Avoid Lee & Man Paper Manufacturing And Explore One Better Dividend Stock

Dividend growth is a key indicator of a company's financial health and its ability to provide sustainable returns to investors. However, not every firm manages to maintain or increase its dividends over time, which can be a red flag for those relying on dividend income. In this context, we will examine two contrasting examples from the Hong Kong market: one that has seen declining dividends, such as Lee & Man Paper Manufacturing, and another that presents a more stable dividend outlook.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.10% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.66% | ★★★★★★ |

China Construction Bank (SEHK:939) | 7.45% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 8.86% | ★★★★★☆ |

China Electronics Huada Technology (SEHK:85) | 8.33% | ★★★★★☆ |

Playmates Toys (SEHK:869) | 8.96% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.60% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.21% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.24% | ★★★★★☆ |

China Overseas Grand Oceans Group (SEHK:81) | 8.09% | ★★★★★☆ |

Click here to see the full list of 86 stocks from our Top Dividend Stocks screener.

We're going to check out one of the best picks from our screener tool and one that could be a dividend trap.

Top Pick

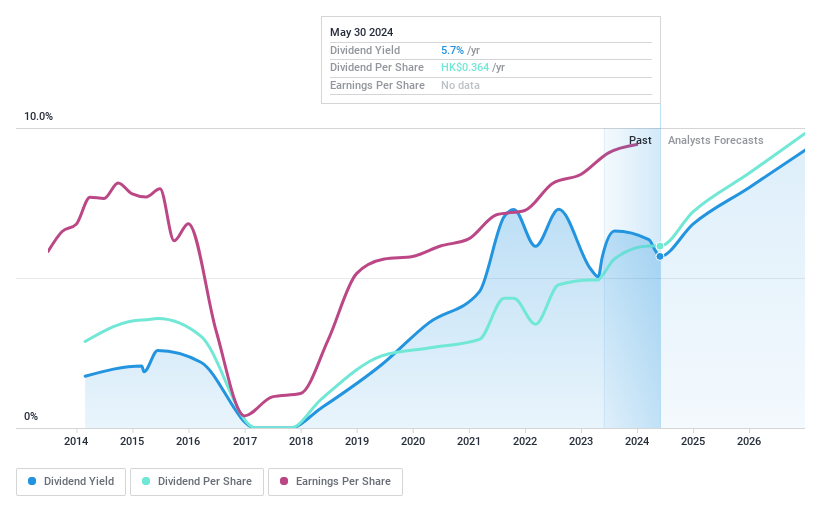

China Unicom (Hong Kong)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Unicom (Hong Kong) Limited operates as a telecommunications provider offering a variety of services in the People's Republic of China, with a market capitalization of approximately HK$219.39 billion.

Operations: The company generates revenue primarily from wireless communications services, totaling CN¥374.87 billion.

Dividend Yield: 5%

China Unicom (Hong Kong) Limited, despite a volatile dividend history, recently declared an increased final dividend of RMB 0.1336 per share for the year ended December 31, 2023. This contrasts with some peers experiencing declining dividends. The company's dividends are supported by earnings and cash flows, with a payout ratio of 55% and a cash payout ratio of 44.7%, indicating sustainability in its distributions to shareholders. While its dividend yield is below the top tier in Hong Kong's market at 5.05%, recent enhancements suggest an improving outlook on shareholder returns.

One To Reconsider

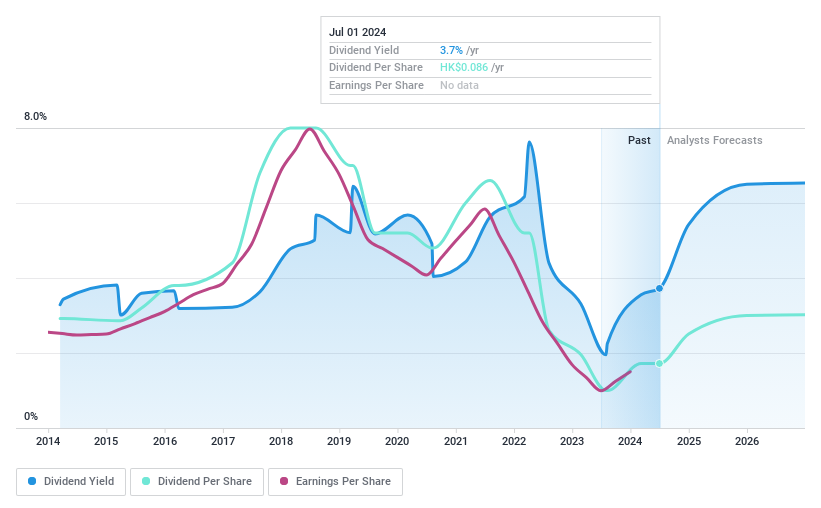

Lee & Man Paper Manufacturing

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Lee & Man Paper Manufacturing Limited operates as an investment holding company that manufactures and trades packaging papers, pulps, and tissue papers across the People’s Republic of China, Vietnam, Malaysia, Macau, and Hong Kong, with a market capitalization of approximately HK$9.92 billion.

Operations: The company generates revenue from three main segments: pulp (HK$2.20 billion), tissue paper (HK$4.68 billion), and packaging paper (HK$19.94 billion).

Dividend Yield: 3.7%

Lee & Man Paper Manufacturing Limited, despite a reasonable price-to-earnings ratio of 9.4x, presents concerns for dividend-focused investors. Its dividend yield of 3.72% is significantly lower than the top quartile of Hong Kong market payers at 7.98%. More critically, the company's dividends have been inconsistent and decreasing over the past decade, with significant annual drops exceeding 20%. Additionally, these dividends are poorly supported by both earnings and cash flows, undermining their sustainability and reliability for long-term investors.

Taking Advantage

Navigate through the entire inventory of 86 Top Dividend Stocks here.

Have a stake in one of these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:762 and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance