Avoid TPG Telecom On The ASX And Explore One Better Dividend Stock Option

The appeal of dividend stocks in the Australian market is undeniable, especially for those looking to generate income. However, caution is advised as some companies exhibit warning signs that could affect their ability to sustain dividends. For instance, firms like TPG Telecom with high payout ratios may struggle to maintain their dividend payments, posing risks for long-term investors.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Collins Foods (ASX:CKF) | 3.11% | ★★★★★☆ |

Lindsay Australia (ASX:LAU) | 6.59% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 5.22% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.02% | ★★★★★☆ |

Fortescue (ASX:FMG) | 9.17% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 7.12% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.09% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.49% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.92% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.17% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top ASX Dividend Stocks screener.

Let's take a closer look at one of our picks from the screened companies and one you may wish to avoid.

Top Pick

Ricegrowers

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ricegrowers Limited is a global rice food company with operations spanning Australia, New Zealand, the Pacific Islands, the Middle East, and the United States, boasting a market capitalization of A$508.42 million.

Operations: Ricegrowers' revenue is generated through several segments, with Riviana contributing A$222.01 million, Cop Rice A$252.75 million, Rice Food A$121.03 million, Rice Pool A$498.11 million, and International Rice A$894.03 million.

Dividend Yield: 7.0%

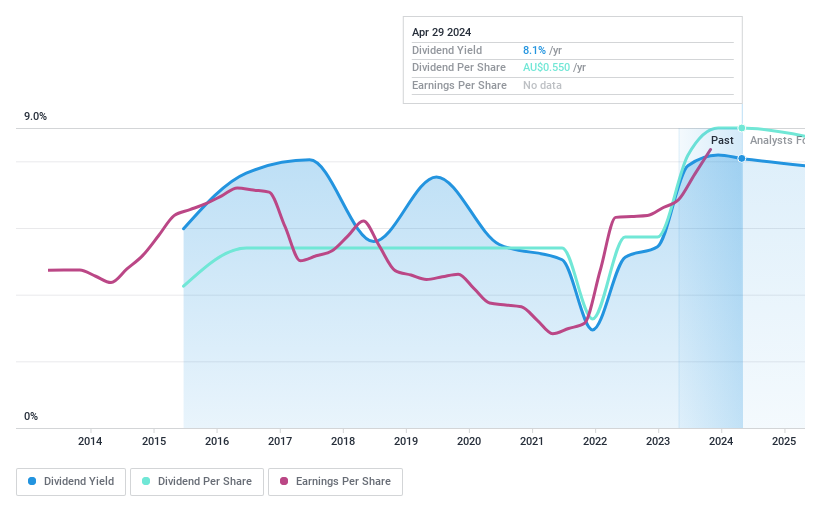

Ricegrowers Limited (SunRice Group), with a dividend yield of 6.98%, stands out in the Australian market, particularly when compared to companies with unsustainable high payout ratios. Despite its relatively short history of dividend payments and some volatility, Ricegrowers maintains a healthy coverage with a cash payout ratio at 44% and an earnings payout ratio at 56.4%. The company's recent financial performance shows robust growth, reporting A$1.87 billion in sales and A$63.14 million in net income for FY2024, marking significant improvements from the previous year. Additionally, management's focus on strategic acquisitions indicates a proactive approach to sustaining and potentially enhancing shareholder value through careful expansion.

Navigate through the intricacies of Ricegrowers with our comprehensive dividend report here.

Upon reviewing our latest valuation report, Ricegrowers' share price might be too pessimistic.

One To Reconsider

TPG Telecom

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: TPG Telecom Limited, an Australian telecommunications provider, offers services to consumer, business, enterprise, government and wholesale customers with a market capitalization of A$8.50 billion.

Operations: TPG Telecom's revenue is derived from two main segments: Consumer at A$4.53 billion and Enterprise, Government, and Wholesale at A$1.12 billion.

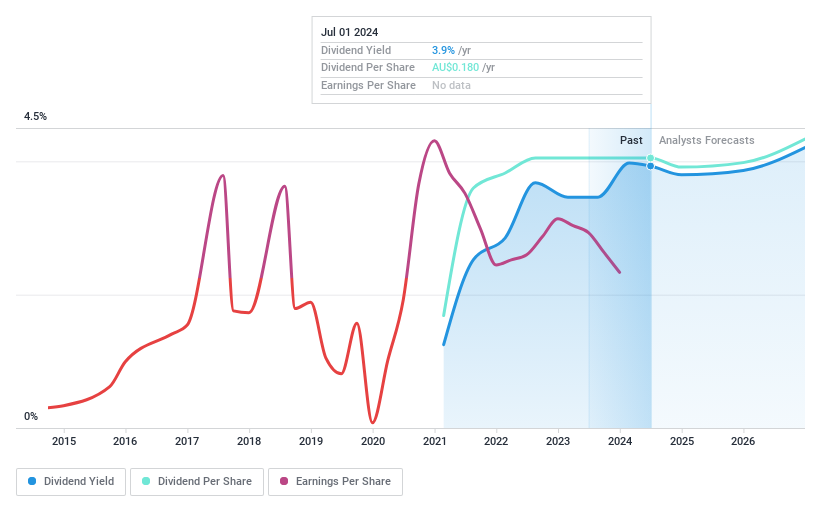

Dividend Yield: 3.9%

TPG Telecom, despite a dividend yield of 3.93%, falls short for dividend investors due to its unsustainable payout ratio of 681.9%. The dividends are poorly covered by both earnings and cash flows, signaling potential risk in maintaining future payments. Recent M&A rumors suggest strategic shifts but do not alleviate the fundamental issues with its high payout commitment and low profit margins (0.9%), making it less appealing compared to more stable dividend options in the market.

Next Steps

Dive into all 28 of the Top ASX Dividend Stocks we have identified here.

Already own any of these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:SGLLV and ASX:TPG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance