Avoid Finework (Hu Nan) New Energy Technology And Explore One Superior Dividend Stock Option

Investors often look to dividend stocks as a source of regular income. However, it's important to assess the sustainability of these dividends. A high payout ratio, such as that seen with Finework (Hu Nan) New Energy Technology, can signal that a company might struggle to maintain its dividend payments, posing risks for income-focused investors. This article explores why such stocks might be less attractive for those seeking reliable dividend investments in China’s market.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.67% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.76% | ★★★★★★ |

Changhong Meiling (SZSE:000521) | 3.97% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.55% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.66% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 6.91% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.60% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.30% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.54% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.59% | ★★★★★★ |

Click here to see the full list of 235 stocks from our Top Dividend Stocks screener.

Let's take a closer look at one of our picks from the screened companies and one you may wish to avoid.

Top Pick

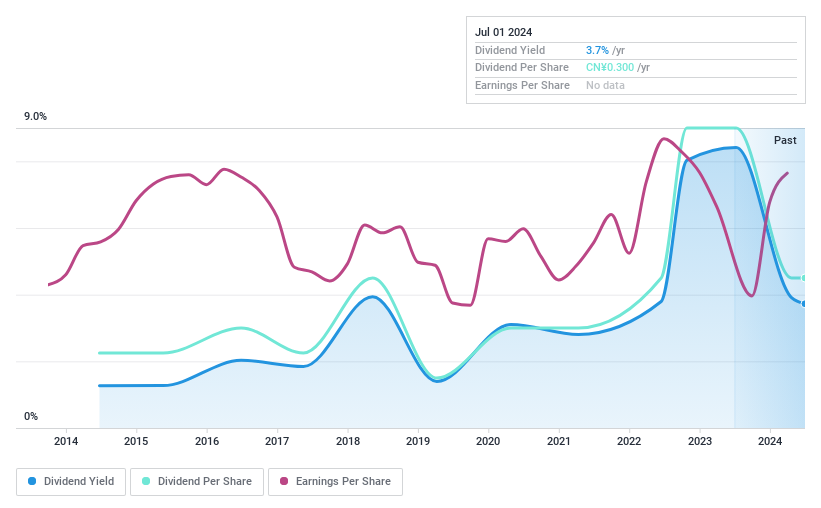

Shaanxi Provincial Natural GasLtd

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shaanxi Provincial Natural Gas Co., Ltd. is a natural gas company based in Shaanxi Province, China, focusing on the planning, construction, operation, management, and distribution of natural gas with a market capitalization of approximately CN¥8.997 billion.

Operations: The company primarily generates its revenue through the planning, construction, operation, management, and distribution of natural gas within Shaanxi Province.

Dividend Yield: 3.7%

Shaanxi Provincial Natural Gas Co., Ltd. offers a dividend yield of 3.71%, ranking it in the top 25% of Chinese dividend payers, with a sustainable payout ratio of 54.3%. Despite its dividends not being well covered by cash flows due to a high cash payout ratio (271.3%), earnings have grown by 15.2% over the past year, supporting future payouts. However, dividend payments have been volatile over the past decade, introducing some risk for investors seeking stable returns.

One To Reconsider

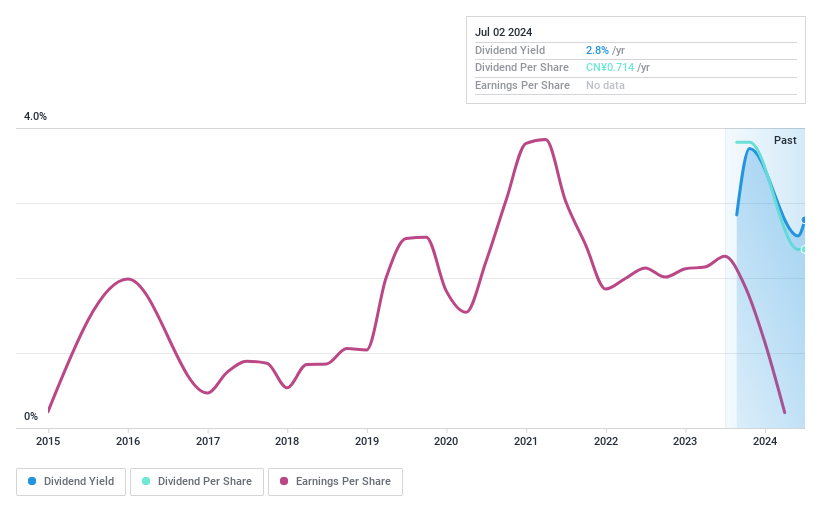

Finework (Hu Nan) New Energy Technology

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Finework (Hu Nan) New Energy Technology Co., Ltd. specializes in the research, development, manufacture, and sale of fasteners both in China and globally, with a market capitalization of approximately CN¥1.93 billion.

Operations: The company generates revenue primarily through the sale of metal products, specifically fasteners, totaling CN¥1.60 billion.

Dividend Yield: 2.8%

Finework (Hu Nan) New Energy Technology Co. Ltd. faces challenges as a dividend stock, primarily due to its high payout ratio of 463.7%, indicating dividends are not well-covered by earnings or cash flows. Recent financial performance shows declining net profit margins from 6.8% to 0.7%, and significant one-off items have further distorted earnings quality, suggesting potential sustainability issues for future dividends despite a current yield of 2.78%. Additionally, the company's share price has been highly volatile recently, adding further risk for dividend investors.

Make It Happen

Access the full spectrum of 235 Top Dividend Stocks by clicking on this link.

Got skin in the game with some of these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SZSE:002267 and SZSE:301232.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance