Axfood And 2 Other Strong Dividend Stocks In Sweden

Amidst a backdrop of fluctuating global markets and political uncertainties in Europe, Sweden's market presents an intriguing area for investors seeking stability through dividend stocks. In times of market volatility, dividend-paying stocks are often considered a prudent investment choice due to their potential to provide steady income streams.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Betsson (OM:BETS B) | 6.11% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 4.23% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.40% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.36% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.07% | ★★★★★☆ |

Duni (OM:DUNI) | 4.84% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.59% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.35% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.08% | ★★★★★☆ |

AB Traction (OM:TRAC B) | 3.99% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

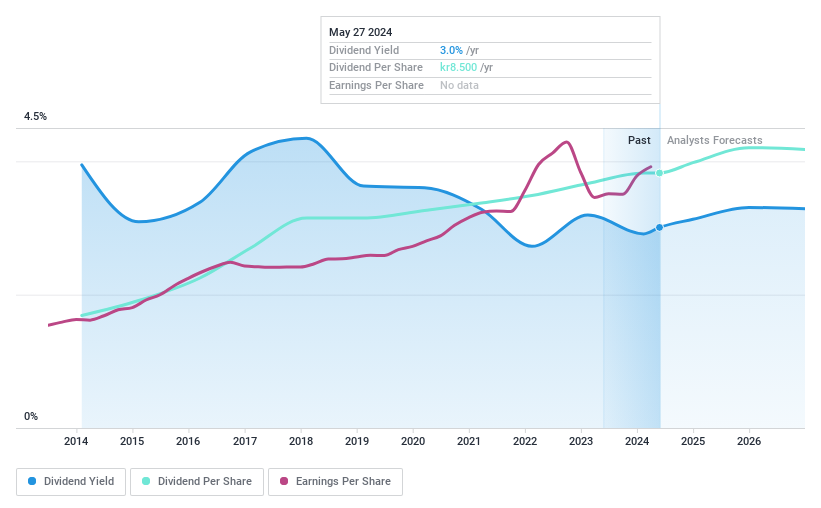

Axfood

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Axfood AB operates primarily in Sweden, focusing on food retail and wholesale, with a market capitalization of approximately SEK 59.84 billion.

Operations: Axfood AB's revenue is primarily generated through its segments: Dagab at SEK 74.94 billion, Willys at SEK 44.54 billion, Home Purchase at SEK 7.57 billion, and Snabbgross at SEK 5.35 billion.

Dividend Yield: 3.1%

Axfood's dividend yield of 3.07% is modest compared to Sweden's top dividend payers. However, its dividends have shown stability and growth over the past decade, supported by a payout ratio of 75.1% and a cash payout ratio of 34.8%, indicating that earnings and cash flows adequately cover dividend payments. Recent executive changes, including the appointment of Simone Margulies as CEO, could influence future strategies but have yet to impact financials significantly, as evidenced by solid earnings growth reported in Q1 2024 with sales reaching SEK 20.25 billion and net income at SEK 561 million.

Unlock comprehensive insights into our analysis of Axfood stock in this dividend report.

Our expertly prepared valuation report Axfood implies its share price may be too high.

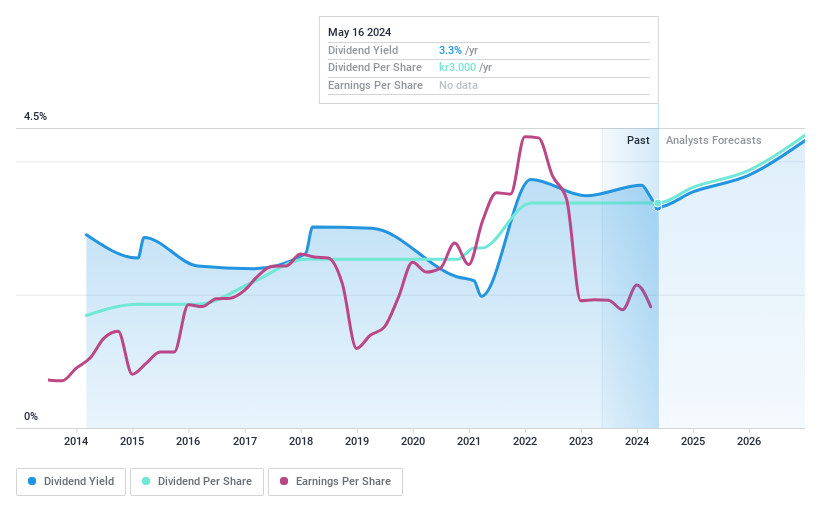

Husqvarna

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Husqvarna AB (publ) specializes in manufacturing and distributing outdoor power products, watering products, and lawn care equipment, with a market capitalization of approximately SEK 50.22 billion.

Operations: Husqvarna AB's revenue is primarily generated through three segments: Gardena at SEK 13.06 billion, Husqvarna Construction at SEK 8.23 billion, and Husqvarna Forest & Garden at SEK 29.38 billion.

Dividend Yield: 3.4%

Husqvarna's recent dividend affirmation at SEK 3.00 per share reflects a modest yield in the context of Sweden's dividend landscape, with payments structured in two installments across the fiscal year. Despite a dip in Q1 2024 sales to SEK 14.72 billion and net income to SEK 1.32 billion, the company maintains a reasonable cash payout ratio of 58.6%, suggesting that current dividends are supported by cash flows. However, the high payout ratio of 92.8% indicates potential pressure on future dividend sustainability amidst ongoing executive transitions and strategic product innovations like battery-powered chainsaws with clutches, aimed at enhancing operational efficiency.

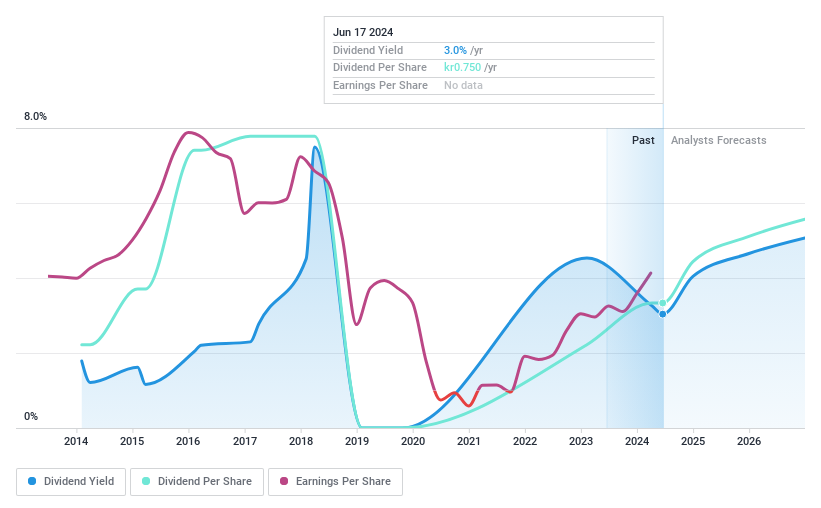

ITAB Shop Concept

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ITAB Shop Concept AB specializes in designing solutions and providing customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores, with a market capitalization of approximately SEK 5.31 billion.

Operations: ITAB Shop Concept AB generates its revenue primarily from the Furniture & Fixtures segment, amounting to SEK 6.21 billion.

Dividend Yield: 3%

ITAB Shop Concept AB's dividend sustainability is supported by a payout ratio of 47.9% and a cash payout ratio of 22.2%, indicating that dividends are well-covered by both earnings and cash flows. However, the dividend yield of 3.04% is below the top quartile of Swedish dividend stocks at 4.29%. Despite this, ITAB has shown an ability to increase dividends, as evidenced by the recent announcement on May 15, 2024, setting a dividend at SEK 0.75 per share for the fiscal year 2023.

Summing It All Up

Click here to access our complete index of 21 Top Dividend Stocks.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:AXFOOM:HUSQ BOM:ITAB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance