Azalea Asset Management to launch Astrea 8 PE bond with total offering size of US$585 mil

The public offer for Class A-1 bonds is $250 million while the public offer for Class A-2 bonds is US$50 million.

Azalea Asset Management will be listing the Astrea 8 private equity (PE) bonds in July. This is the fifth listed retail bond that gives retail investors in Singapore access to the PE asset class. Astrea IV was the first such bond to be available to Singapore retail investors. It was launched in June 2018.

The preliminary prospectus was lodged by the bond’s issuer, Astrea 8 Pte. Ltd. on July 1. Astrea 8 is indirectly wholly-owned by Azalea Asset Management, which is, in turn, wholly-owned by Seviora Holdings. Seviora Holdings is indirectly wholly-owned by Temasek Holdings.

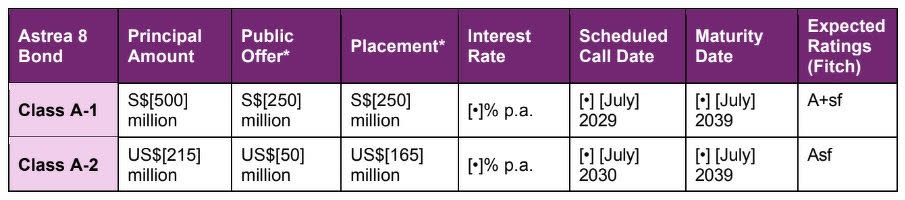

The total offering size of the Astrea 8 bonds is approximately US$585 million ($792.6 million). The figure comprises $500 million worth of Class A-1 bonds and US$215 million worth of Class A-2 bonds. Both classes are ranked equally in terms of priority of payment.

The public offer for Class A-1 bonds is $250 million while the public offer for Class A-2 bonds is US$50 million.

Chart: Astrea 8 Pte. Ltd.

The scheduled call date for Class A-1 bonds is on July 2029 while the scheduled call date for Class A-2 bonds is on July 2030. Both the Class A-1 bonds and Class A-2 bonds will mature on July 2039.

It is mandatory for Astrea 8 to redeem both bonds on their respective call dates if several conditions are met. For instance, for Class A-1 bonds, the bonds need to be redeemed if the cash set aside in the reserves accounts and reserves custody accounts are sufficient to redeem the bonds. There also needs to be no outstanding credit facility loan.

For Class A-2 bonds, there needs to be no outstanding Class A-1 bonds to be redeemed; the cash set aside in the reserves accounts and reserves custody accounts also need to be enough to redeem the bonds. Like the Class A-1 bonds, there needs to be no outstanding credit facility loan.

If the Class A-1 and Class A-2 bonds are not redeemed on their respective scheduled call dates, there will be a one-time 1.0% per annum step-up in the respective rates.

Astrea 8 PE bonds are backed by cash flows from a portfolio of 38 PE funds managed by 27 reputable general partners.

As at Dec 31, 2023, these funds invest in 1,028 companies across various regions, vintages and sectors. The total portfolio net asset value (NAV) for these funds is US$1.47 billion with a fund strategy of 76.4% buy out and 23.6% growth equity. The funds are mostly based in the US (63%) followed by Europe (20%) and Asia (17%). The vintage years range from 2015 to 2020.

Applications for the Class A-1 and Class A-2 public offer bonds can be made from 9am on July 11 to 12pm on July 17.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Temasek’s Azalea raises US$356 mil for Altrium co-invest and growth funds in first closing

Investors can now invest in digital tokens with exposure to Astrea VI Bonds at lower minimum rate

Astrea VI Private Equity Bonds opens retail tranche; strong demand expected

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance