Avoid Hanwha Solutions On The KRX And Explore One Better Dividend Stock Option

Dividend stocks can be a tempting option for investors seeking regular income. However, it's crucial to examine the sustainability of these dividends. While some companies maintain healthy payout ratios that support consistent dividend growth, others may stretch their finances too thin, posing risks to investors. Today, we'll discuss two contrasting examples from the South Korean market to illustrate this point.

Top 10 Dividend Stocks In South Korea

Name | Dividend Yield | Dividend Rating |

Kia (KOSE:A000270) | 4.35% | ★★★★★★ |

NH Investment & Securities (KOSE:A005940) | 6.40% | ★★★★★☆ |

LOTTE Fine Chemical (KOSE:A004000) | 4.44% | ★★★★★☆ |

Industrial Bank of Korea (KOSE:A024110) | 7.10% | ★★★★★☆ |

KT (KOSE:A030200) | 5.42% | ★★★★★☆ |

Shinhan Financial Group (KOSE:A055550) | 4.39% | ★★★★★☆ |

KB Financial Group (KOSE:A105560) | 3.84% | ★★★★★☆ |

HANYANG ENGLtd (KOSDAQ:A045100) | 3.11% | ★★★★★☆ |

Kyung Nong (KOSE:A002100) | 4.76% | ★★★★★☆ |

Korea Cast Iron Pipe Ind (KOSE:A000970) | 5.89% | ★★★★☆☆ |

Click here to see the full list of 71 stocks from our Top KRX Dividend Stocks screener.

We're going to check out one of the best picks from our screener tool and one that could be a dividend trap.

Top Pick

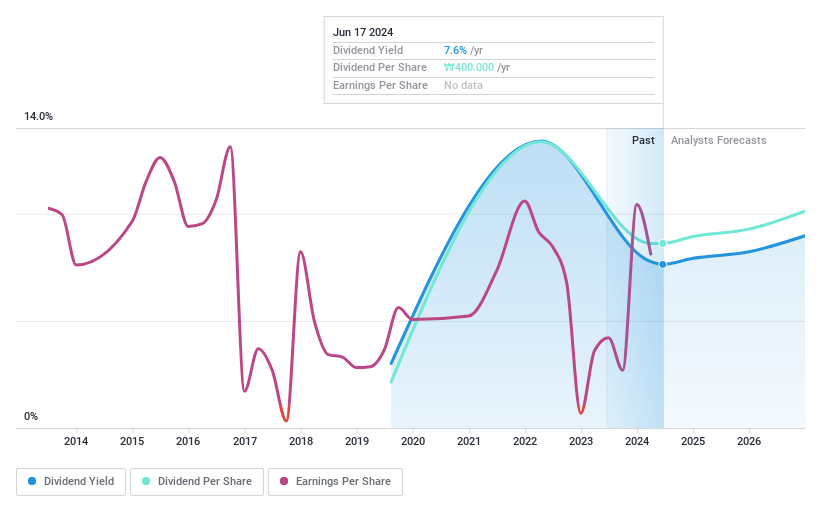

Tong Yang Life Insurance

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tong Yang Life Insurance Co., Ltd. operates in the life insurance sector within South Korea, with a market capitalization of approximately ₩1.20 trillion.

Operations: The company generates its revenue primarily from life and health insurance, totaling approximately ₩2.90 billion.

Dividend Yield: 5.2%

Tong Yang Life Insurance Co., Ltd. maintains a robust dividend profile, characterized by a low payout ratio of 30.6% and an even lower cash payout ratio of 3.8%, ensuring dividends are well-covered by both earnings and cash flows. Despite recent declines in quarterly net income from KRW 149.57 billion to KRW 82.67 billion, the company's ability to sustain its dividend payments remains strong due to these conservative payout policies, unlike other firms struggling with high payout ratios. However, its share price has shown significant volatility over the past three months, which could concern risk-averse investors.

One To Reconsider

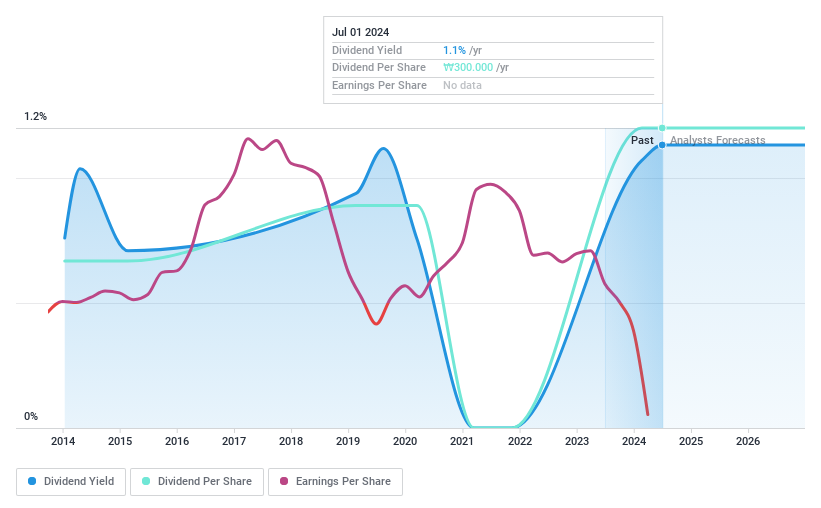

Hanwha Solutions

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Hanwha Solutions Corporation is engaged in chemicals, energy solutions, and advanced materials sectors both domestically and globally, with a market capitalization of approximately ₩4.54 trillion.

Operations: The company generates revenue from three primary sectors: chemicals, energy solutions, and advanced materials.

Dividend Yield: 1.1%

Hanwha Solutions exhibits several red flags for dividend investors. Recently, it reported a substantial net loss of KRW 459.09 billion, a stark contrast to the previous year's net income of KRW 116.25 billion, signaling financial instability. The company's dividend yield is low at 1.13%, underperforming against the top quartile of Korean dividend stocks at 3.54%. Furthermore, its dividends are not well-supported by earnings or cash flow, with no free cash flows reported and a history of unreliable and volatile dividend payments over the past decade. These factors make Hanwha Solutions an unattractive option for those seeking stable and sustainable dividend income.

Next Steps

Delve into our full catalog of 71 Top KRX Dividend Stocks here.

Have you diversified into one of these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSE:A082640 and KOSE:A009830.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance