performance.

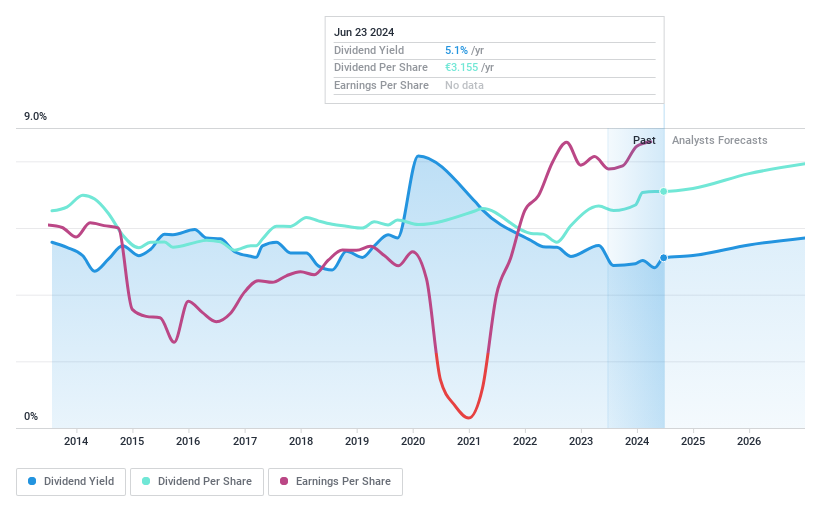

TotalEnergies

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TotalEnergies SE is a diversified energy company engaged in the production and marketing of oil, biofuels, natural gas, green gases, renewables, and electricity across various regions including France, the rest of Europe, North America, and Africa; it has a market capitalization of approximately €149.54 billion.

Operations: TotalEnergies SE generates revenue through diverse segments including Integrated LNG ($22.16 billion), Integrated Power ($29.10 billion), Marketing & Services ($71.62 billion), Refining & Chemicals ($135.72 billion), and Exploration & Production ($47.53 billion).

Dividend Yield: 4.8%

TotalEnergies, a major player in the energy sector, has demonstrated a commitment to sustainability and strategic growth through recent alliances and technological advancements. Notably, its partnership with SLB on July 2, 2024, focuses on developing digital solutions for energy efficiency and carbon capture. This move aligns with its broader strategy to enhance operational efficiencies across its global operations. However, TotalEnergies faces challenges in maintaining dividend attractiveness; its recent dividend increase is modest compared to peers and the payout ratio stands at 37.4%, reflecting a cautious approach amid fluctuating earnings forecasts. Despite these efforts, the company's dividends have shown volatility over the past decade, raising concerns about their reliability for long-term investors seeking stable returns from dividend stocks in France.

Take a closer look at TotalEnergies' potential here in our dividend report.

Our valuation report unveils the possibility TotalEnergies' shares may be trading at a discount.

Taking Advantage

Access the full spectrum of 39 Top Euronext Paris Dividend Stocks by clicking on this link.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:BEN ENXTPA:DG and ENXTPA:TTE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance