Avoid Airtel Africa And Explore One Superior Dividend Stock

When exploring dividend stocks in the United Kingdom, it's important to consider the sustainability of a company's dividend payments. A high payout ratio might initially appear attractive, but it can also signal potential financial strain and a risk to future dividends. This article will discuss two companies: one that may pose such risks due to its high payout ratio, Airtel Africa, and another that offers a more stable dividend prospect.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

James Latham (AIM:LTHM) | 6.30% | ★★★★★★ |

Epwin Group (AIM:EPWN) | 5.75% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.92% | ★★★★★☆ |

Impax Asset Management Group (AIM:IPX) | 7.00% | ★★★★★☆ |

Keller Group (LSE:KLR) | 3.48% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.70% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.83% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.17% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.82% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.52% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top Dividend Stocks screener.

We're going to check out one of the best picks from our screener tool and one that could be a dividend trap.

Top Pick

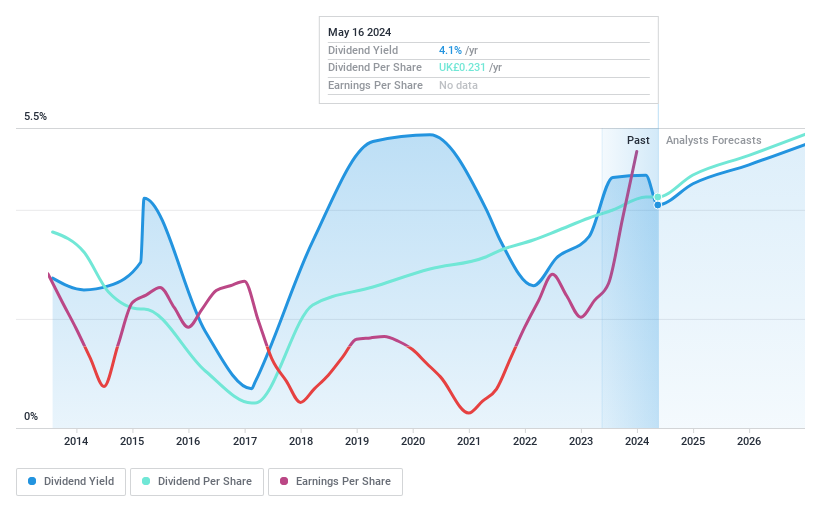

Drax Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Drax Group plc operates in renewable power generation in the United Kingdom, with a market capitalization of approximately £2.07 billion.

Operations: The company's revenue segments include £4.96 billion from customers, £6.79 billion from generation, and £822.40 million from pellet production.

Dividend Yield: 4.3%

Drax Group's dividend sustainability is evident with a low earnings payout ratio of 16.2% and a cash payout ratio of 22.7%, ensuring dividends are well covered by both profits and cash flows, despite its unstable dividend track record over the past decade. Recent board changes, including the appointment of Rob Shuter with extensive financial expertise, may influence strategic directions positively. However, earnings are expected to decline significantly in the next three years, which could challenge future dividend growth and stability.

Take a closer look at Drax Group's credentials here in our dividend report.

Upon reviewing our latest valuation report, Drax Group's share price might be too pessimistic.

One To Reconsider

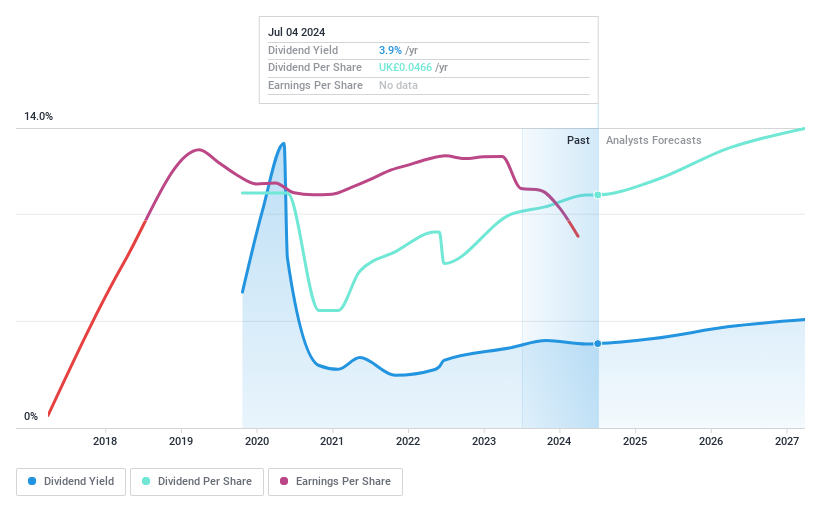

Airtel Africa

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Airtel Africa Plc operates in providing telecommunications and mobile money services across Nigeria, East Africa, and Francophone Africa, with a market capitalization of approximately £4.42 billion.

Operations: The company generates revenue primarily through mobile services and mobile money, with segments totaling $4.34 billion and $0.84 billion respectively.

Dividend Yield: 3.9%

Airtel Africa's dividend profile is concerning due to its high payout ratio, indicating dividends are not well supported by earnings or cash flow. The company has shown volatile dividend payments and a recent shift from profitability to a net loss of US$165 million for the full year ended March 31, 2024. Despite a modest yield of 3.94%, which is below the UK market's top quartile, and ongoing financial challenges underscored by significant revenue declines and losses, it raises doubts about future dividend reliability and growth.

Summing It All Up

Click this link to deep-dive into the 56 companies within our Top Dividend Stocks screener.

Hold shares in some of these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:DRX and LSE:AAF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance