Avidity (RNA) Down on Partial Hold of Myotonic Dystrophy Study

Avidity Biosciences RNA fell 10.9% on Sep 27 after the company announced that the FDA placed a partial clinical hold on any new subject enrollments in phase I/II MARINA study. The study is evaluating its lead candidate, AOC 1001, for treating myotonic dystrophy type 1 (“DM1”) in adults.

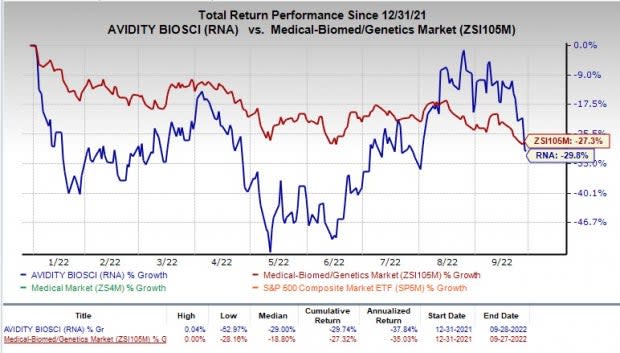

Shares of Avidity Biosciences have declined 29.8% compared with the industry’s fall of 27.3% in the year-to-date period.

Image Source: Zacks Investment Research

DM1 is a rare and progressive monogenic muscle disease affecting the skeletal and smooth muscle, heart, eye, endocrine system and central nervous system. DM1 currently has no approved treatment options.

The phase I/II Marina study is designed to evaluate the safety and tolerability of single and multiple ascending doses of AOC 1001 administered intravenously in adults with DM1. Part A of the MARINA study evaluating a single ascending dose of AOC 1001 is fully enrolled and has completed the dosing of the participants. Avidity was progressing with the enrollment process of part B of the study, evaluating multiple ascending doses of AOC 1001.

One patient from the MARINA study’s 4mg/kg cohort suffered serious adverse events, post which the FDA placed the study on partial clinical hold.

Avidity is working with the FDA to resolve the clinical hold as soon as possible and to begin enrollment of new participants.

However, the already dosed patients in the aforementioned study can continue with the treatment, whether on AOC 1001 or placebo. The existing participants can also be progressed into the MARINE- Open-Label Extension (OLE) study, where they would receive quarterly doses of AOC 1001 as previously planned. But no new patients will be enrolled in phase I/II MARINE study until the partial clinical hold is lifted.

The company intends to conduct a preliminary assessment of the key biomarkers of AOC 1001 and evaluate the candidate’s safety and tolerability in half of the existing MARINA participants in the fourth quarter of 2022.

AOC 1001 has received Orphan Drug status from both the FDA and the European Medicines Agency (EMA).

The company’s pipeline also includes two more candidates, namely — AOC 1044 for treating Duchenne Muscular Dystrophy (“DMD”), and AOC 1020, for facioscapulohumeral muscular dystrophy (“FSHD”). Avidity recently received Investigational New Drug (IND) clearance from the FDA for both AOC 1020 and AOC 1044 and will now advance the candidates into clinical studies.

Avidity Biosciences, Inc. Price

Avidity Biosciences, Inc. price | Avidity Biosciences, Inc. Quote

Zacks Rank and Stocks to Consider

Avidity currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector include Aridis Pharmaceuticals ARDS, Immunocore IMCR and Satsuma Pharmaceuticals STSA, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Aridis Pharmaceuticals' loss estimates for 2022 have remained steady at 23 cents over the past 30 days. The loss estimates for 2023 also remained steady at 53 cents per share in the same time frame.

ARDS surpassed earnings in three of the trailing four quarters, missing the same in one. The average negative earnings surprise for Aridis is 238.54%.

Immunocore’s loss per share estimates for 2022 widened from $1.34 to $1.46 in the past 30 days. The same for 2023 has narrowed from $1.78 to $1.65 in the same time frame.

Earnings of Immunocore missed estimates in three of the trailing four quarters, while beating the same in the remaining occasion. The average earnings surprise for IMCR is 33.28%.

Satsuma’s loss per share estimates for 2022 remained steady at $1.97 in the past 30 days. The loss per share for 2023 has widened from 98 cents to $1.50 in the same time frame.

Earnings of Satsuma beat estimates in three of the trailing four quarters, while missing the same in one. The average negative earnings surprise for STSA is 0.54%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Satsuma Pharmaceuticals (STSA) : Free Stock Analysis Report

Avidity Biosciences, Inc. (RNA) : Free Stock Analysis Report

Aridis Pharmaceuticals (ARDS) : Free Stock Analysis Report

Immunocore Holdings PLC Sponsored ADR (IMCR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance