Avoid Aura Minerals On The TSX And Explore One Better Dividend Stock Option

Investors often turn to dividend stocks for a reliable source of income. However, while the average dividend growth rate in the Canadian market was about 6.3% last year, not every company meets this standard. Companies like Aura Minerals, which have seen their dividends decline over time, present a higher risk and may not be ideal for those seeking dependable dividend growth.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.78% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.29% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.45% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.48% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.30% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.90% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.51% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.31% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 3.23% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 9.08% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

We're going to check out one of the best picks from our screener tool and one that could be a dividend trap.

Top Pick

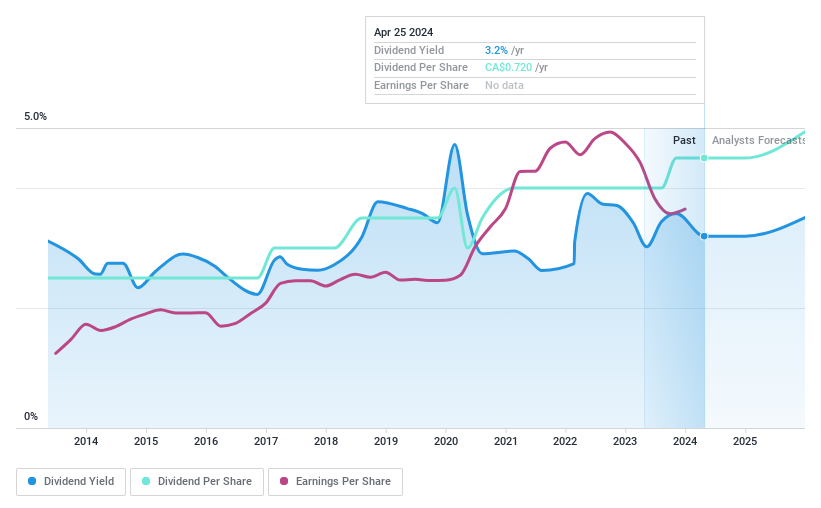

Leon's Furniture

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Leon's Furniture Limited, a Canadian retailer specializing in home furnishings, mattresses, appliances, and electronics, has a market capitalization of approximately CA$1.56 billion.

Operations: The company generates CA$2.50 billion in revenue from the sale of home furnishings, mattresses, appliances, and electronics.

Dividend Yield: 3.1%

Leon's Furniture maintains a consistent dividend, recently declaring a CAD 0.18 quarterly payout, demonstrating stability in contrast to companies with declining dividends. Financially, Leon’s reported a solid first quarter in 2024 with sales rising to CAD 562.25 million and net income increasing to CAD 18.82 million. The company's dividends are well-supported by earnings and cash flows, with payout ratios of 31.9% and 25.1%, respectively, indicating sustainability despite past volatility in dividend payments.

One To Reconsider

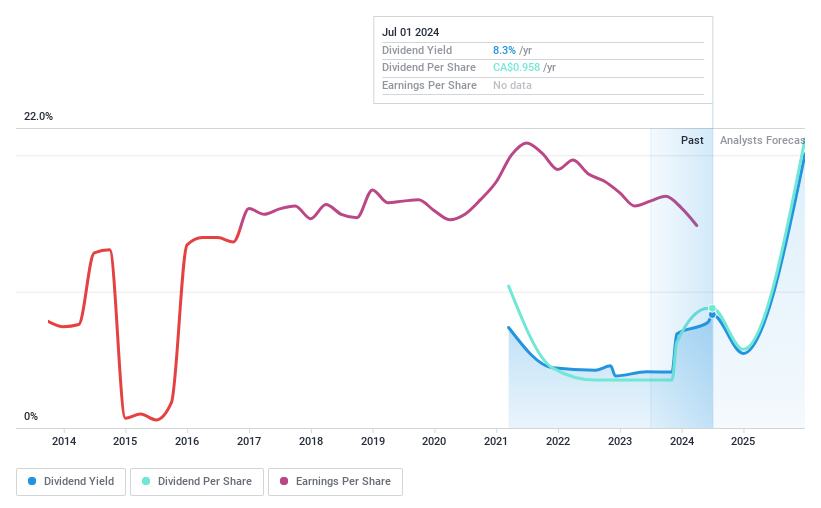

Aura Minerals

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Aura Minerals Inc. is a company engaged in the production of gold and copper, focusing on the development and operation of gold and base metal projects in the Americas, with a market capitalization of approximately CA$0.83 billion.

Operations: The revenue for Aura Minerals is segmented into Minosa at $134.01 million, Aranzazu at $174.23 million, and Apoena Mine at $85.23 million.

Dividend Yield: 8.3%

Aura Minerals Inc. faces challenges with its dividend sustainability, highlighted by a high cash payout ratio of 165.3% and a dividend yield of 8.32%, which is not well-supported by earnings or cash flows. Recent financials show a net loss of US$9.22 million for Q1 2024, contrasting sharply with the previous year's net income of US$18.66 million, indicating potential instability in maintaining future dividends at current levels. Despite recent business expansions and exploration projects aimed at long-term growth, the immediate concern over dividend reliability persists due to these financial pressures and an overall decline in dividends since their initiation three years ago.

Turning Ideas Into Actions

Navigate through the entire inventory of 33 Top TSX Dividend Stocks here.

Got skin in the game with some of these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:LNF and TSX:ORA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance