Avoid Dowlais Group And Explore One Better Dividend Stock Option

Dividend stocks can be an appealing choice for investors seeking regular income, particularly in the United Kingdom where the average yield hovers around 3.9%. However, it's crucial to examine the sustainability of these dividends. Companies with excessively high payout ratios may struggle to maintain their dividend payments, which could pose a risk to investors' capital. In this discussion, we will explore why certain stocks like Dowlais Group might not be ideal for your dividend portfolio due to such financial strains.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

James Latham (AIM:LTHM) | 6.38% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 7.10% | ★★★★★☆ |

Keller Group (LSE:KLR) | 3.56% | ★★★★★☆ |

DCC (LSE:DCC) | 3.53% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.82% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.90% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.87% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.43% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.39% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.67% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results and one of the companies to potentially avoid.

Top Pick

London Security

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: London Security plc is an investment holding company that operates in the fire protection sector, manufacturing, selling, and renting equipment across several European countries, with a market capitalization of approximately £386.19 million.

Operations: The company generates revenue primarily through the provision and maintenance of fire protection and security equipment, totaling £219.71 million.

Dividend Yield: 3.7%

London Security's dividend yield of 3.7% is lower than the top UK dividend payers, and its history shows volatility in payments over the last decade, reflecting some instability. However, it maintains a healthier payout scenario with a 65.3% earnings coverage and 79.8% cash flow coverage, ensuring dividends are sustainably funded by both profits and cash reserves. Recent board affirmations to maintain the £0.42 per share dividend further reflect a commitment to steady shareholder returns despite past fluctuations.

Navigate through the intricacies of London Security with our comprehensive dividend report here.

The valuation report we've compiled suggests that London Security's current price could be inflated.

One To Reconsider

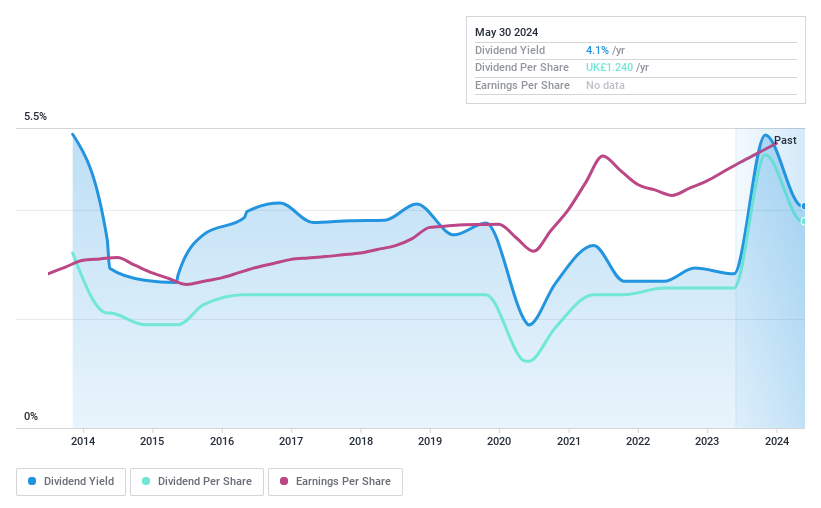

Dowlais Group

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Dowlais Group plc is a manufacturer and seller of automotive parts operating across the United Kingdom, Europe, North America, South America, Asia, and Africa, with a market capitalization of approximately £0.96 billion.

Operations: The company's revenue is primarily generated from three segments: automotive parts contributing £3.84 billion, powder metallurgy at £1.02 billion, and hydrogen with £5 million.

Dividend Yield: 8.1%

Dowlais Group plc offers a high dividend yield of 8.12%, ranking in the top 25% of UK dividend payers. However, this attractive yield is undermined by significant sustainability issues; the dividends are not well-covered by either earnings or cash flows, and the company is currently unprofitable. Additionally, recent executive changes with the termination of two directors could signal internal instability. The initiation of a share buyback program for £50 million might suggest an attempt to stabilize share price rather than a focus on maintaining dividend payouts.

Where To Now?

Dive into all 56 of the Top Dividend Stocks we have identified here.

Have you diversified into one of these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:LSCLSE:DWL and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance