Avoiding Nvidia Causes Fundsmith Equity To Lag Behind Benchmark In First Half

Nvidia Corp (NASDAQ:NVDA) has been the subject of significant debate among investment managers, as highlighted by Terry Smith’s recent comments on his decision to avoid the tech giant.

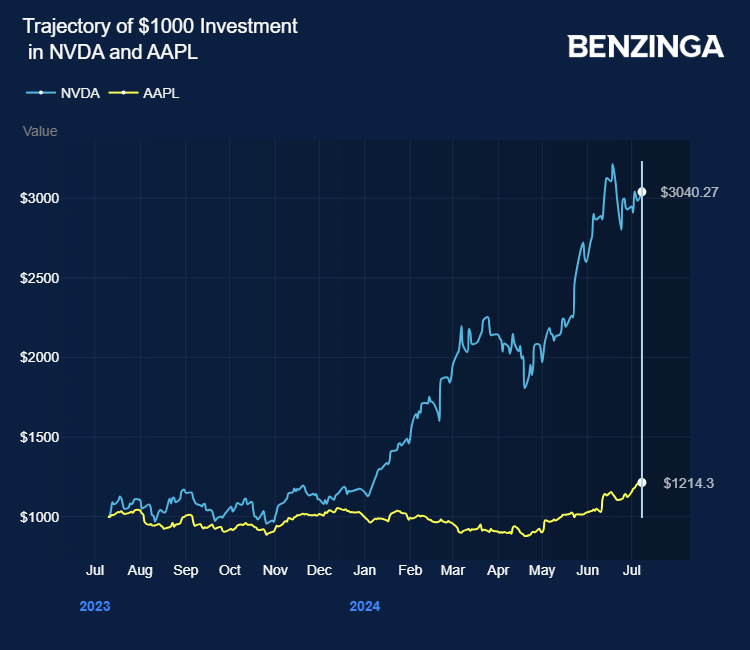

Smith’s global fund, Fundsmith Equity, lagged behind its benchmark in the first half of the year, missing out on the semiconductor manufacturer’s stock surge, the Financial Times reports.

Also Read: Analysts Boost Nvidia and AMD as AI Market Continues to Expand

The $32 billion (25 billion Sterling Pounds) Fundsmith Equity portfolio, which prioritizes growth stocks, holds stakes in major US tech companies like Apple Inc (NASDAQ:AAPL), Meta Platforms, Inc (NASDAQ:META), and Microsoft Corp (NASDAQ:MSFT).

However, Smith opted out of investing in Nvidia, citing unpredictability in its future outlook.

Nvidia, briefly valued at over $3 trillion last month, alongside other tech giants like Microsoft, Amazon.Com Inc (NASDAQ:AMZN), Meta, and Apple, made up nearly 60% of the S&P 500’s 14% rise in the first half of the year.

In the six months ending June, Fundsmith Equity returned 9.3%, trailing the MSCI World Index’s 12.7% return in sterling terms.

The S&P 500 index saw a 17% return over the same period, driven significantly by Nvidia’s performance, which accounted for a quarter of the gain.

Price Actions: NVDA shares traded higher by 1.64% at $130.29 at the last check on Tuesday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Avoiding Nvidia Causes Fundsmith Equity To Lag Behind Benchmark In First Half originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yahoo Finance

Yahoo Finance